Genco Shipping Stock: Inflation-Thumping High-Yielder Crushing the Market

Why GNK Stock Is Compelling

Genco Shipping & Trading Ltd (NYSE:GNK) has been benefiting from an increased demand for dry bulk carriers, particularly large Capesize vessels. That momentum is expected to continue, with the demand for iron ore and coal (the main cargoes for Capesize vessels) remaining robust.

The demand for medium-sized Supramax and Ultramax vessels is also buoyant.

This is, in large part, due to the ongoing demand for dry bulk commodities from China. That country’s steel production in 2023 was at the same level as in 2022, while the demand for aluminum has remained high thanks to the ongoing growth of industries related to electric vehicles and renewable energy. (Source: “Review of the Dry Bulk Market in 2023 and Outlook for 2024,” Mitsui O.S.K. Lines, February 6, 2024.)

The demand for steaming coal (aka thermal coal), which is mainly used for power generation in India and China, also remains strong. The global demand for steaming coal has been heating up due to energy prices being juiced by geopolitical tensions.

All of this is good news for Genco Shipping & Trading Ltd. The New York City-based marine shipping company is the largest U.S.-based dry bulk ship owner. It currently has 43 modern vessels, of which 16 are Capesize ships, 15 are Ultramaxes, and 12 are Supramaxes. (Source: “Sidoti Virtual Small-Cap Conference,” Genco Shipping & Trading Ltd, March 13, 2024.)

The company ships major bulk (iron ore and coal) and minor bulk (grain, cement, fertilizer, etc.) on all major worldwide shipping routes.

To enhance its operations, Genco Shipping & Trading Ltd announced a “comprehensive value strategy” in April 2021. That strategy prioritizes three key tenets, which apply in all market cycles: pay dividends, reduce its debt, and grow its fleet.

To that end, the company has declared 18 consecutive quarterly dividends since 2019. Over this period, it has paid cumulative dividends of $5.155 per share, which is about 25% of its current share price.

Genco Shipping & Trading Ltd has lowered its outstanding debt by 55%, or $249.0 million. That has significantly reduced its net loan-to-value ratio and its cash flow break-even rate to the lowest levels in its peer group.

The company has also invested $520.0 million in fleet expansion and modernization over the last five years. It has added 17 modern, “eco” vessels to its fleet. (Source: “Genco Highlights Steps the Company Is Taking to Drive Sustainable, Long-Term Shareholder Value,” Genco Shipping & Trading Ltd, January 22, 2024.)

Strong 4th-Quarter Results

For the fourth quarter of 2023, Genco Shipping reported net income of $4.9 million, or $0.11 per diluted share. Its adjusted net income in the quarter was $18.6 million, or $0.43 per basic and diluted share. (Source: “Genco Shipping & Trading Limited Announces Q4 2023 Financial Results,” Genco Shipping & Trading Ltd, February 21, 2024.)

The company’s average time charter equivalent (TCE) rate in the fourth quarter of 2023 was $17,373 per day, down from $19,330 in the fourth quarter of 2022.

During the fourth quarter of 2023, the company acquired two Capesize vessels for $86.1 million and agreed to sell three older Capesize vessels for $56.0 million.

For full-year 2023, Genco Shipping & Trading Ltd reported adjusted net income of $28.8 million, or $0.67 per basic and diluted share. Its net cash provided by operating activities in 2023 was $91.8 million.

The company’s full-year TCE rate was $14,766 per day, which outperformed its internal benchmark by approximately $1,300 per day.

Commenting on the results, Genco Shipping & Trading Ltd’s CEO, John C. Wobensmith, said, “2023 marked another strong year for Genco, as we continued to take concrete steps to drive sustainable long-term shareholder value while remaining the #1 shipping company for the third consecutive year in the Webber Research ESG Scorecard.” (Source: Ibid.)

Wobensmith added, “Our performance in the fourth quarter was strong. Importantly, we capitalized on our industry leading commercial platform and our significant operating leverage to once again outperform benchmarks and increase TCE by 44% from third quarter levels. We expect the first quarter to be solid as 81% of our Q1 days are fixed at over $18,700 per day.”

Management Declared 18th Consecutive Quarterly Payout

Because of Genco Shipping & Trading Ltd’s dividend formula—which comprises operating cash flow minus capital expenditures, debt repayment, and cash reserves—its dividend level fluctuates. (Source: Genco Shipping & Trading Ltd, February 21, 2024.)

The company’s overall payout has been high, though. As mentioned earlier, over the last 18 quarters, it has paid out $5.155 per share.

For the fourth quarter of 2023, Genco Shipping declared a dividend of $0.41 per share, which it paid in March 2024. (Source: “Dividend History,” Genco Shipping & Trading Ltd, last accessed April 16, 2024.)

As of this writing, that works out to a yield of 4.16%.

Genco Shipping Stock Up 26% Year-to-Date

At Income Investors, we tend to look for stocks with dividend yields of at least five percent, but we’re willing to make an exception if a stock’s underlying share price is doing very well.

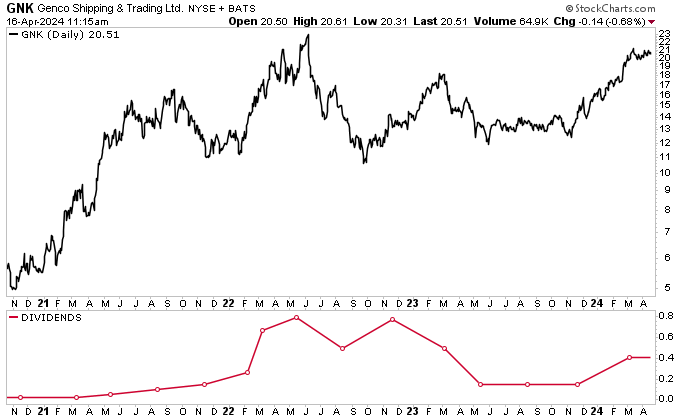

GNK stock has been on fire lately. As of this writing, it’s up by:

- 28% over the last three months

- 48% over the last six months

- 26% year-to-date

- 32% over the last year

Over the same time frames, the S&P 500 has only gone up by six percent, 15%, six percent, and 22%, respectively.

Genco Shipping stock is also up by 45% since I last wrote about the company, which was in July 2023.

Chart courtesy of StockCharts.com

The Lowdown on Genco Shipping & Trading Ltd

Genco Shipping is an excellent marine shipping company with a diverse fleet, strong cash position, low debt level, and lowest cash-flow break-even rate among U.S.-listed marine dry bulk shippers.

Over the past few years, the company has delivered on all three pillars of its business strategy: growth, deleveraging, and dividends. As part of that, Genco Shipping & Trading Ltd has lowered its debt by more than 50% and reduced its cash flow break-even rate.

Moreover, GNK stock pays reliable, high-yield dividends. It recently paid its 18th consecutive distribution.