Innovative Industrial Properties Inc: Is This The Perfect Income Stock?

IIPR Stock’s Dividend Up 833% in 4 Years

You can find stocks with ultra-high dividends that don’t provide much capital appreciation, or are even saddled with a tumbling share price. And you can find stocks that deliver strong capital appreciation but no dividends.

But it’s difficult to find a stock that provides investors with both a steadily rising share price and consistent dividend growth. One of them is Innovative Industrial Properties Inc (NYSE:IIPR).

Innovative Industrial Properties stock is a great stock for investors who want to take advantage of the red-hot cannabis industry but aren’t excited about investing directly in marijuana. It’s also an excellent opportunity for investors who don’t mind investing in sin stocks and who like to see their initial investment soar.

Moreover, IIPR stock could be the perfect dividend stock for investors who like to see their quarterly payout increase on a regular basis.

Innovative Industrial Properties Inc is the first and only publicly traded company on the New York Stock Exchange to provide real estate capital to the medical cannabis industry. The company purchases land from experienced, licensed medical cannabis operators and leases the land back to them. (Source: “Our Business,” Innovative Industrial Partners, Inc, last accessed June 24, 2021.)

Why would a marijuana company do that? Since cannabis is still illegal in the U.S. at the federal level, it’s difficult for marijuana companies to find capital. That’s where Innovative Industrial Properties Inc comes in. It’s a real estate investment trust (REIT) that acquires property and provides medical marijuana growers with capital to develop their operations.

The company targets well-funded medical cannabis companies in the $5.0- to $30.0-million range and signs them up for long-term leases of 10 to 20 years.

The initial base rent is 10% to 16% on total investment. And like all good landlords, Innovative Industrial Partners increases its rent annually by three percent to 4.5%. That provides it with a steady, reliable cash flow.

And by the look of things, many medical marijuana companies need cash to help fund their operations. At the start of 2020, Innovative Industrial Properties Inc’s portfolio consisted of 47 properties. Today, that number stands at 72.

Three of Innovative Industrial Properties’ top tenants are Cresco Labs (CNSX:CL, OTCMKTS:CRLBF), Trulieve Cannabis (CNSX:TRUL, OTCMKTS:TCNNF), and Green Thumb Industries (CNSX:GTII, OTCMKTS:GTBIF).

Innovative Industrial Partners’ aggressive acquisition strategy has helped it achieve consistently strong financial results. In the first quarter of 2021, the company announced that its revenue increased by 103% year-over-year, its net income went up by 113%, and its earnings per share advanced 46%. (Source: “Innovative Industrial Properties Reports First Quarter 2021 Results,” Innovative Industrial Properties Inc, May 5, 2021.)

During the first quarter, Innovative Industrial Properties’ all-important funds from operations (FFO) increased by 110% to $34.4 million, or $1.44 per share. Its adjusted FFO jumped by 116% to $38.4 million, or $1.47 per diluted share. That’s more than enough to help the company continue paying rising dividends.

On June 15, the company declared a second-quarter dividend of $1.40 per share. This represents a six-percent increase over the $1.32 per share the company paid in the first quarter of 2021 and a 32% increase over the $1.06 per share it paid in the second quarter of 2020. (Source: “Dividend History,” Innovative Industrial Properties Inc, last accessed June 24, 2021.)

The quarterly payouts add up to an annual dividend of $5.60 per common share, which comes out to a yield of 3.1%.

This represents the 11th dividend increase since Innovative Industrial Properties stock started paying dividends. In the second quarter of 2017, the stock paid a quarterly dividend of $0.15 per share. That means, over the last four years, IIPR stock’s quarterly payout has soared by 833%.

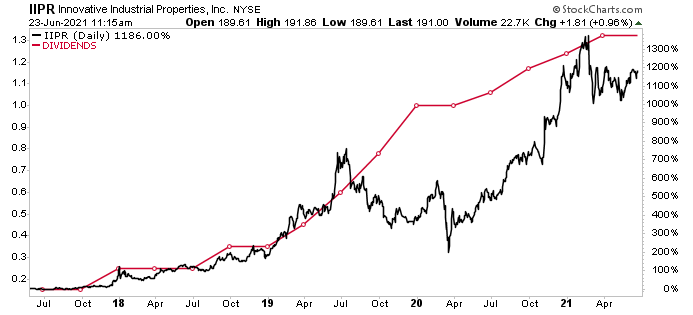

It’s not just Innovative Industrial Properties stock’s dividend that shows consistent growth. As you can see in the following chart, IIPR stock has been rewarding buy-and-hold investors. This held true even in 2020, during the worst economic crisis in 100 years. In that year, Innovative Industrial Properties’ share price advanced 163%.

Chart courtesy of StockCharts.com

The Lowdown on Innovative Industrial Properties Inc

What’s not to love about Innovative Industrial Properties Inc? It’s the only REIT that invests in the cannabis industry, it has a massive cash position, and it has an aggressive acquisition strategy.

All of that helps the company report great financial results, provide significant capital appreciation, and deliver frothy, growing dividends.