Outlook for 9.6%-Yielding Global Partners LP More Bullish on Recent Acquisitions

GLP Stock Bucks Downtrend; Up 7% Year-to-Date

Much of the stock market is in correction or bear-market territory, but some sectors have been doing well and are expected to continue doing well for the foreseeable future. Thanks to soaring fossil fuel prices, juiced by Russia’s unprovoked invasion of Ukraine, oil and gas stocks have been some of the biggest gainers since the start of 2022.

One oil and gas company that continues to do well and is expected to enjoy a boost over the summer driving season—even with the record-high gasoline prices—is Global Partners LP (NYSE:GLP).

Global Partners is a midstream oil and gas company that manages a diverse portfolio of businesses. It’s one of the largest independent owners, suppliers, and operators of gas stations and convenience stores in the Northeast U.S. (Source: “First-Quarter 2022 Investor Presentation: May 2022,” Global Partners LP, last accessed June 15, 2022.)

It also owns, controls, or has access to one of the largest terminal networks in New England and New York, through which it distributes gasoline, distillates, residual oil, and renewable fuels to wholesalers, retailers, and commercial customers.

Global Partners LP has:

- Nine million barrels of storage capacity

- About 375,000 barrels of product sold daily

- About 1,700 owned, leased, or supplied gas stations

- 342 company-operated convenience stores

- 25 bulk product terminals

Two Strategic Acquisitions in 2022

Global Partners LP became one of the most dominant players in its industry because it has a successful history of acquiring, integrating, and operating terminal and retail fuel assets: 20 since 2007.

In January 2022, the partnership completed its previously announced purchase of retail fuel and convenience store assets from Consumers Petroleum of Connecticut, Inc. (Source: “Global Partners Expands Portfolio With Acquisition of Consumers Petroleum of Connecticut’s Wheels Retail Fuel and Convenience Stores,” Global Partners LP, January 27, 2022.)

The deal includes 26 company-operated “Wheels” branded convenience stores in Connecticut, as well as fuel supply agreements with 22 sites in Connecticut and New York. The gas stations sell fuel under the “Citgo” and “Sunoco” brands. Due to a Federal Trade Commission order, Global Partners LP had to divest itself of select retail sites in Connecticut.

A week later, Global Partners LP announced it was expanding its retail footprint in the Mid-Atlantic region with its acquisition of Miller’s Neighborhood Market. The acquisition includes 23 convenience stores (21 company-operated) and fuel supply agreements with 34 locations, primarily in Virginia. (Source: “Global Partners Expands in the Mid-Atlantic Region With Acquisition of Miller’s Neighborhood Market,” Global Partners LP, February 2, 2022.)

The oil and gas industry flows both ways. Global Partners LP has announced that it’s selling an oil and gas terminal in Revere, MA. The partnership said, however, it will lease back key infrastructure at the terminal. The sale was expected to close in the first half of 2022. (Source: “Global Partners Reports Fourth-Quarter and Full-Year 2021 Financial Results,” Global Partners LP, February 28, 2022.

Fabulous Q1 Results

For the first quarter ended March 31, 2022, Global Partners reported net income of $30.5 million, or $0.76 per share, compared to a first-quarter 2021 net loss of $4.3 million, or $0.20 per share. (Source: “Global Partners Reports First-Quarter 2022 Financial Results,” Global Partners LP, May 6, 2022.)

The company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) were $79.8 million in the first quarter of 2022, up by 95% from the first-quarter 2021 EBITDA of $40.9 million. Its adjusted EBITDA were $74.9 million in the first quarter of 2022, compared to $40.4 million in the same period of 2021.

Global Partners LP’s distributable cash flow in the first quarter advanced 256% year-over-year from $14.0 to $49.9 million.

The partnership’s gross profit in the first quarter of 2022 was $206.2 million, compared to $145.0 million in the same period of 2021. The 42.2% increase was fueled primarily by the company’s Gasoline Distribution and Station Operations segment.

Global Partners LP’s combined product margin (gross profit adjusted for depreciation allocated to cost of sales) was $228.2 million in the first quarter of 2022, compared to $165.1 million in the same period of 2021.

The partnership’s first-quarter revenue climbed by 73% year-over-year to $4.5 billion.

Global Partners LP’s volume during the first quarter was 1.5 billion gallons, compared to 1.3 billion gallons in the same period of the previous year. In the first quarter of 2022, the company’s Wholesale segment volume went up by 10% year-over-year to 976.8 million gallons, its Gasoline Distribution and Station Operations volume climbed by 12.6% year-over-year to 376.5 million gallons, and its Commercial segment volume jumped by 43.4% year-over-year to 116.8 million gallons.

Looking ahead, Eric Slifka, Global Partners LP’s president and CEO, said, “We continue to identify new opportunities to further drive value through our integrated network and strategically located assets to enhance efficiencies, increase returns to unitholders and deliver an outstanding experience for our customers and guests.” (Source: Ibid.)

Global Partners LP Hikes Ultra-High-Yield Dividend

Ultra-high-yield dividends are what income hogs want, and Global Partners LP stock delivers.

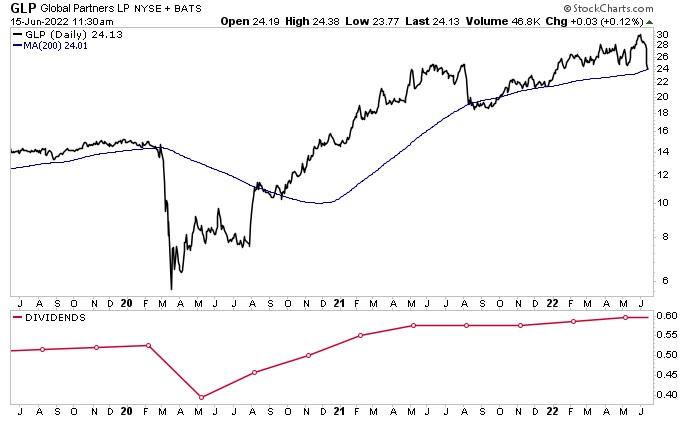

Most recently, in April, the partnership’s board declared a quarterly cash distribution of $0.595 per unit. GLP stock’s yield currently stands at 9.6%. The $0.595 distribution represents a 1.7% increase over the $0.585 paid out in January 2022 and a 3.5% increase over the $0.575 paid out in the same period of 2021.

In addition to providing growing, high-yield dividends, Global Partners LP stock has been outpacing the broader market in terms of share appreciation.

Currently finding support at its 200-day moving average, GLP stock is:

- Down by five percent over the last three months

- Up by 10% over the last six months

- Up by seven percent year-to-date

- Down by five percent year-over-year

In comparison, the S&P 500 is:

- Down by six percent over the last three months

- Break-even over the last six months

- Down by 21% year-to-date

- Down by 15% year-over-year

Chart courtesy of StockCharts.com

The Lowdown on Global Partners LP Stock

The energy sector is cyclical, and right now it’s on an upswing. Rising fossil fuel prices have been helping drive oil and gas stocks like GLP stock higher.

Because of Global Partners LP’s diverse network, strategic acquisitions, and divestitures—as well as industry tailwinds—Global Partners LP stock continues to outpace the broader market. And thanks to the partnership’s high cash flow, GLP stock is able to provide growing, high-yield dividends.