Kimbell Royalty Partners LP: 8.4%-Yielding Oil & Gas Stock Has 50% Upside

Kimbell Royalty Partners Stock Provides High Dividends

Kimbell Royalty Partners LP (NYSE:KRP) is a real estate baron for some of the most lucrative oil and gas properties in the U.S. The Fort Worth, TX-based company has direct mineral ownership for more than 13 million gross acres in 28 states. It has almost 100,000 wells without any of the associated operating costs or capital expenditures.

That makes KRP stock a cash cow that provides investors with a risk-adjusted, high dividend yield.

Whereas most oil and gas exploration companies pour millions of dollars into exploration and drilling programs, Kimbell Royalty Partners doesn’t get its hands dirty. The company benefits from the continued development of its acreage by leading oil and gas operators. (Source: “Summer 2021 Investor Presentation,” Kimbell Royalty Partners LP, last accessed July 15, 2021.)

Kimbell Royalty Partners acquires significant mineral rights in the most prosperous, highest-grossing oil and natural gas basins in the country, including the Permian Basin, Eagle Ford, Bakken, Appalachia, Mid-Continent, Haynesville, and Rockies.

The company currently has almost 50 active rigs drilling on its acreage, and royalty interests in more than 97,000 gross wells across the U.S., which is roughly 11.8% of the entire U.S. lower 48 active drilling feet. It has nearly 146,000 net royalty acres in the U.S. lower 48 states.

Some 98% of all onshore rigs in the lower 48 states are in counties where Kimbell Royalty Partners holds mineral interest positions. Moreover, 91% of the company’s production comes from the seven premier U.S. onshore resource plays, making Kimbell a leading U.S. royalty company.

Since 2017, Kimbell Royalty Partners LP has increased its proven reserves by approximately 175% through a combination of acquisitions and organic reserve growth. In 2017, the company’s reserves stood at 15,403 thousand barrels of oil equivalent (MBOE). That increased to 33,633 MBOE in 2018, 40,912 MBOE in 2019, and 42,418 MBOE in 2020.

In the Permian Basin, the company has 23 active rigs on 23,075 net royalty acres. During Q1 2021, the Permian assets produced 2,576 barrels of oil per day (BOE/D), or 19% of the company’s total production.

In the Eagle Ford, Kimbell Royalty Partners LP has three active rigs and 6,730 net royalty acres. During the first quarter, the Eagle Ford produced 1,551 BOE/D (11% of the company’s total production).

The company’s Bakken properties have two active rigs on 6,051 net royalty acres. During Q1 2021, the Bakken produced 718 BOE/D (five percent of the company’s total production).

Appalachia has two active rigs and 23,202 net royalty acres. Its Q1 2021 production was 2,040 BOE/D (15% of the company’s total production).

The company’s Mid-Continent properties contain seven active rigs on 41,402 net royalty acres and produced 1,545 BOE/D (11% of the company’s total production) during Q1 2021.

There are 11 active rigs on Kimbell Royalty Partners’ Haynesville property, which covers 7,665 net royalty acres. During Q1 2021, Haynesville produced 3,295 BOE/D (24% of the company’s total production).

There are currently no active rigs on the company’s 1,036 net royalty acres in the Rockies. Still, during Q1 2021, the Rockies produced 729 BOE/D (six percent of the company’s total production).

Add it up and, during the first quarter, Kimbell Royalty Partners LP had 49 rigs drilling on its acreage (including one on property designated as “Other”) at no cost to the company.

While there are concerns that the income streams will dry up when the wells do (which is common with all royalty trusts), Kimbell Royalty Partners’ proven reserve decline forecast is much lower than its peers. That’s because 22% of its production is from enhanced oil recovery (EOR) units and conventional fields with low declines. Less than two percent of its production comes from stripper wells (wells that are nearing the ends of their lives, producing just 10 to 15 BOE/D).

Kimbell Royalty Partners’ overall five-year proven reserve decline rate is 12%, compared to some of its mineral peers, which have proven reserve decline rates of more than 30%. Kimbell has approximately 15 years of drilling inventory. That, of course, doesn’t factor in new discoveries on its properties or additional rigs.

Reliable, High-Yield Dividends

Increased real estate, higher rig counts, low decline rates, and increased market share means more money for Kimbell Royalty Partners LP (and its shareholders).

Despite the company’s favorable mineral assets, its dividend payouts depend on the price of oil and gas. That means Kimbell Royalty Partners stock’s payout fluctuates from quarter to quarter.

As you can see in the chart below, KRP stock’s quarterly distributions have been pretty solid since its initial public offering (IPO) in 2017, averaging $0.393 per unit.

Not surprisingly, those payouts took a hit during the COVID-19 pandemic, but with the economy opening back up, those distributions are now on the rise.

In April, the company’s board of directors approved a cash distribution of $0.27 per unit for the first quarter, for a dividend yield of 8.4%. That translates to 75% of the company’s projected cash available for distribution. (Source: “Kimbell Royalty Partners Declares First Quarter 2021 Distribution,” Kimbell Royalty Partners LP, April 23, 2021.)

|

Dividend Period |

Amount Per Common Unit |

|

Q1 2021 |

$0.27 |

| Q4 2020 |

$0.19 |

|

Q3 2020 |

$0.19 |

| Q2 2020 |

$0.13 |

|

Q1 2020 |

$0.17 |

| Q4 2019 |

$0.38 |

|

Q3 2019 |

$0.42 |

| Q2 2019 |

$0.39 |

|

Q1 2019 |

$0.37 |

| Q4 2018 |

$0.40 |

|

Q3 2018 |

$0.45 |

| Q2 2018 |

$0.43 |

|

Q1 2018 |

$0.42 |

| Q4 2017 |

$0.36 |

|

Q3 2017 |

$0.31 |

|

Q2 2017 |

$0.30 |

| Q1 2017 |

$0.23 |

(Source: “Distribution History,” Kimbell Royalty Partners LP, last accessed July 15, 2021.)

It’s not clear sailing just yet, though. Management said that, in spite of ongoing stabilization in the oil and natural gas markets, as well as improved differentials and commodity prices, the ongoing COVID-19 pandemic has the potential to negatively impact supply/demand imbalances in the oil and gas market.

That could have a negative impact on Kimbell Royalty Partners’ business, production, cash flow, and financial results. You could say that about most equities right now, though. All that means is investors need to pay attention to market conditions.

Still, Kimbell Royalty Partners stock’s distribution payout has been outstanding. Since its IPO in 2017, Kimbell Royalty Partners LP has returned approximately 30% of its $18.00/unit IPO price through cash dividends.

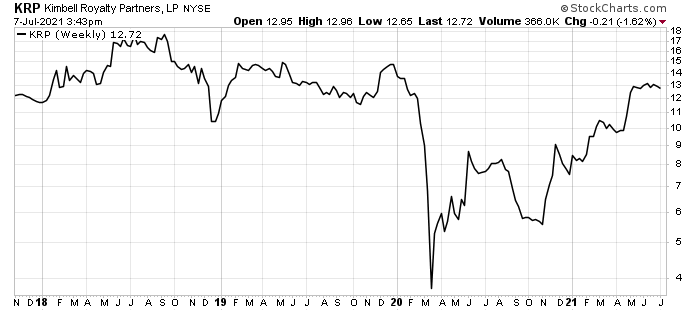

KRP stock has been on an impressive run, up by 69% year-to-date and 68% year-over-year. And there’s still room for it to run. Kimbell Royalty Partners stock needs to climb by approximately 50% to get to its September 2018 high of $18.74.

Chart courtesy of StockCharts.com

Wall Street is bullish on this dividend stock. Of the analysts providing a 12-month share-price forecast for KRP stock, their average target is $15.75 and their high estimate is $17.00, which suggests upside of 23% and 33%, respectively.

The Lowdown on Kimbell Royalty Partners LP

Kimbell Royalty Partners stock is a great energy stock that has been rewarding buy-and-hold investors.

As mentioned earlier, Kimbell Royalty Partners LP owns the mineral rights for 13 million gross acres in 28 states, and oil and gas companies pay Kimbell for the privilege of drilling on its properties. That has resulted in a reliable income stream and high distributions from KRP stock.