MFA Financial Stock: 13.3%-Yielder Up 24.1% Over Past Month

Strong Risk/Reward Opportunity With MFA Stock

Real estate investment trusts (REITs) have been under pressure from the Federal Reserve’s 11 interest rate hikes since March 2022. The reason is quite simple: high carrying costs of loans have a negative impact on operating margins and bottom-line profitability.

But the Fed may be done with its aggressive monetary policy, and we’ll likely see interest rates begin to move lower in 2024. That would help interest-rate-sensitive REITs such as MFA Financial Inc (NYSE:MFA).

The company is a billion-dollar market-cap REIT that invests in residential mortgage loans, residential mortgage-backed securities, and other real estate assets. (Source: “Overview,” MFA Financial Inc, last accessed November 23, 2023.)

The current high mortgage rates have been adding risk to the company’s mortgage investments, but with mortgage rates beginning to ratchet lower, the worst may be over and MFA Financial stock could start to rally.

MFA Financial Inc aims to enhance shareholder value by paying out regular dividends and trying to generate capital appreciation. The stock has paid dividends for 26 consecutive years, and it currently has an ultra-high yield.

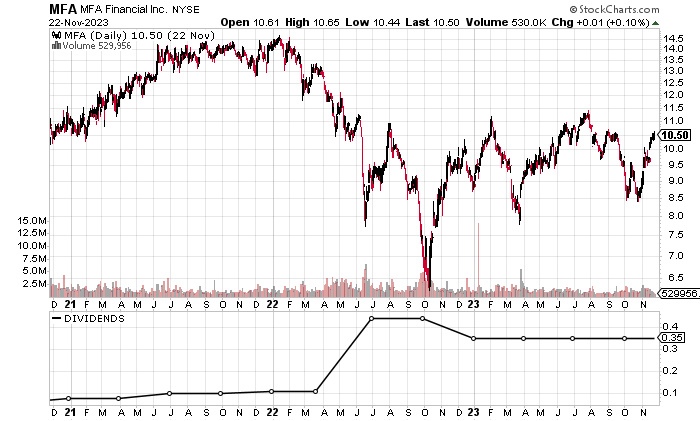

Plus, MFA stock’s price has advanced 24.1% over the past month and 6.4% year-to-date, following a negative share-price performance in 2022.

Chart courtesy of StockCharts.com

MFA Financial Inc Churns Out Free Cash Flow

MFA Financial’s revenues grew in three of its last four reported years.

The COVID-19 pandemic resulted in negative revenues in 2020, but that was followed by two consecutive years of high revenue growth. The negative revenues were caused by significant adjustments that materialized during the pandemic.

| Fiscal Year | Revenues (Millions) | Growth |

| 2018 | $623.4 | N/A |

| 2019 | $752.8 | 20.8% |

| 2020 | -$212.3 | -128.2% |

| 2021 | $488.3 | 330.0% |

| 2022 | $793.7 | 62.5% |

(Source: “MFA Financial, Inc.” MarketWatch, last accessed November 23, 2023.)

The company’s bottom line shows inconsistencies, with MFA Financial alternating between generally accepted accounting principles (GAAP)-diluted earnings-per-share (EPS) profits and losses over its last four reported years.

Analysts expect MFA Financial to significantly improve its GAAP income to $1.50 per diluted share in full-year 2023, followed by $1.60 per diluted share in 2024. (Source: “MFA Financial, Inc. (MFA),” Yahoo! Finance, last accessed November 23, 2023.)

That means its current share price is approximately 6.5 times its consensus 2024 earnings-per-share (EPS) estimate, which is an attractive ratio.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $2.72 | N/A |

| 2019 | $3.17 | 16.6% |

| 2020 | -$6.28 | -298.0% |

| 2021 | $2.63 | 141.8% |

| 2022 | -$2.57 | -197.9% |

(Source: MarketWatch, op. cit.)

Moving to MFA Financial Inc’s funds statement, the company has consistently churned out positive free cash flow (FCF) over its last five reported years.

The company’s high FCF should allow it to continue its dividend streak and potentially raise its dividends.

| Fiscal Year | FCF (Millions) | Growth |

| 2018 | $146.8 | N/A |

| 2019 | $213.9 | 45.8% |

| 2020 | $33.5 | -84.3% |

| 2021 | $108.3 | 222.8% |

| 2022 | $365.8 | 237.9% |

(Source: MarketWatch, op. cit.)

MFA Financial Inc’s major risk is its debt of $8.01 billion. After the company pays its dividends, I expect that it will use its FCF to reduce its debt load. (Source: Yahoo! Finance, op. cit.)

MFA Financial’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a soft reading of 4.0, which is just below the midpoint of the Piotroski score’s range of 1.0 to 9.0.

MFA Financial Stock’s Dividends Could Move Higher

MFA stock’s quarterly dividend of $0.35 per share translates to a yield of 13.33% (as of this writing).

The high dividend yield is due to MFA Financial stock’s price declining far below its record high of $35.60, which it reached in September 2017. (Source: Yahoo! Finance, op. cit.)

I expect that MFA Financial Inc’s higher earnings will allow it to raise its dividend again.

| Metric | Value |

| Dividend Growth Streak | 2 Years |

| Dividend Streak | 26 Years |

| 7-Year Dividend Compound Annual Growth Rate | N/A |

| 10-Year Average Dividend Yield | 19.5% |

| Dividend Coverage Ratio | 0.7 |

The Lowdown on MFA Financial Inc

I anticipate that MFA Financial will benefit from the expected decline in interest rates over the next two years. The company’s lower interest expenses should result in improved profitability.

MFA stock has high capital-appreciation potential, and in the meantime, investors can collect its high-yield dividends while they wait for its share price to rally.