Kimco Realty Corp.: Tempting Near-7% Yield From This Real Estate Company

A Surprising Dividend Stock

High yields and safety go together like teetotalers and alcoholics: they don’t hang out together often.

You don’t need an MBA to find the problem with big payouts. In most cases, the distribution runs on borrowed time. Or maybe management has done something dodgy to keep the checks coming.

But I do get surprises. It doesn’t happen often, yet from time to time, a company crosses my desk that offers safety and a decent yield.

One such surprise is retail landlord Kimco Realty Corp (NYSE:KIM). Investors have abandoned this stock because they worry that Amazon.com, Inc. (NASDAQ:AMZN) will make road pizza out of shopping malls. Yet Kimco has chugged along, earning respectable profits for investors.

Today, units pay out a respectable 6.9% yield.

Savvy readers will ask, “Can such a high distribution be safe?”

Let’s find out.

Is This Dividend Yield Safe?

Kimco Realty Corp stands in fine financial health, with ample liquidity and a manageable debt maturity profile.

The partnership has $5.90 in debt for every dollar generated in earnings before interest, taxes, depreciation, and amortization. That makes it one of the least-levered businesses in the real estate space.

More importantly, management has locked in most of these deals at low interest rates for long periods of time. So even if yields rise, it won’t have a big impact on Kimco’s cash flow. It also means the business doesn’t have to worry about rolling over old bonds.

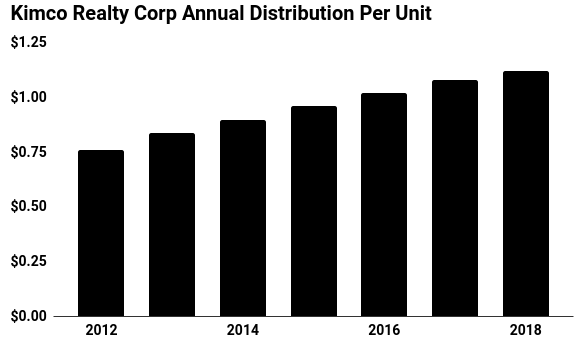

The company has also applied such conservatism to its distribution policy.

This year, Kimco Realty Corp is projected to generate $1.46 per unit in adjusted fund flows from operations, a measure of recurring cash flow in the real estate business. Over the same period, KIM stock will pay out $1.12 per unit to investors in distributions. That comes out to a payout ratio of 77%.

Generally, I like to see businesses pay out 90% or less of their cash flow to shareholders. So Kimco has left itself with plenty of financial flexibility.

(Source: “Dividends,” Kimco Realty Corp, last accessed December 5, 2018.)

So why do Kimco units look so cheap? Amazon.

E-commerce has taken a big chunk out of traditional brick-and-mortar sales. With customers paying fewer visits, shopping malls across the country have started to buckle.

However, Kimco has survived the onslaught well. Management has focused on tenants that sell “necessity-based goods and services,” as well as bulky items that don’t move well online. That has allowed the business to crank out decent cash flow, even as other retail landlords struggle.

For proof, you only need to take a quick glance at the partnership’s financial statements. During the third quarter of 2018, average base rents actually increased five percent year over year. More impressively, more than 95% of Kimco’s retail space remains occupied. (Source: “Kimco Fact Sheet,” Kimco Realty Corp, September 30, 2018.)

So, KIM stock’s 6.9% yield looks safe for now. Investors will need to keep a close eye on cash flows, but in the meantime, these distributions will likely keep rolling in.