Monroe Capital Stock: Bullish 13.8%-Yielder Has 22% Upside Potential

Why MRCC Stock Is Worth Watching

Since July 2023, the U.S. Federal Reserve has held its interest rates at 5.25% to 5.5%, their highest level since 2001. There’s some relief coming, with interest rates expected to start going down this summer.

That’s the good news. At the same time, though, that relief will be tempered.

According to Janet Yellen, the U.S. treasury secretary and former Fed chair, it’s “unlikely” that market interest rates will return to the levels seen before the COVID-19 pandemic. (Source: “Yellen Says US Rates ‘Unlikely’ to Return to Pre-COVID Levels,” Bloomberg, March 13, 2024.)

High interest rates continue to be a strain on the average American, but for business development companies (BDCs), or what we like to call “alternative banks” here at Income Investors, high interest rates should help juice their earnings. This includes Monroe Capital Corp (NASDAQ:MRCC).

Like traditional financial institutions, alternative banks borrow money at low interest rates and lend it out at higher interest rates. BDCs are a financial lifeline for many small and medium-sized companies.

Because of tax breaks, alternative banks are a great option for income investors. Whereas traditional financial outfits have to pay the government between $0.25 and $0.35 in taxes on each dollar they make in profit, under federal guidelines, BDCs pay little or no corporate tax on their earnings.

In exchange for this benefit, BDCs must distribute at least 90% of their ordinary taxable income to shareholders. As a result, these companies pay out some of the biggest dividend yields around.

Monroe Capital Corp is an alternative bank that provides senior secured, unitranche, junior secured, and subordinated debt financing and minority equity investments—primarily to lower-middle-market companies in the U.S. and Canada. (Source: “Investor Presentation: Q3 2023,” Monroe Capital Corp, last accessed May 26, 2024.)

As of March 31, the company held debt equity investments in 98 portfolio companies, with a total fair value of $500.9 million. First-lien loans made up 81.9% of the portfolio. (Source: “Monroe Capital Corporation BDC Announces First Quarter 2024 Results,” Monroe Capital Corp, May 8, 2024.)

As of September 30, 2023, the average loan investment size per company was $5.2 million, with the largest loan being $30.6 million.

Monroe Capital Corp’s portfolio is diversified across several industries, including real estate, health care, pharmaceuticals, business services, high-tech industries, media, and banking.

Solid 1st-Quarter Results

For the first quarter ended March 31, 2024, Monroe Capital Corp reported net investment income of $5.5 million, or $0.25 per share. That’s up from $5.3 million, or $0.24 per share, in the previous quarter. (Source: Ibid.)

The company’s adjusted net investment income also came in at $5.5 million, or $0.25 per share, compared to $5.6 million, or $0.26 per share, in the fourth quarter of 2023. Its net asset value decreased slightly (by 1.1%) in the first quarter to $201.5 million, or $9.30 per share.

Commenting on the first-quarter results, Theodore L. Koenig, Monroe Capital Corp’s CEO, said, “We are pleased to report that our Adjusted Net Investment Income has covered our dividend for the 16th consecutive quarter.” (Source: Ibid)

He continued, “Our focus remains on credit quality for our predominantly first lien portfolio. Additionally, we are leveraging current market dynamics to enhance risk-adjusted returns. This dual focus underscores our commitment to delivering value for stockholders.”

Monroe Capital Corp Pays Ultra-High-Yield Dividends

Since Monroe Capital is a BDC, dividends aren’t just important; they’re a legal responsibility. The company went public in October 2012 and paid its first quarterly dividend in December of that year. It hasn’t missed a dividend payment since then.

In March, Monroe Capital stock paid a quarterly cash dividend of $0.25 per share. (Source: “Dividends and Distributions,” Monroe Capital Corp, last accessed May 26, 2024.)

That translates to a forward dividend yield of 13.8% (as of this writing). You might think a 13.8% yield is exceptionally high, and it is, especially compared to the S&P 500, where the average dividend yield is just 1.35%. But it’s also in keeping with MRCC stock’s historical five-year average dividend yield of 12.78%.

Monroe Capital Stock Has 22% Upside

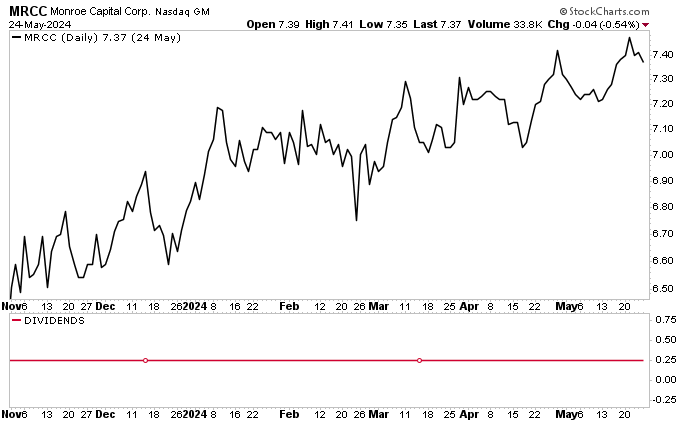

In early November 2023, the Fed said it was pausing its interest rate hikes. In December, it held its interest rates again but also said rate cuts were on the table. Investors responded by sending shares of capital-intensive stocks significantly higher.

Some stocks ripped higher in early November then leveled out, while others, like MRCC stock, have been on a more reliable, sustained upward trajectory. Since the start of November, shares of Monroe Capital Corp have rallied by 16.5%. Monroe Capital stock is also up by eight percent since the start of 2024 and up by 12.5% over the last 12 months.

Solid gains, and MRCC stock is expected to climb even higher over the coming 12 months, topping its December 2021 record high of $8.86 per share.

Of the analysts providing a 12-month share-price target for Monroe Capital Corp, their average estimate is $8.50 and their high estimate is $9.00. This points to potential gains in the range of 15.5% to 22.1%.

Chart courtesy of StockCharts.com

The Lowdown on Monroe Capital Corp

Monroe Capital Corp is a great BDC with a diverse portfolio that’s primarily anchored by first-lien senior secured loans.

Thanks to its strong financial position and steady, reliable income stream, the company has been able to provide investors with safe, high-yield dividends.

Moreover, Monroe Capital stock’s price has been on the move since last November and is expected to hit fresh highs over the coming quarters.