Horizon Technology Finance Stock: 10.7%-Yielder Announced Special Dividend

HRZN Stock Is Attractive Right Now: Here’s Why

U.S. inflation may be down at 3.2%, and an interest rate hike in December is pretty much off the table, but the outlook for business development companies (BDCs) like Horizon Technology Finance Corp (NASDAQ:HRZN) is robust.

Income Investors has nicknamed these kinds of firms “alternative banks” because they operate much like traditional financial institutions, although they don’t have branches or ATMs.

BDCs borrow money at low interest rates and lend it out to small and midsized businesses at higher interest rates. Their profit, called the spread, comes from the difference between what they pay to their creditors and what they receive from their clients.

Moreover, alternative banks must distribute at least 90% of their ordinary taxable income to their shareholders. As a result, BDCs like Horizon Technology Finance Corp pay out some of the highest yields around, making them attractive to dividend hogs.

Thanks to stubbornly high inflation, more and more investors have been taking a closer look at BDCs.

To combat inflation, the Federal Reserve has raised its benchmark interest rate 11 times since the start of 2022, to about 5.4%, its highest level in 22 years.

The unexpected drop in inflation to 3.2% in October 2023 has many questioning whether the Fed will soon pivot from pausing its interest rate hikes to cutting them. However, the Fed’s chairman, Jerome Powell, recently said he was “not confident” that the Fed had done enough to return inflation sustainably to its target of two percent. That means investors should brace for additional interest rate hikes.

Higher interest rates are always good for alternative banks like Horizon Technology Finance Corp.

The Farmington, Connecticut-based BDC provides structured debt products to health-care information service, life science, sustainability, and technology companies. Since 2004, Horizon Technology Finance has directly originated and invested more than $1.0 billion in venture loans to more than 315 growing companies. (Source: “Investor Presentation – Third Quarter 2023,” Horizon Technology Finance Corp, last accessed November 20, 2023.)

The transaction sizes of the company’s loans are up to $50.0 million. The time lengths of the loans are generally between three and five years, including a meaningful interest-only period. Its loans are secure, with term, bridge, and special-purpose loans taking priority over equity and unsecured debt.

The BDC’s clients use the money they borrow to expand their operations, fund acquisitions, pad their cash holdings, etc.

Q3 Investment Income Up 25% & Net Investment Income Up 56%

Since it’s a financial services company, you’d hope that Horizon Technology Finance would be good at making money. It is.

For instance, in the third quarter, the company’s net investment income advanced 56% year-over-year to $17.4 million, or $0.53 per share. (Source: “Horizon Technology Finance Announces Third Quarter 2023 Financial Results,” Horizon Technology Finance Corp, October 31, 2023.)

Its total investment income grew in the quarter by 25.3% year-over-year to $29.1 million. The double-digit gain was mainly due to a rise in the BDC’s interest income on investments, which was a result of an increase in the average size of its debt investments.

At the end of the third quarter, the company’s total investment portfolio stood at $729.1 million, with an annualized yield on debt investments of 17.1%.

During the quarter, Horizon funded eight loans totaling $88.4 million. It also raised total net proceeds of about $13.9 million through an at-the-market offering program.

Commenting on the results, Horizon Technology Finance Corp’s chairman and CEO, Robert D. Pomeroy, Jr, said, “In the third quarter, our debt portfolio yield of over 17% continued to generate net investment income that exceeded our distributions, while we opportunistically added select venture debt investments to our portfolio and committed backlog.” (Source: Ibid.)

He added, “As we close out the year, in light of the current [macroeconomic] environment, persistent inflation and reduced venture investing, we will remain cautious with respect to growing HRZN’s portfolio of debt investments, but believe that there remain select excellent investment opportunities.”

Management Raised Monthly Payout 10% & Declared Special Dividend

In the current economic climate, not many people can say their bosses gave them a raise and a holiday bonus, but buy-and-hold Horizon Technology Finance stockholders have been on the receiving end of both!

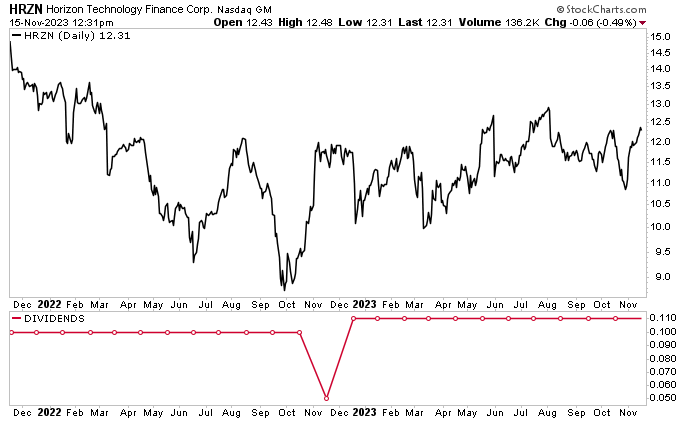

In January, the company increased its monthly distribution by 10% from $0.10 to $0.11 per share. (Source: “Dividend History,” Horizon Technology Finance Corp, last accessed November 20, 2023.)

That works out to an annual yield of 10.67%, which is more than three times the current U.S. inflation rate of 3.2%.

Furthermore, in late October, the company declared a special distribution of $0.05 per share for December. This will take HRZN stock’s yield to about 11.1%.

The company also paid special dividends of $0.05 per share in April 2020, December 2021, and December 2022.

Horizon Technology Finance Stock Has 22% Upside

Regular monthly dividends and occasional special dividends are great, but they’re even better when they’re supplemented with a rising share price.

Shares of Horizon Technology Finance Corp have been rewarding investors with solid gains in 2023: 16.1% as of this writing. That’s just slightly behind the S&P 500, which has advanced 17.4% this year.

The outlook for HRZN stock is solid, with Wall Street analysts providing a 12-month high estimate of $15.00 per share. This points to potential gains of approximately 22%. It would also put Horizon Technology Finance stock within striking distance of its all-time record high of $15.60 per share.

Chart courtesy of StockCharts.com

The Lowdown on Horizon Technology Finance Corp

Horizon Technology Finance is a great alternative bank with a top-yielding investment portfolio. The BDC has a growing pipeline of investments, increasing leverage, substantial capacity, and future warrant upside.

Thanks to the diversity of its lending portfolio, the company has a low concentration of risk. This has allowed it to generate total returns that are above those of its industry. Over the last 60 months, Horizon Technology Finance Corp has posted total profits of 71%, compared to 42% for the ETRACS MVIS BDC index.

That’s why HRZN stock is able to provide investors with reliable, high-yield monthly payouts and occasional special dividends.