Lock in New Senior’s Appealing Dividend Yield of 10.3% Now

Few things are more attractive to income investors than a high dividend yield. But of course, increased yields usually come with increased risks, so we need to ensure that the fundamentals supporting a company’s dividend are as solid as possible.

Now, to be sure, stocks with sustainable high yields aren’t exactly easy to spot. But luckily, our team here at Income Investors has decades of experience in identifying stable high-yield plays.

So what exactly are we looking for? Well, ideally, we’d like to see a company have 1) a solid competitive advantage, 2) healthy cash flows, 3) a proven management team, and 4) strong demographic trends working in its favor. When combined with a high dividend yield, these qualities can make for an especially potent income stock.

From the research I’ve conducted so far, New Senior Investment Group Inc (NYSE:SNR) nicely checks off all the boxes on that list.

Let’s take a closer look at the opportunity.

Senior Home Honcho

For readers who aren’t too familiar with New Senior Investment, it is a real estate investment trust (REIT) that owns senior housing properties. In fact, it is one of the country’s largest publicly traded senior housing companies, owning about 150 properties across the United States.

So where does New Senior derive its competitive advantage? Well, the company concentrates primarily on private pay senior housing properties, which gives it a unique edge over its publicly traded peers.

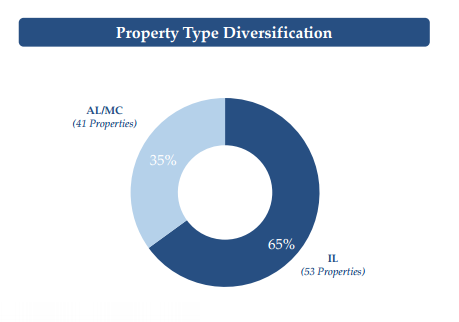

See, the senior housing industry consists of services that range from “mostly housing” (i.e. senior apartments) to “mostly healthcare” (i.e. skilled nursing, hospitals, etc.). But by focusing strictly on the center of that band, namely independent living (IL) and assisted living (AL) properties, management can stick to its core expertise, as well as eliminate the redundant back-office costs of its properties.

Moreover, investors benefit from New Senior’s focused approach by being able to play the positive trends of the senior housing sector without being exposed to the higher levels of risk associated with healthcare real estate.

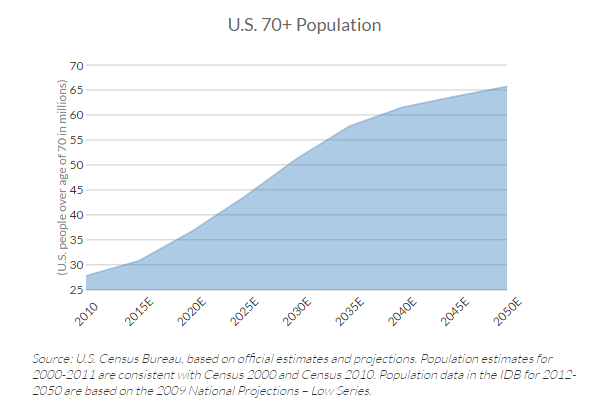

According to the U.S. Census Bureau, the population of seniors over 70 years of age totals 32 million and is projected to increase to 46 million by 2025. That represents a spike of 44% and a whopping five times the growth rate of the total population. Additionally, with 1.2-million seniors living in senior housing today, the penetration rate sits at under four percent.

Needless to say, the demographic trends are clearly in New Senior’s favor.

Diversified Strength

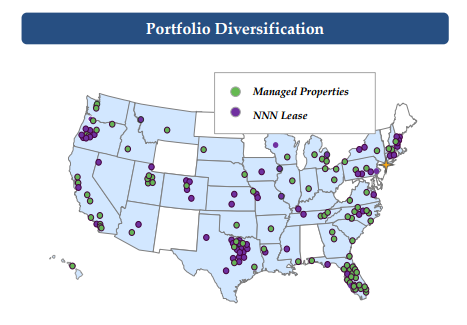

New Senior is also relatively diversified in terms of product type, operating model, and geography, giving the company yet another durable competitive edge.

In addition to operating both IL properties (105) and AL properties (42) across 37 states, the company’s portfolio is also categorized by two major segments: 1) Managed Properties, which are operated by property managers; and 2) Triple Net Lease Properties, which the company leases to tenants.

So while New Senior benefits by having a narrow private pay focus, its results are less volatile than you’d think due to the strong product and geographic diversification within the category.

Source: “Quarterly Investor Presentation: Fourth Quarter & Full Year 2016,” New Senior Investment Group Inc, February 28, 2017.

In Q4, for example, the company’s total same store net operating income increased 1.1%, despite a slight decline in the Managed Properties business. Why? Because a nice 4.3% same-store sales bump from the Triple Net Lease segment did well to offset that weakness. Moreover, solid performance in the company’s independent living segment, which represents 65% of the company’s total portfolio, nicely made up for relative softness in assisted living.

Source: “Quarterly Investor Presentation: Fourth Quarter & Full Year 2016,” New Senior Investment Group Inc, February 28, 2017.

“While competition for labor is competitive, our operators again continue to manage expenses effectively in the fourth quarter,” said managing director David Smith in the conference call with analysts. “Also, similar to the third quarter, our IL portfolio continuing to outperform our AL portfolio.” (Source: “New Senior Investment Group’s (SNR) CEO Susan Givens on Q4 2016 Results – Earnings Call Transcript,” Seeking Alpha, February 28, 2017.)

Formidable FFO

Of course, these competitive advantages are basically meaningless to us income investors if they don’t translate into robust cash flow. Luckily for New Senior shareholders, they absolutely do.

In the world of REITs, funds from operations (FFO) are what are used to pay dividends to shareholders. And in 2016, New Senior generated FFO of about $99.0 million, or $1.19 per share. Meanwhile, the company’s 2016 dividend payout clocked in at $1.04 per share. That works out to a trailing 12-month coverage ratio of 114%, suggesting that the company’s current level of dividends remains nicely supported.

New Senior’s well-diversified portfolio and laser-sharp focus on private independent living have done well to generate robust FFO over the years, and given the strong demographic trends working in its favor, should continue to do so in the future.

“As many of you know, since our inception, we’ve constructed the portfolio as differentiated from our peers with our IL focus, which accounts for roughly 70% of our NOI,” said Smith. “We continue to be uniquely positioned in today’s environment, given the composition of our portfolio.” (Source: Ibid.)

High Dividend Yield at a Good Price

That brings us to New Senior’s stock price, which is down about 12% over the past six months, primarily on concerns over rising interest rates. But when you consider the company’s respectable operating performance of late, as well as its favorable long-term outlook, that kind of double-digit pullback seems overdone.

After all, New Senior now boasts a juicy dividend yield of 10.3%. That is roughly two times the yield of other senior home stocks like LTC Properties Inc (NYSE:LTC) (4.8%) and Welltower (NYSE:HCN) (4.9%), as well as the overall real estate industry average of 5.2%.

Given how nicely New Senior’s fundamentals are holding up, I can only see that dividend yield spread narrowing over the long run.

The Bottom Line On New Senior Investment

There you have it, my fellow Income Investors: a few bullish reasons to consider adding New Senior to your portfolio.

As usual, don’t view this article as a formal recommendation. Instead, think of it as an idea worth further research. Because while New Senior’s 10%-plus dividend yield seems decently covered at this point in time, it’s vital that investors keep monitoring the company’s FFO to ensure that it stays that way.

But as of this moment, New Senior is definitely an outsized income opportunity worth watching.