Medical Properties Trust Stock’s High-Yield Dividends Keep Going Up

Why MPW Stock Is Worth Considering

Inflation is soaring, interest rates are on the rise, fears of a recession loom, and geopolitical tensions have created economic headwinds not seen in decades. The S&P 500 is in bear-market territory and most analysts don’t believe stocks have bottomed yet. If there’s a silver lining, it’s that high-yield dividend stocks have continued to reward shareholders.

Investors looking for annual raises that help combat inflation might want to consider Medical Properties Trust Inc (NYSE:MPW), a global real estate investment trust (REIT). The company, which acquires and develops net-leased health-care facilities, is the first and only U.S. company to focus exclusively on hospital facilities in the U.S. and around the world. (Source: “Investor Update: April 2022,” Medical Properties Trust Inc, last accessed July 5, 2022.)

Since being formed in 2003, the company has grown to become one of the world’s largest owners of hospitals. It has 440 facilities and roughly 46,000 licensed beds in 10 countries on four continents. Medical Properties Trust Inc’s single-largest property accounts for less than three percent of its total portfolio. Its weighted average lease and loan maturity is 17.8 years.

The REIT has total pro forma gross assets of approximately $22.2 billion, including $16.0 billion worth of general acute care hospitals, $2.6 billion worth of behavioral health facilities, and $2.0 billion worth of inpatient rehabilitation hospitals.

Medical Properties Trust stock had its initial public offering (IPO) in July 2005.

Medical Properties Trust Inc’s Great Financial Performance

Medical Properties Trust’s strong underwriting skills have helped it generate reliable cash flow.

For the first quarter ended March 31, the company announced that its net income was $632.0 million, or $1.05 per share, compared to first-quarter 2021 net income of $164.0 million, or $0.28 per share. Its normalized funds from operations (NFFO) in the first quarter of 2022 were $282.0 million, or $0.47 per share. That was up by 12% from $244.0 million, or $0.42 per share, in the same period of the previous year. (Source: “Medical Properties Trust, Inc. Reports First Quarter Results,” Medical Properties Trust Inc, April 28, 2022.)

During the first quarter, the company added approximately $370.0 million in new investments, including an aggregate of approximately $200.0 million for four general acute hospitals in Finland.

In March, Medical Properties Trust completed its previously announced hospital partnership transaction with Macquarie Asset Management. Under the partnership, Macquarie gains a 50% interest in a portfolio of eight Massachusetts-based general acute care hospitals owned by Medical Properties Trust and operated by Steward Health Care System. (Source: “Medical Properties Trust Completes Hospital Partnership With Macquarie Asset Management,” Medical Properties Trust Inc, March 16, 2022.)

The transaction resulted in Medical Properties Trust gaining approximately $600.0 million from the sale of real estate and $1.3 billion in cash proceeds, which the REIT has used to pay down debt.

Medical Properties Trust Inc expects to spend $1.0 to $3.0 billion on acquisitions in full-year 2022. It also expects to report net income in the range of $1.10 to $1.14 per share and NFFO of $1.78 and $1.82 per share. This helps the company more than cover its growing, high-yield dividends.

Medical Properties Trust Stock’s Dividends Raised for 10 Consecutive Years

Since 2012, Medical Properties has rewarded investors with $3.2 billion in cash dividends and $5.1 billion in equity capital appreciation. As the company is fond of saying, cash cannot be engineered or manipulated.

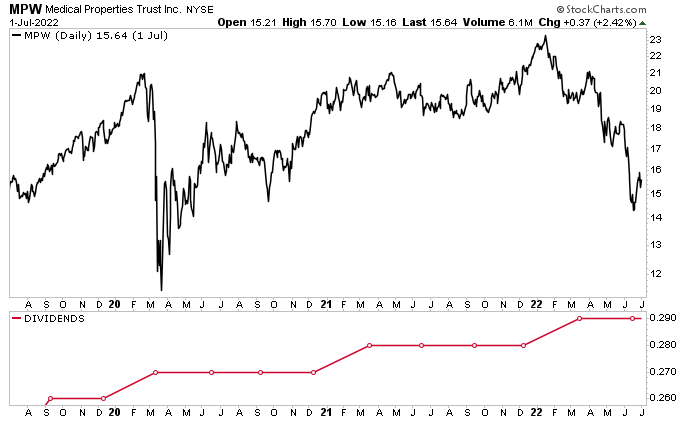

In February, management declared a quarterly dividend of $0.29 per share, for a yield of 7.4%. The company’s payout ratio is just 60.1%. The $0.29 dividend represents a four-percent increase over the $0.28 paid out in the previous quarter. It also represents the 10th consecutive year that MPW stock’s dividend has risen. (Source: “Medical Properties Trust Increases Regular Quarterly Dividend by Four Percent,” Medical Properties Trust Inc, February 17, 2022.)

While dividend growth is paramount for income hogs, Medical Properties Trust stock has also performed well in terms of price appreciation. Since 2012, its total shareholder returns of 356% have outpaced the Dow Jones U.S. Real Estate Health Care Index, which has gained 102%; the MSCI U.S. REIT/Health Care REIT Index, which has gained 192%; and the S&P 400, which has gained 277%.

|

Period |

MPW Stock’s Total Shareholder Returns |

|

3 Years (2018–2021) |

73% |

|

5 Years (2016–2021) |

160% |

| 10 Years (2011–2021) |

356% |

| 2005 IPO Date Through 2021 |

661% |

(Source: “Investor Relations,” Medical Properties Trust Inc, last accessed July 5, 2022.)

Recent Share-Price Performance

Despite the high overall returns and robust outlook, Medical Properties Trust stock has been taking a hit lately, along with the rest of the market. As of this writing, MPW stock is down by:

- Eight Percent over the last month

- 26% over the last three months

- 32% year-to-date

- 18% year-over-year

Chart courtesy of StockCharts.com

When you consider Medical Properties Trust Inc’s cash flow and history of providing growing, high-yield dividends, the sell-off of Medical Properties Trust stock has simply put it in a better trading range—at least that’s what Wall Street thinks. Of the analysts providing a 12-month share-price target for MPW stock, their average estimate is $21.44 and their high estimate is $26.00. This points to potential growth in the range of 37% to 66%.

The Lowdown on Medical Properties Trust Inc

Medical Properties Trust Inc is an excellent REIT with a rock-solid balance sheet and growing international property portfolio. Thanks to its unmatched hospital underwriting, it continues to report strong cash flow generation. This allows the company to reward investors with annual pay raises, even during the worst economic conditions.

MPW stock’s history of consistent dividend growth is propelled by accretive acquisitions. It’s also juiced by the uninterrupted and compounding annual rent increases that are embedded in virtually 100% of the company’s leases. This bodes well for the likelihood of another pay raise in 2023 and beyond.