Is Enable Midstream Partners, LP’s 7.5% Yield Safe?

Can You Trust This Payout?

If you want to earn higher yields, you have to think differently from other investors.

Blue-chip dividend stocks don’t cut it anymore. Income hunters need to seek out lesser-known niches like business development corporations (BDCs) or real estate investment trusts (REITs).

Master limited partnerships (MLPs) serve as one of the last bastions of high yields. These investment vehicles combine the tax advantages of a partnership with the liquidity of publicly traded securities. And because they’re required by law to mail out most of their earnings to unitholders, these investments pay some of the best yields around.

Case in point: oil pipeline owner Enable Midstream Partners LP (NYSE:ENBL). With a 7.5% yield, this partnership has started to get fans among the income investing community. But can such a high payout possibly be safe? Let’s dig into the numbers.

The business throws off an ample amount of cash, first off. In the pipeline business, we measure financial performance through a metric called distributable cash flow. This metric provides a good proxy for profitability.

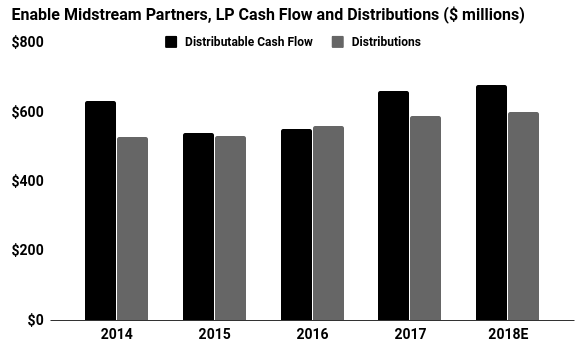

In 2017, Enable Midstream Partners’ distributable cash flow topped $660.0 million. At the same time, management paid out $589.0 million to unitholders in distributions.

Such a high payout ratio sits at the upper end of my comfort zone. In a more cyclical sector, that would be enough to disqualify the business out of hand. But given the recession-proof nature of the pipeline industry, investors have little to worry about.

Those cash flows will likely continue to grow, too. As regular readers know, new technologies have unlocked vast swaths of oil supplies across the United States. This has boosted the demand for all types of energy infrastructure.

That’s good news for Enable Midstream Partners.

Thanks to a shortage of pipeline capacity, management has boosted tariffs on existing routes. Executives have also plowed billions of dollars back into operations, adding thousands of miles of shipping capacity to the partnership’s network.

All of this should translate into more money for the company. Over the next five years, analysts see the partnership’s distributable cash flows growing at a mid-single-digit annual clip. By rough extension, we can expect the payout to grow more or less in line with profits.

(Source: “Investors,” Enable Midstream Partners LP, last accessed August 24, 2018.)

The biggest risk here? Energy prices.

Pipelines serve as the toll roads of the oil patch, earning a small fee on each barrel shipped. As a result, their profits don’t have the same exposure to energy prices as traditional drilling companies.

That said, a sustained downturn in oil prices would eventually clip production. With fewer barrels of crude moving through its network, the partnership would have less cash flow to reward unitholders.

Management, however, has positioned themselves well for any downturn. With ample liquidity, a modest payout ratio, and a light debt load, Enable Midstream Partners sailed through the recent oil patch skid without any hiccups in distributions. Such a conservative approach would likely pay off again in the event of another oil industry slump.

In other words, investors can count on this 7.5% payout.