Innovative Industrial Properties Stock: Pot REIT Yields 8.2%

Why Investors Should Consider IIPR Stock

Innovative Industrial Properties Inc (NYSE:IIPR) is an intriguing real estate investment trust (REIT) that focuses on leasing out specialized, regulated properties to state-licensed marijuana operators.

A REIT is a fantastic way to generate income, since this type of structure is mandated to pay a minimum of 90% of its taxable income to its shareholders in the form of dividends.

I like the potential of Innovative Industrial Properties stock, which is due to the company’s focus on the growing U.S. cannabis industry. Although the sector is currently soft, it has great long-term prospects, especially if we eventually see the federal decriminalization of recreational marijuana.

Innovative Industrial Properties currently operates a network of advanced facilities comprising 108 properties, representing about 8.9 million rentable square feet in 19 states. That includes about 1.6 million rentable square feet that are under development or redevelopment. (Source: “Company Profile,” Innovative Industrial Properties Inc, last accessed September 7, 2023.)

The breakdown of Innovative Industrial Properties’ facilities is as follows:

- Industrial: 91.0%

- Industrial Retail: 6.0%

- Retail: 3.0%

As far as the company’s clients go, 58% are public companies and 42% are private. (Source: “Our Portfolio,” Innovative Industrial Properties Inc, last accessed September 7, 2023.)

Innovative Industrial Properties Stock Down 70% From Its High

In November 2021, IIPR stock was trading at $288.02. Since then, it has been on a bumpy ride and is now down by 70% from that high point.

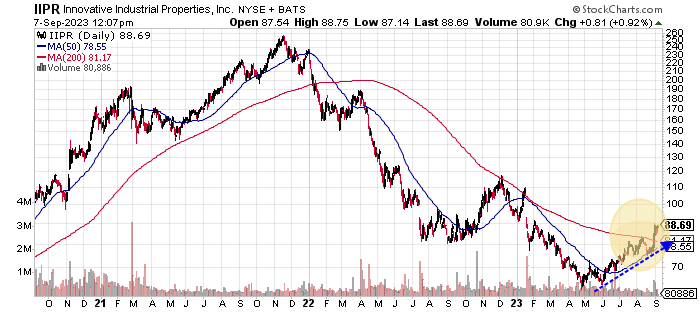

The below chart shows Innovative Industrial Properties stock hovering just above its 50-day moving average (MA) of $78.55 and its 200-day MA of $81.17.

There is technical risk, as IIPR stock is currently in a bearish death cross formation, with its 50-day MA below its 200-day MA. A plus is that Innovative Industrial Properties Inc’s 50-day MA appears to be set to break above the 200-day MA—forming a bullish technical crossover pattern.

While Innovative Industrial Properties stock’s near-term technical picture is bearish, I like the risk/reward opportunity at its current share-price level.

Chart courtesy of StockCharts.com

Strong Revenue Growth & Free Cash Flow

Innovative Industrial Properties Inc has reported double-digit and triple-digit revenue growth for the last five straight years. Its revenues rose from $14.8 million in 2018 to a record $276.4 million in 2022, representing a compound annual growth rate (CAGR) of 101.4%.

The REIT’s revenue growth rate is expected to slow down, which is common when a company’s revenue base rises. Moreover, the company needs cannabis to be more widely legalized in the U.S.

Analysts estimate that Innovative Industrial Properties will deliver revenue growth of 10.4% to $305.1 million in full-year 2023, followed by further growth to $307.6 million in 2024. (Source: “Innovative Industrial Properties, Inc (IIPR),” Yahoo! Finance, last accessed September 7, 2023.)

| Fiscal Year | Revenues (Millions) | Growth |

| 2018 | $14.8 | N/A |

| 2019 | $44.7 | 202.1% |

| 2020 | $116.9 | 161.7% |

| 2021 | $204.6 | 75.0% |

| 2022 | $276.4 | 35.1% |

(Source: “Innovative Industrial Properties Inc.” MarketWatch, last accessed September 7, 2023.)

On the bottom line, Innovative Industrial Properties has been hugely profitable on a generally accepted accounting principles (GAAP) basis. The company reported record-high GAAP-diluted earnings per share (EPS) for 2022.

Analysts expect Innovative Industrial Properties Inc to report a small increase in its earnings to $5.67 per diluted share for full-year 2023 and $5.59 per diluted share for 2024. (Source: Yahoo! Finance, op. cit.)

If the marijuana legislative and economic climate improves, I would expect the REIT to report much higher GAAP-diluted EPS.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $0.75 | N/A |

| 2019 | $2.03 | 170.7% |

| 2020 | $3.27 | 61.1% |

| 2021 | $4.55 | 39.3% |

| 2022 | $5.52 | 21.2% |

(Source: MarketWatch, op. cit.)

Moving to Innovative Industrial Properties Inc’s funds statement, Innovative Industrial Properties has churned out positive free cash flow (FCF) in its last five straight years, including a record-high $234.1 million in 2022.

| Fiscal Year | FCF (Millions) | Growth |

| 2018 | $15.7 | N/A |

| 2019 | $44.9 | 186.0% |

| 2020 | $110.8 | 146.8% |

| 2021 | $188.7 | 70.3% |

| 2022 | $234.1 | 24.1% |

(Source: MarketWatch, op. cit.)

6-Year Dividend Growth Streak

IIPR stock’s most recent quarterly dividend was $1.80 per share, translating to a current yield of about 8.2%. The stock’s five-year average dividend yield is lower than that, at 4.1%, which is largely due to its higher share price. (Source: Yahoo! Finance, op. cit.)

Innovative Industrial Properties Inc’s current payout ratio of 127.7% is higher than the minimum 90% requirement for REITs.

Given the company’s expected flat earnings over the next two years and its high payout ratio, I forecast that Innovative Industrial Properties stock’s dividends will stay flat or increase slightly and extend its dividend growth streak.

| Metric | Statistic |

| Dividend Growth Streak | 6 Years |

| Dividend Streak | 7 Years |

| 3-Year Dividend CAGR | 21.6% |

| 3-Year Average Dividend Yield | 5.5% |

| Dividend Coverage Ratio | 1.2 |

The Lowdown on Innovative Industrial Properties Inc

Shares of Innovative Industrial Properties Inc are struggling at this time, but I like the opportunity they present to investors.

Here, we have a growing REIT that’s currently facing some hurdles, but you’ve got to love the company’s profitability and FCF. This should allow IIPR stock to continue paying nice dividends, at the very least staying close to its current distribution level.