Market-Crushing PSTL Stock Hits Record High

Postal Realty Trust Has Raised Dividend for 6 Years

Today, I’m focusing on PSTL stock.

Rising interest rates are not great for real estate investment trusts (REITs), because they increase the cost of borrowing and eat into profit margins. High interest rates and inflation also make it difficult for tenants to pay their bills, including rent.

However, those headwinds may not be bothering REITs for much longer.

With U.S. President Donald Trump announcing Kevin Warsh as his pick to replace Jerome Powell at the Federal Reserve, it looks like interest rates are going to start heading much lower. That’s good for REITs, because they can borrow money at better rates.

One REIT that has no trouble getting its customers to pay rent, and that’s more than happy to borrow money on the cheap, is Postal Realty Trust Inc (NYSE:PSTL).

About Postal Realty Trust

PSTL stock is the first and only publicly traded REIT focused on properties leased to the United States Postal Service (USPS).

The REIT’s diversified real estate portfolio is comprised of 1,872 properties across 49 states with approximately seven million net leasable interior square feet (equal to 121 NFL fields). (Source: “Investor Presentation November 2025,” Postal Realty Trust Inc, last accessed January 30, 2026.)

The occupancy rate is 99.8% with an average weighted lease term of four years. While USPS leases have historically been five years in duration with flat rents, once those rents expire, Postal Realty Trust converts those leases to new leases with10-year terms and annual rent escalations of three percent.

Currently 37% of the REIT’s portfolio contains annual rent escalations. Better still, 34% of current leases expire between 2025 and 2027.

As rents escalate each year, revenue does too, and this ultimately benefits adjusted funds from operations (AFFO) per share. Current annual rent escalations are projected to contribute $0.02–$0.06 of AFFO accretion from 2025 to 2027.

It’s always growing, too. Postal Realty Trust’s portfolio is big, but it only accounts for roughly eight percent of the leased market with nearly 17,000 different lessors of property leased to the USPS.

The next 20 largest portfolios combined only own ~11% of the market. To put that into perspective, 92 million square feet is privately owned, while 6.9 million square feet are owned by Postal Realty Trust. The weighted average rental rate is $11.62 per leasable square foot

Over the last seven years, the REIT has acquired more than $650.0 million in real estate at or below costs. In the third quarter of 2025, Postal Realty Trust acquired 47 USPS properties for $42.3 million.

And who wouldn’t want a reliable tenant like the USPS? Aside from being quiet, the USPS is a reliable tenant, with 100% of its contractual rent payments collected. That includes during the 2020 health crisis.

Admittedly, you might think mail is going the way of the Dodo, but the USPS is home to critical infrastructure that supports e-commerce and last-mile delivery. Companies like Amazon, UPS, FedEx, and DHL tap into USPS’s logistics network every day.

And for good reason, with 31,000+ facilities, the USPS represents the largest retail distribution network in the U.S., with 44% of the world’s mail volume processed and delivered by the USPS.

Strong Q3; 2025 AFFO Guidance Increased

For the third quarter ended September 30, 2025, Postal Realty announced that revenue advanced 24% to $24.3 million. Net income jumped 255% to $3.8 million, or $0.13 per share. (Source: “Postal Realty Trust, Inc. Reports Third Quarter 2025 Results,” Postal Realty Trust Inc, November 11, 2025.)

The REIT’s funds from operations (FFO) increased to $11.0 million, or $0.34 per share. Adjusted FFO came in at $10.8 million, or $0.33 per share.

Commenting on the third-quarter results, Andrew Spodek, Postal Realty Trust’s chief executive officer, said, “We are pleased with our strong third quarter results; we are increasing our AFFO per share guidance for the year by $0.06, driven by strength in our programmatic leasing with the U.S. Postal Service and operating efficiencies.”

“Additionally, our acquisition volume of $101 million closed year to date through October 17th supports future growth. We believe our focus on internal growth, disciplined acquisitions, and a resilient balance sheet positions us well to continue creating value for shareholders.”

Postal Realty Trust’s Q4 & 2025 Update

In January, Postal Realty provided a fourth-quarter and full-year 2025 update. During the fourth quarter, it acquired 65 properties leases to the USPS for roughly $29.1 million. For full year 2025, the company acquired 216 properties leased to the USPS for approximately $123.0 million. (Source: “Postal Realty Trust, Inc. Provides Fourth Quarter and Full Year 2025 Update,” Postal Realty Trust Inc, January 8, 2026.)

“The acquisition volume we achieved in 2025 reflects the strength of our long-standing relationships, our differentiated sourcing strategy, and our specialized expertise in postal real estate,” said Spodek.

“Last year’s acquisitions represent approximately 20% growth in our asset basefrom year-end 2024. Importantly, we drove this growth while maintaining a strong balance sheet.”

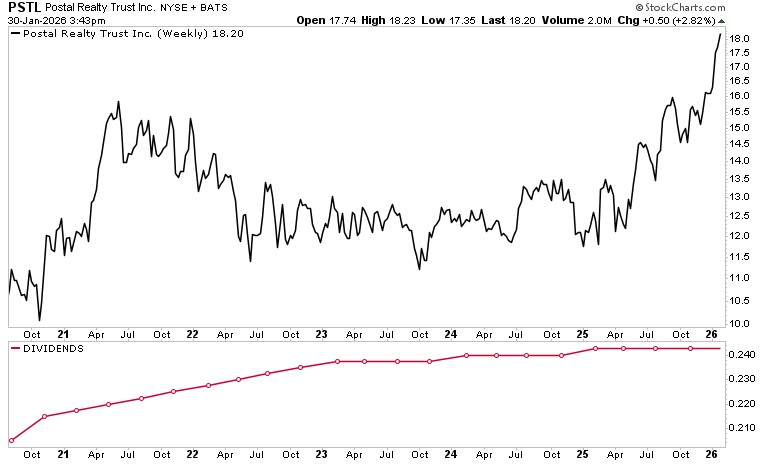

PSTL Stock: Quarterly Dividend Upped to $0.2425/Share

As a REIT, Postal Royalty is legally required to distribute at least 90% of its taxable income to investors. Not only is PSTL stock known for its attractive return profile, but it has also increased its dividend every year since its 2019 initial public offering. (Source: “Dividend History & Tax Information,” Postal Realty Trust Inc, last accessed January 30, 2026.)

In November, the REIT paid out a third-quarter dividend of $0.2425 per share, or $0.97 per share on an annual basis, for a forward dividend yield of 5.4%. That’s significantly higher than the S&P 500 dividend yield of 1.13%.

PSTL stock’s third-quarter payout of $0.2425 per share also represents a one-percent increase over the $0.2400 paid out in the third quarter of 2024.

That dividend payout is safe, too, easily covered by the third-quarter AFFO of $0.33 per share.

PSTL Stock Crushing the S&P 500

PSTL stock has been doing well since the start of 2025, and even more so since the start of 2026, which is when it announced its 2025 update. As of January 30, PSTL is seriously outpacing the broader market, now up:

- 13.5% over the last month

- 26.7% over the last three months

- 34% over the last six months

- 13% year to date

- 51% year over year

PSTL stock actually hit a record high of $18.26 on January 30. Despite the big near-term moves, Wall Street thinks PSTL will hit fresh highs over the coming quarters, with analysts providing a 12-month share price high target of $20.00.

Chart courtesy of StockCharts.com

The Lowdown on PSTL Stock

Postal Realty Trust Inc is a great specialty REIT. It’s the only publicly traded REIT focused on properties leased to the USPS. It has a large and growing real estate portfolio and collects 100% of its rent.

Thanks to its reliable tenant, Postal Realty Trust does not have to provide for tenant improvements, allowances, or free rent when it renews leases. USPS leases are also not subject to annual budget appropriations.

Thanks to baked-in rent escalations, its leases are also protected from inflation. Moreover, renewing a lease is a more economic alternative than moving to a postal build-to-suit option.

Taken together, these dynamics provide PSTL stock with a reliable income stream, which helps support its reliable, growing, high-yield dividend.