Green Plains Partners Stock: Bullish 13.3%-Yielder Raises Payout for 5 Straight Quarters

GPP Stock Might Be Perfect for Income & Growth

Sometimes it’s fun to be a contrarian investor and go against the grain, but other times it’s good to just go with the flow. These days, with energy prices high—and expected to remain high—there’s no reason to shun oil and gas stocks.

If you’re looking for an oil and gas play with stable earnings and cash flow, a rising share price, and growing, ultra-high-yield dividends, look no further than Green Plains Partners LP (NASDAQ:GPP).

Green Plains Partners is a fee-based, limited partnership formed by its parent company, Green Plains Inc (NASDAQ:GPRE), to provide ethanol and fuel storage, terminal transportation assets, and other related assets and businesses. (Source: “Who We Are,” Green Plains Partners LP, last accessed February 3, 2023.)

The partnership owns 29 biofuel storage facilities located at or near Green Plains Inc’s 11 ethanol production plants in Indiana, Illinois, Iowa, Minnesota, Nebraska, Tennessee, and Virginia. Green Plains Partners’ biofuel storage assets have a combined capacity of approximately 25.9 million gallons. Its biofuel terminals have a total storage capacity of 6.9 million gallons. (Source: “What We Do,” Green Plains Partners LP, last accessed February 3, 2023.)

These facilities have a combined throughput capacity to support Green Plains Inc’s annual production capacity of about one billion gallons.

Green Plains Partners LP’s transportation assets include a fleet of approximately 2,500 leased railcars. These railcars are dedicated to transporting ethanol and other fuels (under commercial agreements with Green Plains Inc) to refiners throughout the U.S. and international export terminals.

Green Plains Partners LP’s Net Income Increased in Third Quarter

For the third quarter ended September 30, 2022, Green Plains Partners reported net income of $10.2 million, or $0.43 per unit. That was up by 8.5% from the company’s third-quarter 2021 net income of $9.4 million, or $0.40 per unit. (Source: “Green Plains Partners Reports Third Quarter 2022 Financial Results,” Green Plains Partners LP, November 3, 2022.)

The partnership also reported third-quarter adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $13.0 million and distributable cash flow of $11.3 million. That’s compared to adjusted EBITDA of $13.5 million and distributable cash flow of $11.5 million in the same period of 2021. The company’s distribution coverage in the third quarter of 2022 was 1.05x.

“We were pleased to increase the quarterly distribution for the fifth consecutive quarter,” said Todd Becker, Green Plains Partners LP’s president and CEO. “Strong liquidity and achieving higher year over year throughput rates resulted in stable earnings and cash flow at the partnership and higher cash distributions for our unitholders.” (Source: Ibid.)

Green Plains Partners Stock’s Dividend Hiked for 5 Straight Quarters

In October 2022, Green Plains Partners LP announced that its board declared a quarterly cash distribution of $0.455 per unit. That was up from its previous quarterly distribution of $0.45 per unit. Moreover, it was GPP stock’s fifth consecutive dividend increase.

In January 2023, the company announced that its board was maintaining the quarterly cash distribution of $0.455 per unit. The current dividend translates to a yield of 13.3%.

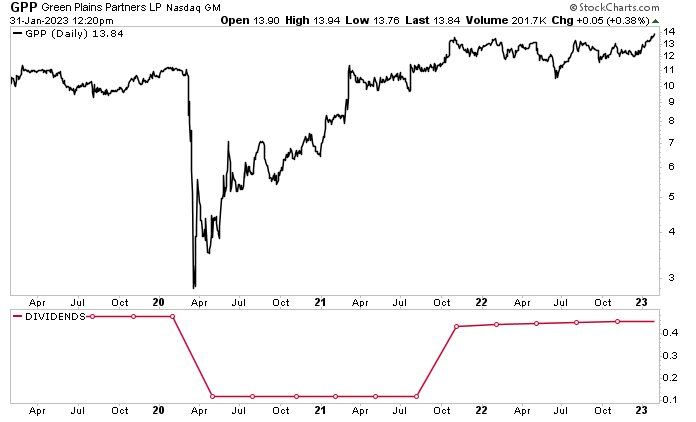

As you can see in the chart below, Green Plains Partners stock’s dividend and price fluctuate along with the supply/demand metrics of the energy industry.

GPP stock cratered in March 2020 during the opening weeks of the COVID-19 pandemic. Perhaps not surprisingly, the company’s board then reduced its cash distribution to $0.12 per unit. The partnership said the dividend reduction would annually free up $33.8 million, which it planned to use to pay down its debt and strengthen its balance sheet. (Source: “Green Plains Partners Reduces Quarterly Distribution,” Green Plains Partners LP, April 16, 2020.)

Before the pandemic, Green Plains Partners stock’s quarterly distribution stood at $0.475, a level it held for eight quarters. In November 2021, Green Plains Partners raised its distribution from $0.12 to $0.435 per unit and then hiked it for the next four quarters. In the coming quarters, I wouldn’t be surprised to see the board increase GPP stock’s distribution to at least where it was before the pandemic.

The solid earnings and distributable cash flow have done more than just juice Green Plains Partners stock’s ultra-high-yield dividend. Superb financial results have also helped fuel the company’s unit price. In fact, on January 31, GPP stock hit a record high of $13.94. As of this writing, shares of Green Plains Partners LP are up by 5.7% year-to-date and 6.1% over the last six months.

Chart courtesy of StockCharts.com

The Lowdown on Green Plains Partners LP

Thanks to high oil prices and expectations that oil demand from China will hit a record high in 2023, energy companies like Green Plains Partners LP have been doing exceptionally well. As such, Green Plains Partners stock’s ultra-high-yield dividend and unit price have been growing to record levels.

It won’t always be this way, though. Dividend hogs need to keep an eye on the economic conditions and the company’s earnings. That’s because a recession, a pandemic, or another black swan event could seriously undermine dividends and share prices.

Right now, though, GPP stock is in a sweet spot, and income investors have been enjoying the ride.