Lock in Genesis Energy’s 9.4% Dividend Yield Today

I always get interested when a high dividend yield stock drops in price. Why? Well, because it might mean that a juicy income opportunity has just become a little juicier.

Midstream energy company Genesis Energy, L.P. (NYSE:GEL), for example, typically sports a dividend yield of around six percent. But, due to a sharp downturn over the past four months or so, Genesis now boasts a dividend yield of more than nine percent.

To be sure, Genesis is a master limited partnership (MLP). It is required to distribute most of its income to investors, so a high dividend yield in itself isn’t all that special. But, given how solid the company’s fundamentals have been historical, today’s extra-high dividend yield is certainly worth looking into.

Remember: there is no easier way to build wealth than by consistently buying solid dividend stocks when they go on sale.

Let’s take a closer look at Genesis.

Refined Behavior

If you aren’t familiar with Genesis Energy, it is an MLP focused on the midstream segment of the oil and gas industry. What does that mean? See, the oil industry is commonly categorized by three phases: upstream, midstream, and downstream.

The upstream part involves the finding and drilling of oil. The midstream part–Genesis’ specialty–involves the shipping and storing of oil. Finally, the downstream stage involves refining and distributing the processed oil-based products.

Specifically, Genesis provides services around and within the refineries. Upstream of the refineries, the company gathers and transports the crude oil. Downstream of the refineries, Genesis offers transportation services and even provides outlets for the finished products. And, within the refineries, the company provides chemical balancing services.

Additionally, Genesis has a thriving pipeline business in the Gulf of Mexico. It includes roughly 2,600 miles of oil and gas pipelines. It also includes six offshore hubs that serve highly active drilling regions such as offshore of Texas, Louisiana, Mississippi, and Alabama. So, although Genesis focuses entirely on the midstream, its portfolio is very well diversified.

Thus, management’s general objectives are pretty simple: 1) optimize its existing assets, 2) expand its geographic reach, and 3) economically expand its pipeline and terminal operations.

But how well is management performing on these goals? Well, judging from its quarterly results released last Thursday, things are certainly looking up.

Rebounding Performance

To be sure, Genesis has been experiencing a downturn of sorts over the last few years. The weakness in energy prices fueled a decline in oil and gas production in the U.S.

However, there is good reason to believe that Genesis is turning the corner.

In the first quarter (Q1), Genesis posted earnings per share of $0.23. That squeaked past estimates by $0.01. Meanwhile, revenue increased a solid 9.8% over the year-ago period to $415.5 million. Also, the company’s adjusted earnings before interest, taxes, and depreciation (EBITDA) only slipped about two percent over the prior year.

So, although energy prices haven’t fully recovered, Genesis’ most recent results suggest that things are certainly improving.

“While certain headwinds persist, we are encouraged by the performance of our base businesses some of which we feel are clearly bottoming and poised to potentially deliver increased financial contributions in future periods with little or no additional capital required,” said Chief Executive Officer Grant Sims.” (Source: “Genesis Energy, L.P. Reports First Quarter 2017 Results,” Genesis Energy, L.P., May 4, 2017.)

Recovering Cash Flows

Of course, rebounding revenue is meaningless to us income investors if it doesn’t translate into robust cash flow. After all, cash flow is what companies use to pay our dividends. Here, the news is also good.

In Q1, Genesis’ operating cash flow clocked in at $64.6 million. That represents a big increase of 57% over the same period last year.

Thanks to that strong cash generation, management also upped its quarterly dividend distribution to $0.72. That is a solid increase of 7.1% over the Q1 distribution of $0.6725 in 2016.

But here’s the most impressive part: Genesis has now increased its distribution for a whopping 47 consecutive quarters. That is nearly 12 straight years of dividend growth. Talk about consistency.

Given the company’s improving operating environment, I wouldn’t expect that dividend growth to slow.

“The momentum for the rest of this year and into 2018 positions us to do reasonably well even if things don’t improve in late 2017 or 2018,” continued Sims. (Source: Ibid.)

High Dividend Yield at a Great Price

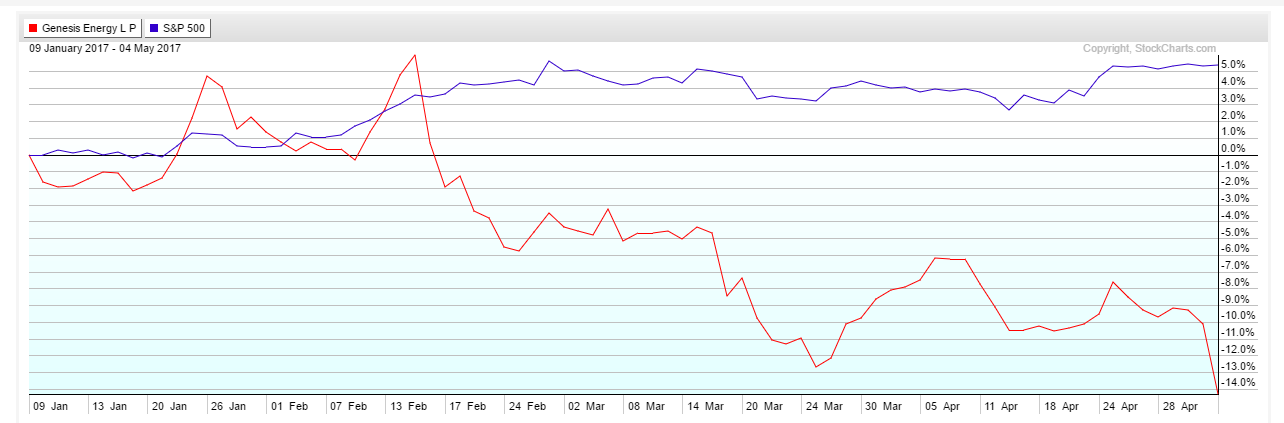

That brings us back to Genesis’ slumping stock price. Over the past 80 days, it is down about 14%, significantly underperforming the S&P 500.

Chart courtesy of StockCharts.com

However, when you consider Genesis’ awesome dividend consistency and rebounding fundamentals, I believe the decline is well overblown.

After all, Genesis’ dividend yield currently sits at 9.4%. That dwarfs the energy industry’s average yield of 5.5%, as well as the S&P’s yield of 2.1%.

It’s not very often that you come across a company that has grown its dividend for more than 10 years and also offers a nine-percent-plus yield. For that reason, I fully expect the spread between Genesis’ yield and the overall market to narrow.

The Bottom Line on Genesis Energy

There you go, my fellow Income Investors: a few good reasons to add Genesis Energy to your income portfolio.

As always, please don’t view this write-up as a formal stock recommendation. Instead, take it as sort of a jump-off point for further research. Although Genesis’ 9.4% yield is tantalizing at this point, it’s vital that you understand how volatile energy prices and interest rates can still wreak havoc with the stock price.

But with that said, Genesis easily deserves a place on your watchlist.