Lock in LaSalle Hotel’s Juicy (and Healthy) 6.3% Dividend Yield

People often ask me what I emphasize more when searching for a high dividend yield stock, growth or value? In other words, would I rather invest in a company that is growing, or one whose stock is cheap?

But as much as Wall Street views growth and value as opposing concepts, the truth is that they are connected at the hip. How is this possible? Well, when you consider that growth is simply a variable in the calculation of a company’s value, it’s easy to see how interlocked the two really are.

So all else equal, it’s far better to invest in companies that show consistent dividend growth. But we must also be very careful to never overpay for that growth, either. After all, even a wonderful company can turn out to be a horrible investment if its price is too high.

Thus, we need to ensure that we actually benefit from a company’s future growth. As the great Warren Buffett says, “Price is what you pay. Value is what you get.”

Well, this week, I think I’ve found a high-dividend yield play that is both growing and offers great value: real estate investment trust (REIT) LaSalle Hotel Properties (NYSE:LHO). Let’s take a closer look, shall we?

The Lowdown on LaSalle

If you’re not too familiar with LaSalle, don’t worry; it won’t take too long to get caught up to speed. Because at the heart of it all, what the company does is pretty simple: it owns, acquires, and redevelops upscale hotels. That’s it.

At the end of last year, it owned 46 hotels with roughly 11,500 guest rooms, located in nine states and the District of Columbia. While that doesn’t sound like a whole lot of geographic diversification, LaSalle focuses on the largest urban markets coast-to-coast. They include New York City, Los Angeles, Chicago, Boston, and San Francisco.

Thus, the company’s primary objective is to take the cash flow provided by these hotels across the country and distribute it to shareholders (providing them with income). But in order to provide more stable, consistent, and faster-growing dividends than the competition, management specifically targets hotels that:

- Have clear competitive advantages in the form of location, amenities, etc.

- Can be purchased at a significant discount to their fair market value

- May benefit from any operational changes such as rebranding, new management, renovations, etc.

- Have clear expansion opportunities

As you can probably tell, much of LaSalle’s success depends heavily on the skill of its management team. And luckily for shareholders, LaSalle’s leadership is one of the best in the business. In fact, LaSalle’s return on invested capital has been much higher than the industry average over the last 18 years. Moreover, revenue has grown at a brisk compounded rate of 20% since 1998.

So when it comes to hotel companies, few have a better long-term track record of growth than LaSalle.

Suite Softness

But how has LaSalle’s operating performance been of late? Well, to be sure, the company has been facing some industry headwinds in recent months. Specifically, increasing hotel supply is putting a bit of pressure on the top line.

In the second quarter, for example, revenue per available room (RevPAR), a key statistic in the hotel industry, slipped 1.6% year-over-year.

Of course, the great news is that the revenue decline is primarily tied to industry softness, as opposed to company weakness. In fact, LaSalle continues to perform superbly in terms of profitability. For Q2, net income increased 0.5%, while hotel operating margins expanded 40 basis points. Hotel expenses even managed to decline 2.1%.

So although hotel industry dynamics aren’t exactly favorable at the moment, LaSalle continues to be far more efficient that its peers.

“Despite softening RevPAR in the face of increasing hotel supply in our markets, we remain proud that our teams are operating with excellent efficiency across the portfolio,” said President and Chief Executive Officer Michael Barnello. (Source: “LaSalle Hotel Properties Reports Second Quarter 2017 Results,” LaSalle Hotel Properties, July 19, 2017.)

Also Read:

REIT ETF List: Earn Regular Income from These Real Estate ETFs

7 Dividend Stocks to Invest into in 2017

Cash Flow Remains King

Of course, what we really want to see as income investors is healthy cash flow. Because while increasing profitability is nice, long-term dividend growth can only be sustained through long-term cash flow growth.

In other words, the stronger a company’s cash flow is, the higher quality its dividends will be. And when it comes to LaSalle’s dividend yield, it is of very high quality.

In fact, the company’s operating cash flow has grown from $216.0 million in 2012 to a robust $359.0 million last year. And on the strength of that cash flow, LaSalle’s quarterly dividend has jumped from $0.11 in Q1 of 2012 to $0.45 in Q1 of 2017. That represents compound annual dividend growth of 33%. Not too shabby.

Given LaSalle’s still-very strong financial position and high operating efficiency, I don’t expect that growth to significantly slow anytime soon.

“We continue to have substantial flexibility with 39 of our 41 hotels unencumbered by debt and nearly $775 million of capacity available on our lines of credit,” said CFO Ken Fuller in a conference call. “We have a highly liquid balance sheet and remain extremely well capitalized.” (Source: “LaSalle Hotel Properties’ (LHO) CEO Michael Barnello on Q2 2017 Results – Earnings Call Transcript,” Seeking Alpha, July 19, 2017.)

Get This High Dividend Yield on the Cheap

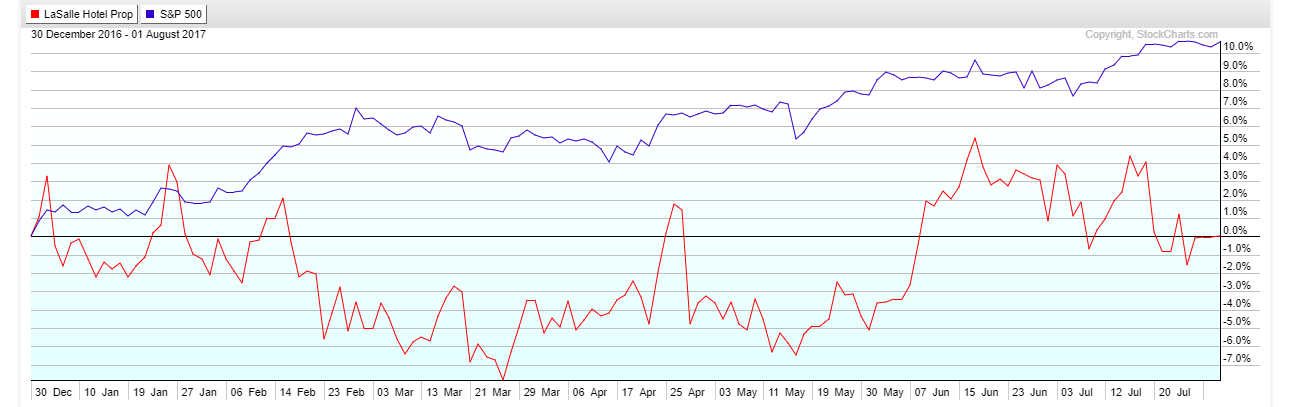

And that brings us LaSalle’s stock price, which has underperformed considerably in 2017:

But of course, it is because of this price weakness that LaSalle also represents a tremendous value in my eyes.

Specifically, the stock’s dividend yield of 6.3% is higher than the hotel REIT average of 5.2%, as well as the S&P 500’s yield of two percent. Furthermore, LaSalle’s price-to-book of 1.3 is well below that of its peers, suggesting that it is cheap on a pure physical asset basis as well.

Considering LaSalle’s industry-topping track-record, its current industry-lagging valuation seems too good to pass up.

The Bottom Line on LHO Stock

There it is, my fellow Income Investors: several reasons why I think LaSalle is a high-dividend yield play worth considering.

But as always, don’t view this write-up as a formal recommendation. Instead, use it as a jump-off point for further research. After all, LaSalle is no sure thing, and you need to be comfortable with all of its risks.

But with that said, I believe the chances are high that LaSalle outperforms over the long run.