14.9%-Yield Hawaiian Electric Industries Stock on 53-Year Dividend Streak

HE Stock Has Compelling Risk/Reward Ratio

When I search for high-yield dividend stocks, I like the ones that have appreciated in price and have raised their dividends.

High yields, however, are often a result of share-price weakness. For contrarian income investors, that situation represents an opportunity.

That’s where Hawaiian Electric Industries, Inc. (NYSE:HE) comes in. Hawaiian Electric Industries stock currently has a high yield, and its share price went down by a lot in 2023.

Yes, there’s a significant amount of risk with these types of dividend stocks, but as long as a company is profitable, it generates positive free cash flow, and its debt is manageable, it’s worth a look.

HE stock is an example of a battered dividend stock with a good risk/reward ratio.

The company operates as an electric utility and a banker. It invests in non-regulated renewable/sustainable infrastructure projects in Hawaii. Its three operating units are Hawaiian Electric Company, Inc., American Savings Bank, F.S.B., and Pacific Current. (Source: “2022 Annual Report to Shareholders,” Hawaiian Electric Industries, Inc., last accessed December 27, 2023.)

Hawaiian Electric provides electricity to 95% of the Hawaiian population, American Savings Bank provides banking and other financial services, and Pacific Current invests in sustainable infrastructure.

Despite paying dividends for 53 straight years and raising its dividends for the last four years, Hawaiian Electric Industries stock’s price went down by a whopping 66% in 2023. Moreover, as of this writing, it has gone down by 76% from its record high of $55.15 in March 2020.

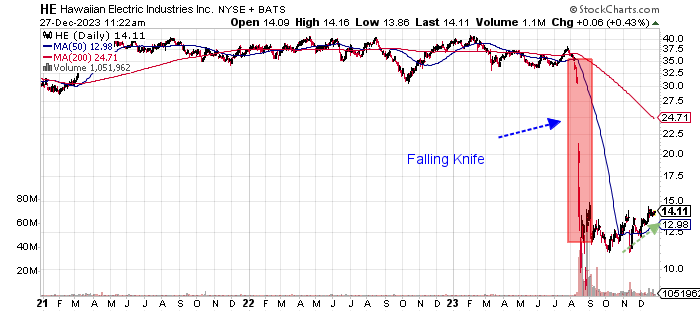

The following chart shows HE stock selling off in a bearish falling knife pattern. The stock will require time to recover from that drop. Fortunately, it appears that shares of Hawaiian Electric Industries, Inc. have found a base and have been rallying.

My view is that, as long as Hawaiian Electric Industries stock’s dividends are safe, investors can collect those dividends while they wait for its share price to bounce back.

Chart courtesy of StockCharts.com

Hawaiian Electric Industries, Inc. Generates Profits & Positive Free Cash Flow

Hawaiian Electric Industries has increased its revenues in four of its last five reported years to a record-high $3.74 billion in 2022. The company’s revenue growth rate of 31.3% in 2022 was its highest in a decade.

Analysts expect lower revenue growth over the next two reportable years. They estimate that the company will report revenues of $3.84 billion in 2023, followed by $3.88 billion in 2024. (Source: “Hawaiian Electric Industries, Inc (HE),” Yahoo! Finance, last accessed December 27, 2023.)

This forecast has had a negative impact on HE stock’s price.

| Fiscal Year | Revenues (Billions) | Growth |

| 2018 | $2.87 | N/A |

| 2019 | $2.87 | 0.1% |

| 2020 | $2.58 | -10.2% |

| 2021 | $2.85 | 10.5% |

| 2022 | $3.74 | 31.3% |

(Source: “Hawaiian Electric Industries Inc.” MarketWatch, last accessed December 27, 2023.)

Hawaiian Electric Industries has consistently generated steady gross margins above 20%. I expect this to improve as interest rates decline.

| Fiscal Year | Gross Margin |

| 2018 | 21.2% |

| 2019 | 21.8% |

| 2020 | 22.0% |

| 2021 | 23.6% |

| 2022 | 20.2% |

On the bottom line, Hawaiian Electric Industries, Inc. has been a consistent generator of generally accepted accounting principles (GAAP) profits.

The company’s GAAP-diluted earnings per share (EPS) in its last two reported years were its highest since 2016, when they were $2.29.

Analysts expect the company to report an adjusted $2.02 per diluted share for full-year 2023. They expect this to rise to $2.10 in 2024. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $1.85 | N/A |

| 2019 | $1.99 | 7.6% |

| 2020 | $1.81 | -9.0% |

| 2021 | $2.25 | 24.3% |

| 2022 | $2.20 | -2.2% |

(Source: MarketWatch, op. cit.)

Hawaiian Electric Industries, Inc.’s free cash flow (FCF) has also been strong. Its five-year FCF high was $110.4 million in 2022. That was its second-highest FCF in a decade (its highest FCF in that period was in 2016).

| Fiscal Year | FCF (Millions) | Growth |

| 2018 | -$38.1 | N/A |

| 2019 | $54.9 | 244.4% |

| 2020 | $45.5 | -17.2% |

| 2021 | $61.2 | 34.4% |

| 2022 | $110.4 | 80.6% |

(Source: MarketWatch, op. cit.)

Hawaiian Electric Industries, Inc.’s balance sheet is manageable, with a healthy amount of working capital, $3.93 billion of debt, and $667.2 million in cash at the end of September 2023. (Source: Yahoo! Finance, op. cit.)

The following table shows that the company easily covered its interest expense via higher earnings before interest and taxes (EBIT) from 2019 through 2022. Its interest coverage ratio of 4.0 in 2022 was reasonable.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2019 | $357.9 | $86.4 |

| 2020 | $326.3 | $85.7 |

| 2021 | $402.0 | $91.1 |

| 2022 | $404.2 | $100.0 |

(Source: Yahoo! Finance, op. cit.)

Hawaiian Electric Industries, Inc.’s Piotroski score, which is an indicator of a company’s balance sheet, profitability, and operational efficiency, is 4.0 (as of this writing). That’s just below the midpoint of the Piotroski score’s range of 1.0 to 9.0. From 2018 to 2022, the company’s Piotroski score averaged a far better 6.0.

Hawaiian Electric Industries Stock’s Dividend Streak Is Safe

Hawaiian Electric Industries, Inc.’s quarterly dividend of $0.36 per share in September 2023 translates to a forward yield of 14.91% (as of this writing). (Source: “Dividends,” Hawaiian Electric Industries, Inc., last accessed December 27, 2023.)

HE stock’s current high yield (compared to its five-year average of 3.86%) is due to its price deterioration.

The company’s dividend coverage ratio of 4.7 suggests that its dividend streak will remain intact. (Source: Yahoo! Finance, op. cit.)

| Metric | Value |

| Dividend Growth Streak | 4 Years |

| Dividend Streak | 53 Years |

| 7-Year Dividend Compound Annual Growth Rate | 1.7% |

| 10-Year Average Dividend Yield | 4.1% |

| Dividend Coverage Ratio | 4.7 |

The Lowdown on Hawaiian Electric Industries, Inc.

Hawaiian Electric Industries has an attractive valuation of about 6.3 times its consensus 2024 EPS estimate, 0.37 times its consensus 2024 revenue estimate, and 0.65 times its book value.

Hawaiian Electric Industries stock represents an opportunity for above-average price appreciation if the company can re-energize its financial growth. Meanwhile, investors can keep collecting regular dividend income from Hawaiian Electric Industries, Inc.