Golden Ocean Stock: 24%-Yielder Makes $291-Million Acquisition

Golden Ocean Group Ltd Becomes World’s Largest Dry Bulk Company

Despite what you may have heard, when it comes to Wall Street, bigger is better.

And when it comes to dry bulk shipping, you can’t get any bigger than Golden Ocean Group Ltd (NYSE:GOGL), an excellent international marine shipping company. The company currently owns and operates a fleet of 94 dry bulk carriers, focusing on the two biggest segments of its industry, Capesize and Panamax. (Source: “Pareto Energy Conference: September 2022,” Golden Ocean Group Ltd, last accessed February 13, 2023.)

Capesize vessels, the largest class of bulk carriers, are used to transport coal and iron core. Because of their size (twice as big as an NFL football field), they cannot pass through the Panama Canal. Instead, they need to travel around the Cape of Good Hope, hence their name. Capesize ships aren’t cheap to rent. In the third quarter, the daily cost to rent a Capesize was $22,658. The breakeven rate for a Capesize vessel is about $11,700 per day.

With industry-low breakeven rates, Golden Ocean Group Ltd is well positioned to generate a significant amount of cash over the long run.

The demand for dry bulk shipping is expected to increase significantly through 2024. To meet this growing demand, Golden Ocean just announced that it has entered an agreement to acquire six 208,000-deadweight-ton (dwt) vessels for $291.0 million. Golden Ocean will then charter those vessels back to their former owner, an unrelated third party, for approximately three years at an average daily time charter equivalent (TCE) rate of about $21,000 (net). (Source: “GOGL – Acquisition of Six Newcastlemax Vessels,” Golden Ocean Group Ltd, February 13, 2023.)

Following the acquisition, Golden Ocean will be the world’s biggest publicly listed dry bulk shipping company in terms of dwt.

Commenting on the agreement, Ulrik Andersen, Golden Ocean Group Ltd’s CEO, said, “This acquisition cements our position as the largest owner of modern Capesize vessels. It also increases our fleet’s fuel efficiency and reduces its emissions profile as we continue to make progress toward our 2030 emission-reduction target of 30%.” (Source: Ibid.)

He added, “Due to our strong balance sheet, we are able to do the transaction with moderate leverage and cash on hand without impacting our dividend capacity.”

Over the past 24 months, Golden Ocean Group Ltd has sold 11 of its older vessels, generating aggregate net proceeds of about $124.0 million. Based on conservative debt financing assumptions, these proceeds are sufficient for the company to fund the majority of the equity that’s expected to be required for its 10 new Kamsarmax ships currently under construction, as well as the aforementioned six vessels it just acquired.

Management expects to Report Strong Returns for Q4

For the third quarter ended September 30, 2022, Golden Ocean reported net income of $104.6 million, or $0.52 per share, compared to $163.7 million, or $0.82 per share, in the second quarter of 2022. The company’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) in the third quarter were $118.2 million, versus $191.6 million in the second quarter. (Source: “GOGL – Third Quarter 2022 Results,” Golden Ocean Group Ltd, November 16, 2022.)

Golden Ocean reported third-quarter TCE rates for its Capesize and Panamax/Ultramax vessels of $22,658 per day and $23,562 per day, respectively. The TCE rates for its entire fleet were $23,017 per day.

During the third quarter of 2022, Golden Ocean Group Ltd completed its sale of two Ultramax vessels, recording a gain of $21.9 million and net cash proceeds of $43.0 million.

Commenting on the company’s 2022 third-quarter financial results, Andersen said, “While geopolitical and macroeconomic factors present a challenging backdrop, Golden Ocean generated solid results in the third quarter.” (Source: Ibid.)

He continued, “Our modern, fuel-efficient vessels command a significant premium to benchmark earnings, a factor that has helped us consistently outperform the market this year.”

For the fourth quarter of 2022, management estimates that Golden Ocean Group Ltd’s TCE rates will be $23,100 per day for 75% of its Capesize available days and $19,100 per day for 78% of its Panamax available days.

For the first quarter of 2023, management estimates that its TCE rates will be $21,300 per day for four percent of its Capesize available days and $21,150 per day for 21% of its Panamax available days.

Golden Ocean Group Ltd Announces $0.35/Share Dividend & $100 Million in Share Buybacks

Reliable cash flow and a growing shipping fleet mean Golden Ocean can provide investors with reliable, high-yield dividends.

That’s when times are good, of course. GOGL stock’s dividend fluctuates based on the company’s TCE rates and earnings—sometimes wildly. During the COVID-19 pandemic, Golden Ocean Group Ltd suspended its dividend, reinstating it in the first quarter of 2021. Since then, Golden Ocean stock’s dividend has been going up and down, but it has always been large enough for dividend hogs.

Right now, things are good for the company. Management declared a third-quarter dividend of $0.35 per share, for a current yield of 24.1%. This is a good example of why investors should keep an eye on stocks whose dividends are directly tied to the economic cycle and are sensitive to supply/demand metrics.

| Period | Dividend Per Share |

| Q3 2022 | $0.35 |

| Q2 2022 | $0.60 |

| Q1 2022 | $0.50 |

| Q4 2021 | $0.90 |

| Q3 2021 | $0.85 |

| Q2 2021 | $0.50 |

| Q1 2021 | $0.25 |

| Q4 2019 | $0.05 |

(Source: “Dividend,” Golden Ocean Group Ltd, last accessed February 13, 2023.)

In addition to providing reliable, high-yield dividends, Golden Ocean has been returning value to investors through a recently announced $100.0-million share repurchase program.

Business & Share-Price Outlook

Golden Ocean Group Ltd is currently operating in a sweet spot, and management expects this to continue. “Based on our contracted charter coverage, we expect to generate strong results in the fourth quarter of 2022 ahead of an expected seasonal slowdown in the first quarter of next year,” said Andersen. (Source: Ibid.)

He continued, “Our strong earnings generation potential, combined with an expectation for historically low fleet growth, gives us confidence in our positive long-term outlook. This is reflected in our continued commitment to returning dividends to our shareholders and in our recently announced share buy-back program.”

This should be good news for GOGL stock’s price, which, as of this writing, is up by 11% year-to-date and 7.5% year-over-year. The outlook for Golden Ocean stock is solid, with analysts providing a 12-month share-price target between $10.80 and $14.00. This points to potential gains in the range of 14% to 47%.

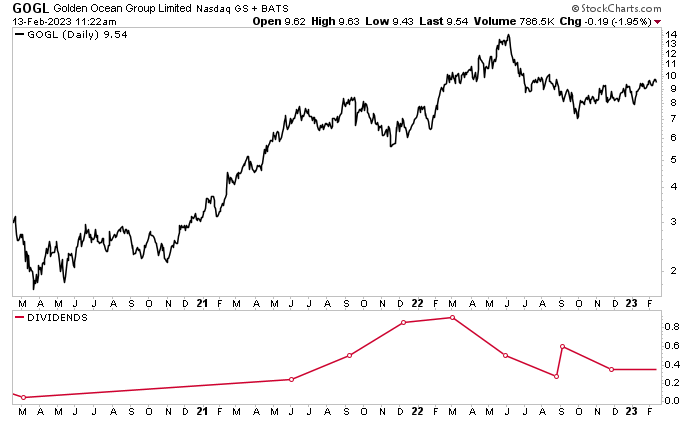

Chart courtesy of StockCharts.com

The Lowdown on Golden Ocean Stock

The world’s leading owner of large dry bulk vessels, Golden Ocean Group Ltd, is a great marine shipping company that’s been taking full advantage of the growing demand for dry bulk. To that end, it just announced a deal to acquire six vessels, making it the world’s largest publicly listed dry bulk shipping company.

Already, the company’s TCE rates are significantly higher than its breakeven levels, which provides it with reliable cash flow. Golden Ocean’s recent acquisitions, new-build ships, and industry dynamics should help it continue rewarding GOGL stockholders with a rising share price and growing, ultra-high-yield dividends.