Golden Ocean Group Ltd: 11%-Yielder a Great Contrarian Play

Golden Ocean Group Stock Up 29% Since April

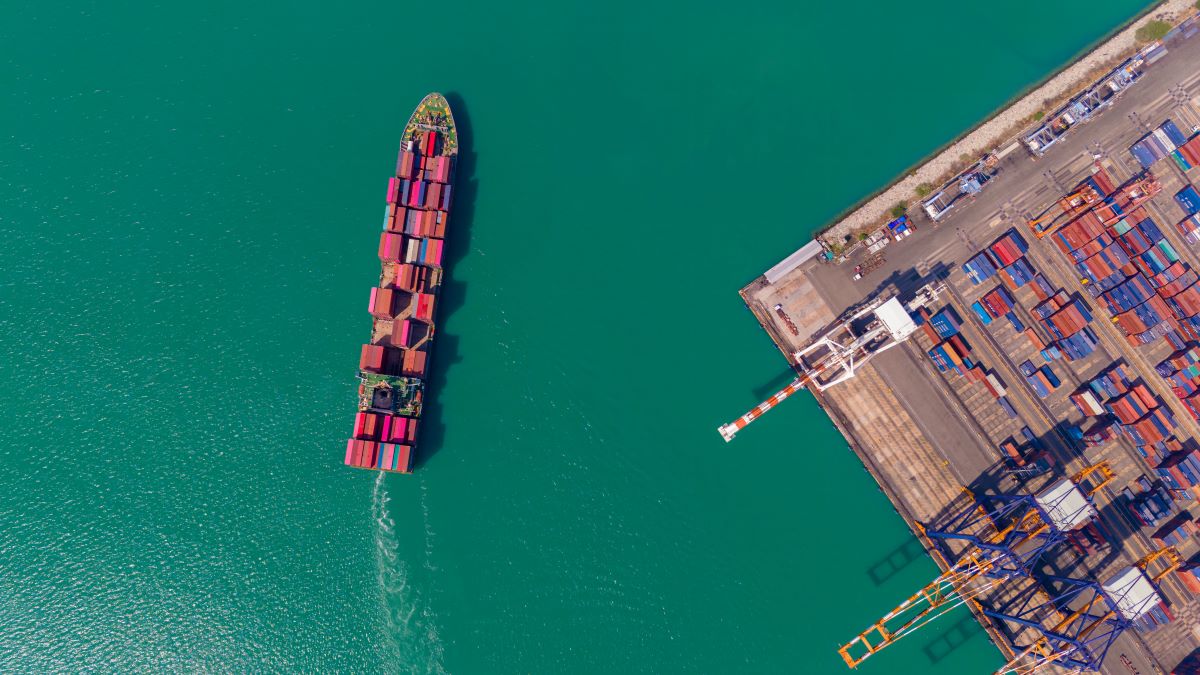

Some stocks underperform because they’re in financial straits or have bad management. Then there are stocks that are being held back because of temporary headwinds. And the latter situation is the case with Golden Ocean Group Ltd (NASDAQ:GOGL), a dry bulk shipping company.

GOGL stock is down five percent year to date and 32% year over year, but those underwhelming numbers are masking a great company. The stock has been taking a beating not just on the seasonal slowdown, but also on softer charter rates due in part to macroeconomic uncertainty, including recently announced trade tariffs.

Despite these challenges, the fundamentals underpinning dry bulk shipping remain solid, especially when it comes to the Capesize segment. Thanks to limited fleet growth, shifting trade patterns, and infrastructure-led demand in key regions, the mid-term outlook for drybulk shipping continues to support, in management’s words, “a constructive medium-term outlook.”

About the Company

Hamilton-Bermuda-based Golden Ocean is one of the world’s leading dry bulk shipping companies, operating a fleet of approximately 90 dry bulk vessels, focused on the largest segments: Capesize and Panamax markets. All of its vessel names begin with “Golden,” so you’d know one when you see one. (Source: “Investor Presentation Q1 2025,” Golden Ocean Group Ltd, May 21, 2025.)

Capesize vessels, the largest class of bulkship, are used to transport coal and iron core. Because of their size (twice as big as an NFL football field), they cannot pass through the Panama Canal; instead, these vessels need to travel around the Cape of Good Hope. Hence the name, “Capesize.”

Panamax vessels, meanwhile, are the largest class of ship that can navigate the Panama Canal.

Golden Ocean could be getting a lot bigger, too. In May, it announced plans for a stock-for-stock merger with CMB.TECH NV (NYSE:CMBT). Once completed, the merger will create one of the largest listed diversified maritime groups in the world with a combined fleet of approximately 250 vessels. (Source: “CMB.TECH NV AND GOLDEN OCEAN GROUP LIMITED ANNOUNCE AGREEMENT AND PLAN OF MERGER,” CMB.TECH NV, May 28, 2025.)

Upon completion of the merger, CMB.TECH shareholders would own approximately 70% of the total issued share capital of CMB.TECH, and Golden Ocean shareholders would own approximately 30% of the total issued share capital of CMB.TECH.

The merger is expected to be completed in the third quarter of 2025.

Expected Headwinds Impact Q1

Expected headwinds, including a seasonal slowdown, an intensive drydocking schedule, and concerns over trade tariffs, and softer charter rates impacted Golden Ocean’s first-quarter results. However, the longer-term outlook remains robust. (Source: “GOGL – First Quarter 2025 Results,” Golden Ocean Group Ltd, May 21, 2025.)

For the first quarter ended March 31, Golden Ocean Group reported a net loss of $44.1 million, or loss of $0.22 per share, down from fourth-quarter 2024 net income of $39.0 million, or $0.20 per share.

The company reported an adjusted net loss of $37.5 million, compared to adjusted net income of $12.7 million for the fourth quarter of 2024.

Golden Ocean reported adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $12.7 million, down from $69.9 million in the fourth quarter of 2024.

The company recognized $38.4 million in drydocking expense, compared to $34.3 million in the fourth quarter of 2024.

During the first quarter, it reported daily time charter equivalent (TCE) rates for Capesize vessels of $16,827 per day and Panamax vessels of $10,424 per day. This resulted in an average of $14,409 per day for the entire fleet.

At the time of its first-quarter earnings announcement in late May, Golden Ocean stated that its estimated TCE rates for the second quarter were $19,000 per day for 69% of Newcastlemax/Capesize available days and $11,100 per day for 81% of Kamsarmax/Panamax available days.

The company’s estimated TCE rates for the third quarter were $20,900 per day for 12% of Newcastlemax/Capesize available days and $12,900 per day for 38% of Kamsarmax/Panamax available days.

Quarterly Dividend of $0.05/Share

Dividends are “a cornerstone” for Golden Ocean and its capital allocation strategy, with a stated goal of growing its annual dividend. When times are good, of course.

The company suspended its distribution during the 2020 health crisis, but reinstated it at the start of 2021. It hasn’t missed a payout since then.

Save for the first quarter, times have been good for Golden Ocean. In the first quarter, it declared a dividend of $0.05 per share, or $0.80 per share, for a forward annual dividend yield of 10.95%. (Source: “Dividend,” Golden Ocean Group Ltd, last accessed July 14, 2025.)

You can see in the chart below that Golden Ocean’s quarterly dividend payout fluctuates based on TCE rates and earnings. And it can fluctuate wildly.

| Period | Dividend Per Share |

| Q1 2025 | $0.05 |

| Q4 2024 | $0.15 |

| Q3 2024 | $0.30 |

| Q2 2024 | $0.30 |

| Q1 2024 | $0.30 |

| Q4 2023 | $0.30 |

| Q3 2023 | $0.10 |

| Q2 2023 | $0.10 |

| Q1 2023 | $0.10 |

| Q4 2022 | $0.20 |

| Q3 2022 | $0.35 |

| Q2 2022 | $0.60 |

| Q1 2022 | $0.50 |

20%+ Upside Possible with GOGL Stock?

You can see in the chart below just how much tariff talk has negatively impacted GOGL stock. In early March, President Donald Trump discussed tariffs against Canada and Mexico, America’s two largest trading partners. This included tariffs on steel and aluminum.

Chart courtesy of StockCharts.com

After the president announced what he called his global “Liberation Day” tariffs on April 2, both GOGL stock and the broader market fell again. Since then though, GOGL has been clawing its way back, much like the rest of the stock market, with the exception of the S&P 500 and Nasdaq, which are near record levels.

Investors are optimistic that a number of trade deals will soon be signed. This should put to rest fears of a global recession. And that’s been good for GOGL. It has essentially erased all of the losses associated with Liberation Day, and it’s trading up 29% since then.

Despite macroeconomic headwinds, Wall Street remains bullish on the stock, with analysts providing a 12-month share price target range of $9.00 to $10.00. This points to potential upside of nine percent to 21%.

The Lowdown on Golden Ocean Group

As one of the world’s leading dry bulk shipping companies, Golden Ocean Group Ltd continues to be a great marine shipping stock. While it reported underwhelming first-quarter results, they were mostly due to temporary headwinds. The medium-term outlook for the dry bulk industry remains decent.

This should help Golden Ocean to continue to provide shareholders with a reliable, variable dividend. It should also help juice its stock over the coming quarters.

This should be encouraging news to the 252 institutions that hold 34.8% of all GOGL outstanding shares. Three of the biggest holders include BlackRock Inc, The Vanguard Group, and Arrowstreet Capital. (Source: “Golden Ocean Group Limited (GOGL),” Yahoo! Finance, last accessed July 14, 2025.)

A far greater 49.3% of all outstanding shares are held by insiders. This should entice management to see the company perform well.