Main Street Capital Stock: 6.6%-Yield BDC Raised Dividend Again

Why MAIN Stock Is Worth Watching

Investors who are looking for high-yield dividends and big stock market gains might want to put Main Street Capital Corp (NYSE:MAIN) on their radar.

Why?

Main Street Capital is a business development company (BDC) that lends capital to small and midsized companies. We at Income Investors have nicknamed these firms “alternative banks” because they operate much like traditional financial institutions.

BDCs lend capital to the smaller companies that big banks won’t touch. These “small” companies might generate between $20.0 and $100.0 million in yearly sales, but that’s not enough for the big banks.

Because small companies have few options for borrowing money, BDCs can charge above-average interest rates. Therefore, BDCs might generate returns as high as 15% from their loan portfolios, while commercial banks might earn as little as three percent.

And thanks to a quirk in U.S. tax law, BDCs pay out some of the highest-yield dividends around. BDCs benefit from the same kind of rules that real estate investment trusts (REITs) do.

Traditional financial outfits have to pay the government between $0.25 and $0.35 in taxes for each dollar they make in profit, but BDCs pay little or no corporate tax on their earnings. In exchange for this benefit, alternative banks must distribute at least 90% of their ordinary taxable income to their shareholders.

As a result, BDC stocks pay some of the highest dividend yields around. It’s not uncommon to see alternative bank stocks with yields as high as 15%, which is five times higher than the typical yields from traditional bank stocks.

About Main Street Capital Corp

Main Street Capital is a BDC that targets lower-middle-market companies with annual revenues between $10.0 and $150.0 million and earnings before interest, taxes, depreciation, and amortization (EBITDA) between $3.0 and $20.0 million. (Source: “Investor Presentation: Third Quarter – 2023,” Main Street Capital Corp, last accessed January 19, 2024.)

The loans come with conditions that are pretty favorable to Main Street Capital. Most of the loans have fixed variable rates, which means they rise along with market interest rates. Moreover, because Main Street Capital’s equity has senior status, the BDC gets paid before anyone else does.

The combination of working with profitable companies and having senior-status loans means Main Street Capital has an exceptionally low default rate.

In addition to making money from loans, Main Street Capital Corp takes an equity position in each company it lends money to. With over $6.8 billion in capital under management, its portfolio currently comprises 195 companies.

The BDC’s average loan is $18.7 million. Its largest total investment in an individual company generates 3.7% of its total investment income and 3.2% of its total portfolio fair value.

By industry, Internet software and services represents the largest portion of Main Street Capital’s portfolio, at eight percent. (Source: “Fact Sheet as of September 30, 2023,” Main Street Capital Corp, September 30, 2023.)

A few of the other many industries that the BDC loans capital to include machinery (seven percent), health-care providers and services (six percent), tobacco (three percent), aerospace and defense (two percent), electrical equipment (two percent), hotels, restaurants, and leisure (one percent), and chemicals (one percent).

Net Investment Income Increased 32% in Third Quarter

For the third quarter, Main Street Capital announced that its total investment income increased 25% year-over-year to $123.2 million. (Source: “Main Street Announces Third Quarter 2023 Results,” Main Street Capital Corp, November 2, 2023.)

Its net investment income climbed by 32% year-over-year to $82.1 million, or $0.99 per share. Its distributable net investment income rallied by 31% to $86.7 million, and its distributable net investment income per share went up by 18% to $1.04.

Commenting on the results, Dwayne L. Hyzak, Main Street Capital Corp’s CEO, said, “We are pleased with our performance in the third quarter, which included continued strength in the underlying performance of the majority of our lower middle market and private loan portfolio companies and significant contributions from our asset management business.” (Source: Ibid.)

He later added, “We continue to focus on maintaining a conservative capital structure and significant liquidity as one of our key strengths, and we believe this strength has us well positioned for the future.”

Management Increased Monthly Dividend & Announced Special Dividend

Main Street Capital Corp’s unique investment strategy and conservative capitalization allow it to provide sustainable, long-term dividend growth to its shareholders. Main Street Capital stock pays recurring monthly dividends and supplemental quarterly dividends.

Since its October 2007 initial public offering (IPO), Main Street Capital has periodically increased the amount of its regular monthly dividends and has never reduced it.

In November 2023, the BDC announced that its board declared regular monthly cash dividends of $0.24 per share for January, February, and March 2024. (Source: “Main Street Announces First Quarter 2024 Regular Monthly Dividends, Including a Monthly Dividend Increase, and Supplemental Dividend Payable in December 2023,” Main Street Capital Corp, November 1, 2023.)

That works out to a quarterly payout of $0.72 per share and an inflation-thumping yield of 6.58% (as of this writing).

MAIN stock’s current monthly payout of $0.24 per share represents a 2.1% increase from its fourth-quarter 2023 monthly dividend and a 6.7% increase from its first-quarter 2023 monthly dividend.

Main Street Capital Corp also declared a supplemental cash dividend of $0.27 per share, which it paid on December 27, 2023. That was Main Street Capital stock’s ninth consecutive quarterly supplemental dividend.

It also translated to a 29% year-over-year increase in the total dividends it paid in the fourth quarter of 2023 and a 25% year-over-year increase in the total dividends it paid in the full year.

Adding up all the dividends that Main Street Capital Corp’s board has declared to date, including the first-quarter 2024 regular monthly dividends, results in a total of $39.535 per share.

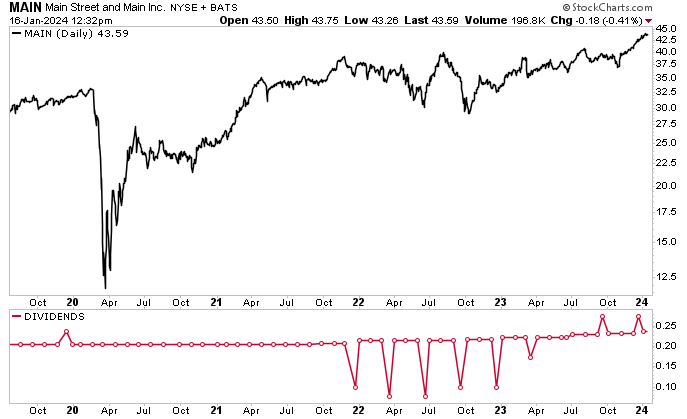

MAIN stock’s dividend amount isn’t the only thing that’s been rising; so too has its share price. As of this writing, Main Street Capital Corp’s share price has gone up by 10% over the last three months and 24% year-over-year. On January 9, Main Street Capital stock hit a new all-time record high of $44.17.

More record highs are expected from MAIN stock, with Wall Street analysts providing a median 12-month share-price forecast of $45.00 and a high forecast of $47.00.

Chart courtesy of StockCharts.com

The Lowdown on Main Street Capital Corp

Thanks to Main Street Capital’s diverse loan portfolio and favorable lending terms, it’s a cash cow for income-starved investors.

Main Street Capital stock pays stable, monthly, high-yield dividends that have never decreased. Main Street Capital Corp recently raised the amount of its monthly dividends declared its ninth consecutive quarterly supplemental dividend.

Furthermore, its share price has consistently outperformed its peers and the broader market, regardless of the economic cycle. MAIN stock recently traded at record-high prices.