Iron Mountain Inc: Will This 7.7% Yield Stay Safe?

Can You Trust Iron Mountain Inc’s 7.7% Yield?

I keep a fair bit of paperwork in my office: bank records, tax returns, mortgage information, etc. Now picture the mountains of documents generated by a business like a law practice or brokerage office.

So where can companies stash their growing piles of paperwork? Iron Mountain Inc (NYSE:IRM).

Iron Mountain owns more than 1,450 storage facilities in about 50 countries. In addition to paper documents, customers entrust the company to keep everything from artwork and vintage films to ancient artifacts and original music recordings. (Source: “Iron Mountain Inc: We Protect What You Value Most,” Iron Mountain Inc, November 12, 2019.)

It’s a cash cow business. Iron Mountain earns millions of dollars in storage rents, in addition to fees on scanning, moving, and retrieving documents. Moreover, its facilities cost little in the way of overhead. That explains why management can fund a 7.7% dividend yield.

But can investors really trust such a big payout? It’s always smart to dig into the numbers before pulling the trigger on a high-yield stock. So let’s dive into the financials.

Iron Mountain Inc’s revenues have my favorite feature of any business: stickiness.

Each year, only about two percent of its customers pull their documents out of storage. Once inside an Iron Mountain facility, the average document stays there for 15 years. (Source: Ibid.)

Why such long stays? Relocating records is a big headache. Most businesses won’t go through the hassle just to save a few bucks elsewhere. High switching costs keep customers locked in and allow management to raise rents each year.

For IRM shareholders, this basically turns each document into an annuity of cash flow. As long as Iron Mountain has more documents coming in than going out, this income stream keeps growing. And while we live in an increasingly digitized world, the number of documents in the company’s care has grown each year for decades.

Moreover, management appears to be running the business in a conservative manner.

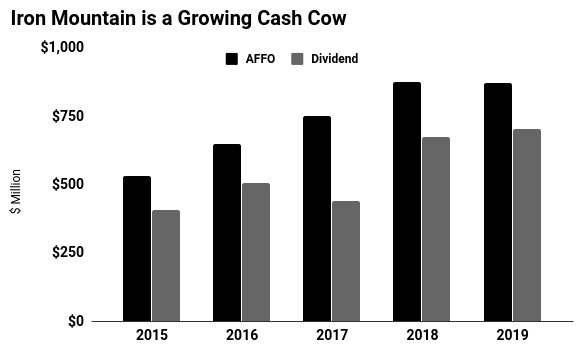

In real estate, we use a metric called adjusted fund flows from operations (AFFO). This metric provides a better insight than traditional profit numbers into how much cash a business can return to its shareholders.

In the case of Iron Mountain Inc, analysts project that its AFFO will top $870.0 million in 2019. From the total, management will pay out around $702.0 million. That comes out to a payout ratio of 81%

Generally, I like to see companies pay out no more than 90% of their cash flow as distributions. That leaves a little bit of wiggle room for Iron Mountain’s management to maneuver in the event of a downturn. So Iron Mountain’s dividend sits well within my comfort zone.

(Source: “Investor Relations,” Iron Mountain Inc, last accessed December 3, 2019.)

So what could go wrong here? Technology.

Digital record-keeping won’t replace hard-copy backups. But it does mean Iron Mountain’s revenues, and by extension its dividends, will grow at a slower pace than in years past.

Management, however, has responded to this threat. Iron Mountain executives have plowed millions of dollars into building data storage centers. This industry continues to enjoy low vacancies and high rents as companies look for new places to keep their growing number of computer terminals.

But this new type of business will need big investments. And that means less money left over to pay shareholders.

For 2019, Iron Mountain executives project that AFFO will remain flat or decline slightly. And in October, executives only boosted the quarterly dividend by about one percent.

That doesn’t put the current payout in danger. But it does mean IRM shareholders can’t expect big, ongoing dividend bumps for the foreseeable future.

Bottom line

Iron Mountain Inc’s core business faces challenges. But the company continues to throw off ample cash flow—at least enough to pay the current distribution.

Therefore, this 7.7% yield looks safe for now.