Main Street Capital Corp.: Is This the Stock Market’s Safest 8.1% Yield?

Can You Trust Main Street Capital’s Payout?

It’s the triple crown of income investing.

A big yield, solid fundamentals, and solid cash flow; it’s no wonder that Main Street Capital Corporation (NYSE:MAIN) has emerged as a favorite among income investors.

This business development company (BDC) is one of the best-managed firms in the industry. Last year, it paid out $2.69 in regular distributions. That figure will likely grow, given that the company has raised its payout for nine consecutive years.

But it gets better. In addition to regular distributions, Main Street also supplements its payout through a semi-annual special dividend. That lifts the total annual yield on shares to over eight percent.

Can Main Street continue to deliver for investors? Let’s take a look.

The business stands in a solid financial position, to begin with.

With BDCs, we use a metric called distributable net investment income to measure performance. This provides us with the best picture as to how much cash the company can return to shareholders.

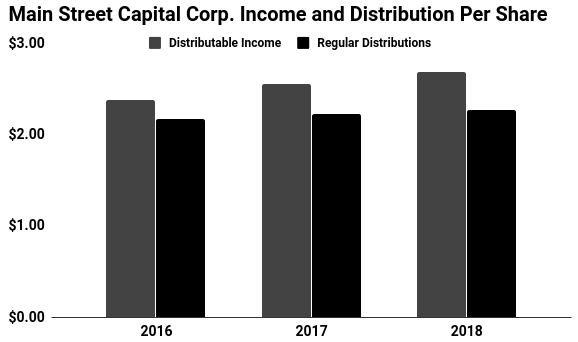

In 2018, analysts estimate Main Street will generate $2.69 per share in distributable net investment income. Over the same period, the firm has paid out $2.28 per share in regular distributions—which comes out to a payout ratio of 85%.

Generally, I like to see companies pay out 90% or less of their profits to shareholders. That leaves management with a little wiggle room to keep mailing out checks even in the event of a downturn. So Main Street’s dividend policy sits well within my comfort zone.

That payout will likely continue to grow.

Through the first nine months of 2018, Main Street has seen its distributable net investment income jump 15% year-over-year. Analysts credit that increase to a low default rate, a strong economy, and growing loan demand.

Management projects an even bigger increase this year. Because Main Street lends most of its capital on a floating-rate basis, coupons in its portfolio reset every few months. So, as interest rates continue to rise, the company’s investment income will start to soar.

(Source: “Investor Relations,” Main Street Capital Corporation, last accessed January 14, 2018.)

So what could go wrong here?

A downturn in the economy would spell bad news for Main Street. A recession would likely trigger a spike in defaults, which would mean fewer dividend hikes for shareholders.

That said, management has done a good job of protecting their investors. Main Street stands first in line to get paid on most of its loans and has required borrowers to supply plenty of collateral. Still, it’s a risk to consider.

Regardless, Main Street offers a stellar track record backed by impressive fundamentals. You probably won’t find a safer eight-percent yield than this.