Leggett & Platt Stock: Contrarian Play Yielding 7.9%

52 Straight Years of Higher Dividends From LEG Stock

When you think of dividend kings (stocks with at least 50 straight years of dividend increases), the companies that immediately come to mind are large ones, but there are also smaller ones that fit the bill.

Leggett & Platt Inc (NYSE:LEG), which has been operating for 140 years, has rewarded income investors with 52 straight years of dividend hikes. Note that there are currently only 50 or 51 dividend kings (depending on the source), so Leggett & Platt is in an exclusive club.

The company, which has a market cap of $3.1 billion, is a diversified manufacturer of engineered components and products that are found in homes and automobiles. It has 15 business units and 135 manufacturing facilities in 18 countries. (Source: “Investor Relations,” Leggett & Platt Inc, last accessed November 13, 2023.)

The company’s offerings include:

- Adjustable beds

- Private-label finished mattresses

- Bedding components

- Specialty bedding foams

- Bedding industry machinery

- Home and workplace furniture components

- Automotive seat support and lumbar systems

- Flooring underlayment

Leggett & Platt Inc faces some hurdles on the operational side, given the current inflationary pressures and some slowing of consumer demand.

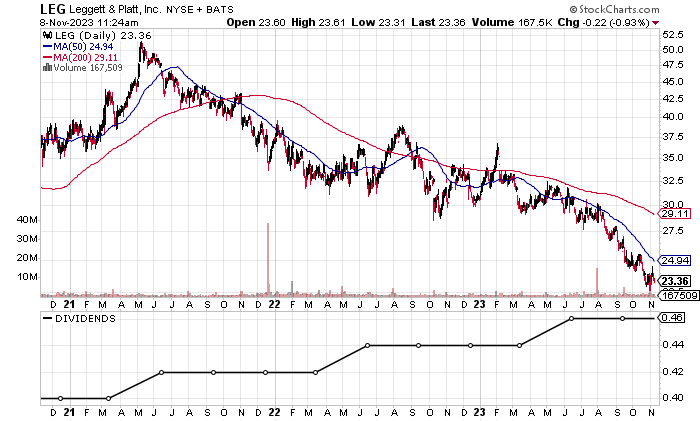

Moreover, the company’s share price has been lagging the S&P 500 and Dow Jones Industrial Average. As of this writing, Leggett & Platt stock is down by 27.3% this year and down by 39.1% from its 52-week high of $38.55.

LEG stock has decent institutional ownership, with 523 institutions holding 71.2% of the outstanding shares. (Source: “Leggett & Platt, Incorporated (LEG),” Yahoo! Finance, last accessed November 13, 2023.)

Can Leggett & Platt stock regain its former status as a leading dividend stock?

Chart courtesy of StockCharts.com

A Turnaround Needed at Leggett & Platt Inc

Leggett & Platt grew its revenues in three of its last four reported years, from $4.27 billion in 2018 to a record-high $5.15 billion in 2022.

There are some concerns about the company after its soft revenue growth in 2022, which is why LEG stock’s share-price performance has been weak.

Analysts estimate that Leggett & Platt Inc will report a revenue contraction of 5.8% to $4.85 billion in full-year 2023, followed by a 2.8% rise to $4.99 billion in 2024. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | Revenues (Billions) | Growth |

| 2018 | $4.27 | N/A |

| 2019 | $4.75 | 11.4% |

| 2020 | $4.28 | -10.0% |

| 2021 | $5.07 | 18.3% |

| 2022 | $5.15 | 1.7% |

(Source: “Leggett & Platt Inc.” MarketWatch, last accessed November 13, 2023.)

On the bottom line, Leggett & Platt has delivered generally accepted accounting principles (GAAP) profits in its last five straight reported years. Its five-year best was $2.94 per diluted share in 2021, which was followed by a decline of 22.8% to $2.27 in 2022.

Analysts expect Leggett & Platt Inc’s GAAP-diluted earnings per share (EPS) to fall further to $1.53 per diluted share in full-year 2023 before edging up to $1.63 in 2024. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $2.26 | N/A |

| 2019 | $2.32 | 2.7% |

| 2020 | $1.86 | -19.8% |

| 2021 | $2.94 | 58.1% |

| 2022 | $2.27 | -22.8% |

(Source: MarketWatch, op. cit.)

Leggett & Platt Inc’s funds statement shows positive free cash flow (FCF) over its last five reported years, with FCF growth in three of those years.

| Fiscal Year | FCF (Millions) | Growth |

| 2018 | $280.7 | N/A |

| 2019 | $524.9 | 87.0% |

| 2020 | $536.4 | 2.2% |

| 2021 | $164.7 | -69.3% |

| 2022 | $341.1 | 107.1% |

(Source: MarketWatch, op. cit.)

The company’s financial situation is manageable as long as its profits and FCF don’t significantly relapse.

At the end of June, Leggett & Platt Inc held $273.9 million in cash and had a debt of $2.2 billion. (Source: Yahoo! Finance, op. cit.)

Its Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is an acceptable reading of 4.0, which is just below the midpoint of the Piotroski score’s range of 1.0 to 9.0.

Furthermore, the following table shows that Leggett & Platt Inc has managed to consistently cover its interest expense via much higher earnings before interest and taxes (EBIT).

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2019 | $513.4 | $83.3 |

| 2020 | $400.5 | $79.6 |

| 2021 | $596.0 | $73.9 |

| 2022 | $485.0 | $81.4 |

(Source: Yahoo! Finance, op. cit.)

Leggett & Platt Stock’s Dividend Growth May Pause

Leggett & Platt Inc is a work in progress. In the meantime, income investors can collect steady dividends from LEG stock. This will help compensate them for the stock’s added risk.

Leggett & Platt’s current quarterly dividend of $0.46 per share translates to a yield of 7.85% (as of this writing), which is largely a result of its share-price weakness.

As Leggett & Platt stock’s price edges higher, I expect its dividend yield to approach its five-year average of 4.35%. (Source: Yahoo! Finance, op. cit.)

Considering Leggett & Platt Inc’s lower expected earnings over the next two years, I wouldn’t be surprised to see its dividend increases pause on a temporary basis until the company’s financial situation improves. On the other hand, the company’s high free cash flow (FCF) should allow it to continue increasing its dividends.

| Metric | Statistic |

| Dividend Growth Streak | 52 Years |

| Dividend Streak | 53 Years |

| 7-Year Dividend Compound Annual Growth Rate | 4.7% |

| 10-Year Average Dividend Yield | 4.3% |

| Dividend Coverage Ratio | 2.5 |

The Lowdown on Leggett & Platt Inc

Although Leggett & Platt Inc is currently facing some demand challenges due to the high-interest-rate environment and other macroeconomic overhangs. I suggest being patient while waiting for the global economic situation to improve.

When that happens, LEG stock could provide significant capital appreciation while paying out steady dividends.