Medical Properties Trust Stock Is a Contrarian 12.1%-Yielder

Second-Largest Non-Governmental Hospital Owner

Populations are rapidly aging around the world, and I don’t see this trend reversing. That translates to an increasing demand for health care services. For a company like Medical Properties Trust Inc (NYSE:MPW), the strong tailwinds provide opportunities.

Founded in 2003, Medical Properties Trust currently has a market capitalization of about $2.8 billion.

The company owns hospitals and other health-care facilities in 31 U.S. states, seven European countries, and South America. In total, it owns 441 properties in 10 countries, with a total worth of about $19.0 billion. (Source: “Our Portfolio,” Medical Properties Trust Inc, last accessed December 8, 2023.)

The breakdown of the trust’s real estate portfolio, based on asset type, is as follows:

- General Acute Care Hospitals: 63.7% of its portfolio

- Behavioral Health Facilities: 13.3%

- Other: 12.8%

- Inpatient Rehabilitation Hospitals: 7.5%

- Long-Term Acute Care Hospitals: 1.5%

- Freestanding Emergency Room/Urgent Care Facilities: 1.2%

Medical Properties Trust Inc has paid dividends for 19 consecutive years, but it cut MPW stock’s dividend by about 50% on October 12 as the company continued to work on improving its operations and financial growth. Prior to this, the trust had hiked its dividends for 10 straight years. (Source: “Dividend History,” Medical Properties Trust Inc, last accessed December 8, 2023.)

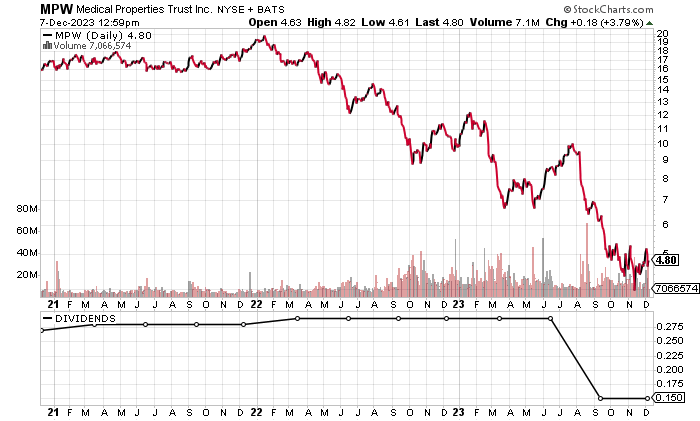

Medical Properties Trust stock’s 12.12% dividend yield (as of this writing) might seem high at first glance, but it’s a result of the stock’s price going down by 57% in 2023 and by a whopping 80% from its all-time high of $24.29 in February 2020.

The following chart shows MPW stock being caught in a nasty downward trend since December 2021, when it was trading at nearly $24.00.

Medical Properties Trust stock is clearly struggling, but its dividends appear to be safe for now, and hopefully, the trust can reduce its high debt.

Chart courtesy of StockCharts.com

Medical Properties Trust Inc’s Expansion Drives Its Revenues

Medical Properties Trust’s revenue growth has been impressive, with a near-doubling from 2018 to its record high in 2021. The company’s revenue compound annual growth rate (CAGR) for the period from 2018 through 2022 was 18.3%.

But analysts expect that the trust’s revenue growth will slow, including in full-year 2023. They estimate that Medical Properties Trust Inc will report lower revenues of $1.34 billion for full-year 2023, followed by $1.35 billion in 2024. (Source: “Medical Properties Trust, Inc (MPW),” Yahoo! Finance, last accessed December 8, 2023.)

I expect the company to beat the consensus estimate for its revenues in full-year 2023, given that its trailing 12-month revenues were $1.37 billion to September.

| Fiscal Year | Revenues | Growth |

| 2018 | $784.5 Million | N/A |

| 2019 | $854.2 Million | 8.9% |

| 2020 | $1.25 Billion | 46.3% |

| 2021 | $1.54 Billion | 23.7% |

| 2022 | $1.54 Billion | -0.1% |

(Source: “Medical Properties Trust, Inc,” MarketWatch, last accessed December 8, 2023.)

A look at Medical Properties Trust Inc’s cost side shows the company consistently generating high gross margins.

| Fiscal Year | Gross Margin |

| 2018 | 98.8% |

| 2019 | 97.2% |

| 2020 | 98.0% |

| 2021 | 97.5% |

| 2022 | 97.1% |

On the bottom line, Medical Properties Trust Inc is a steady producer of generally accepted accounting principles (GAAP) profits, including a record-high $1.50 per diluted share in 2022.

But like the case with its revenues, analysts expect the company’s GAAP-diluted earnings-per-share (EPS) to decline in full-year 2023, to $0.37, before rebounding to $0.84 in 2024. (Source: Yahoo! Finance, op. cit.)

The 2023 estimate isn’t great, but the improvement in 2024 offers some optimism.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $2.77 | N/A |

| 2019 | $0.87 | -68.6% |

| 2020 | $0.81 | -6.9% |

| 2021 | $1.11 | 36.9% |

| 2022 | $1.50 | 35.8% |

(Source: MarketWatch, op. cit.)

Moving on to Medical Properties Trust Inc’s funds statement, the company has churned out high free cash flow (FCF) over its last five reported years. It generated three years of high FCF growth prior to having some FCF weakness in 2022.

The trust’s high FCF allows it to pay dividends and reduce its debt.

| Fiscal Year | FCF (Millions) | Growth |

| 2018 | $449.1 | N/A |

| 2019 | $494.1 | 10.1% |

| 2020 | $617.6 | 25.0% |

| 2021 | $811.7 | 31.4% |

| 2022 | $729.0 | -9.0% |

(Source: MarketWatch, op. cit.)

On its balance sheet, Medical Properties Trust Inc needs to address its significant debt load, which stood at $10.16 billion at the end of September. The company’s buildup in debt was due in part to the expansion of its hospital assets and the cost of operating its vast global network. A plus is that the trust has $340.1 million in cash and a solid amount of working capital. (Source: Yahoo! Finance, op. cit.)

The debt is a concern, but for now, I think the company will be fine, considering its high FCF.

Medical Properties Trust Inc’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is currently a weak 2.0. That’s near the bottom of the Piotroski score’s range of 1.0 to 9.0. From 2018 to 2022, the trust had a far better average score of 5.0.

Furthermore, the trust’s interest coverage ratio is somewhat on the low end. The following table shows that Medical Properties Trust has managed to cover its interest expense via its high earnings before interest and taxes (EBIT) from 2019 through 2022.

| Fiscal Year | EBIT | Interest Expense |

| 2019 | $581.48 Million | $237.8 Million |

| 2020 | $828.44 Million | $328.7 Million |

| 2021 | $1.04 Billion | $367.4 Million |

| 2022 | $1.00 Billion | $359.0 Million |

(Source: Yahoo! Finance, op. cit.)

MPW Stock’s Dividend Cut as Company Works on Improvements

Medical Properties Trust Inc recently reduced its quarterly dividend to $0.15 per share, versus the $0.29 per share it paid on July 13. (Source: “Dividend History,” Medical Properties Trust Inc, op. cit.)

The dividend cut was disappointing, but the trust’s dividend coverage ratio was soft, which supported the cut.

Moreover, given the company’s expected decline in its revenues and earnings, and the likely decline in its FCF, Medical Properties Trust, Inc will need to work things out before it raises its dividend again.

| Metric | Value |

| Dividend Streak | 19 Years |

| 7-Year Dividend CAGR | 4.0% |

| 10-Year Average Dividend Yield | 8.9% |

| Dividend Coverage Ratio | 0.8 |

The Lowdown on Medical Properties Trust Stock

Institutional investors continue to back Medical Properties Trust Inc. As of this writing, 854 institutions hold a 78.4% stake in the outstanding shares. (Source: Yahoo! Finance, op. cit.)

Watch the large short position on MPW stock. As of November 15, there were 141.1 million shares shorted, representing 32.8% of the float and an increase from 130.0 million on October 12. The significant short position could drive short-covering and buying of Medical Properties Trust stock.

For now, income investors can receive dividends from MPW stock and wait for a potential reversal in its share price.