Lamar Advertising Stock: Price of High-Yielder Up 22% in One Month

Outlook for LAMR Stock Is Bullish

Real Estate Investment Trusts (REITs) have struggled in this high-interest-rate, inflationary environment due to higher debt repayment costs, upcoming maturities, and tight liquidity in the banking industry. REITs have also faced headwinds as a result of reduced demand for commercial properties.

Fortunately for companies like Lamar Advertising Co (NASDAQ:LAMR), not all REITs are created equal.

When it comes to REITs, most people think of residential, office, retail, and mortgage REITs, but there are many “specialty” REITs that don’t fit into those neat packages. This includes Lamar Advertising.

You may not have heard of the company before, but if you live in the U.S. or Canada and have walked around in an urban setting or driven down a highway, chances are good you’ve seen what Lamar Advertising Co does.

Baton Rouge, Louisiana-based Lamar Advertising is one of the largest outdoor advertising companies in North America. It has approximately 361,000 ad displays across the U.S. and Canada. (Source: “Our Company,” Lamar Advertising Co, last accessed November 23, 2023.)

The company’s display formats include billboards, interstate logos, and transit and airport ads. It has the largest network of digital billboards in the U.S., with more than 4,600 digital displays.

Why use old-school advertising methods? Because they work.

Through billboards, advertisers can capture the attention of their audience 24 hours a day, seven days a week. Digital billboards, meanwhile, have taken outdoor advertising to a new level, allowing clients to rotate slides every few seconds, stream live data, or change their message in real time.

Bus and rail transit ads are moving billboards that expose messages to drivers, transit riders, and pedestrians. The transit ad category also includes displays on bus shelters, on benches, and in stations. (Source: “Transit,” Lamar Advertising Co, last accessed November 23, 2023.)

Airport ads put messages in front of hundreds of millions of travelers every year. And those ads work. According to one study, 42% of frequent flyers visit a web site or store after seeing that brand’s airport ad, and 90% of them are likely to shop at a brand’s brick-and-mortar location after seeing an airport ad. (Source: “Airport Advertising Spurs Action,” Lamar Advertising Co, last accessed November 23, 2023.)

Third-Quarter Revenues Up & Expenses Down

Thanks to resilient economic growth, Lamar Advertising continues to report solid financial results.

For the third quarter ended September 30, the company announced that its net revenues increased by 2.9% year-over-year to $542.6 million. (Source: “Lamar Advertising Company Announces Third Quarter Ended September 30, 2023 Operating Results,” Lamar Advertising Co, November 2, 2023.)

Its operating income went up in the quarter by approximately four percent year-over-year to $188.1 million. Its net income slipped by about four percent year-over-year to $141.0 million, or $1.37 per share. That decrease was mainly a result of an increase in the company’s interest expenses.

Lamar Advertising Co’s cash flow from operations went down slightly in the third quarter to $22.5 million, while its free cash flow went up by 2.9% year-over-year to $181.0 million.

The company’s funds from operations (FFO) inched up by one percent year-over-year to $210.0 million, while its adjusted funds from operations (AFFO) grew by 1.2% year-over-year to $208.8 million, or $2.04 per share.

Lamar Advertising ended the third quarter with $645.7 million in total liquidity.

Commenting on the results, Sean Reilly, Lamar Advertising Co’s CEO, said, “In the third quarter, we demonstrated impressive operating leverage, increasing revenue while decreasing expenses on a year-over-year, acquisition-adjusted basis.” (Source: Ibid.)

He continued, “The broader advertising environment remains challenging. Nevertheless, based on current bookings, we are pacing to reach or even slightly exceed the upper end of our revised guidance for full-year diluted AFFO per share.”

Lamar Advertising Co’s revised guidance for its full-year diluted AFFO is in the range of $7.13 to $7.28 per share.

Subsequent to the end of the third quarter, the company paid down $70.0 million of its outstanding borrowing under its revolving credit facility. The company has just $65.0 million in outstanding balances under its revolving credit facility.

Management Increased Q3 Dividend to $1.25/Share

Lamar Advertising Co’s large North American footprint helps it generate reliable revenues and earnings. The only thing that really got in the way of its long-term financial growth was the COVID-19 pandemic, but that obstacle was short-lived.

In 2019, the company had revenue growth of 7.8% and net income growth of 21.9%. In 2020, its revenues slipped by 10.5%, while its net income tumbled by 34.6%. (Source: “Lamar Advertising Co. Cl A,” MarketWatch, last accessed November 23, 2023.)

Things turned around in 2021, though, with its revenues climbing by 13.9% and its net income rallying by an impressive 59.5%. That momentum continued in 2022, with its revenues going up by 13.7% and its net income climbing by 13.0%.

Reliable earnings, FFO, and AFFO growth are why Lamar Advertising is able to provide investors with reliable, growing, high-yield distributions. In fact, from 2015 to 2019, before COVID-19 ravaged the global economy, the company raised its dividend each year. (Source: “LAMR Dividend History,” Nasdaq, last accessed November 23, 2023.)

Lamar Advertising Co cut its dividend during the pandemic, but that, too, was short-lived. In the first quarter of 2021, the company raised its payout to $0.75 per share. In the third quarter, it raised its payout to $1.00 per share. That’s the same level Lamar Advertising stock’s dividend was at before the pandemic.

The company has raised its quarterly payout three times since then. In March, the company raised LAMR stock’s quarterly dividend by 13.6% year-over-year from $1.00 to $1.25 per share.

Lamar Advertising Co has held its distribution at that level since then. This works out to a yield of 5.02% (as of this writing).

Lamar Advertising Stock Rewards Dividend Hogs

I’ve said many times that high-yield dividends can help shareholders weather market volatility. Fortunately for LAMR stockholders, they haven’t needed a lot of shelter. In terms of price appreciation, Lamar Advertising Co’s shares have been rewarding buy-and-hold investors for years (for the most part).

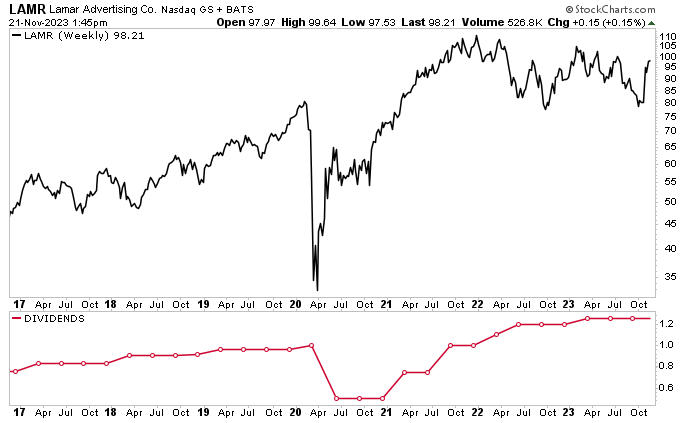

As you can see in the chart below, Lamar Advertising stock performed well from the start of 2009 to February 2020, climbing by 907% over that period.

That momentum was disrupted by the 2020 health crisis, but the pain was short-lived. By February 2021, LAMR stock had erased all of its pandemic-related losses and was marching on to record-high levels, hitting an all-time intraday high of $113.37 in January 2022.

Chart courtesy of StockCharts.com

Lamar Advertising stock has been trading range-bound since then, but it has been surging since the start of November, up more than 22% (as of this writing).

Why?

Lamar Advertising Co reported fabulous third-quarter results on November 2.

Perhaps more importantly, on November 1, the Federal Reserve said it would be keeping its interest rates between 5.25% and 5.5%. The Fed didn’t rule out another rate hike when it meets in December, but Wall Street seems pretty confident that the Fed has finished raising its rates for this cycle.

A pause in interest rate hikes and the lowering of inflation means the U.S. economy is probably going to avoid the long-promised recession. A stronger economy means many small and medium-sized businesses will be looking to Lamar Advertising Co to ramp up their marketing.

This should help juice LAMR stock over the coming quarters. Even conservative Wall Street analysts are on board, providing a 12-month share-price high target of $112.00. This would put Lamar Advertising Co’s share price once again in record-high territory.

The Lowdown on Lamar Advertising Co

Lamar Advertising is a REIT with a leading position in a lucrative, niche market. It’s one of the largest outdoor advertising companies in the world.

The company experienced a slowdown during the COVID-19 pandemic, but its business activity has begun to normalize since then. Lamar Advertising Co still faces challenges, but it reported wonderful third-quarter results, including high AFFO, in spite of the choppy economic environment. AFFO is a key profitability measure for REITs.

The REIT industry is still recovering, but Lamar Advertising expects to reach or even exceed the upper end of its full-year AFFO-per-share guidance. That bodes well for Lamar Advertising stock’s price and dividends.