GasLog Partners LP: This 9.1% Yield Looks Compelling

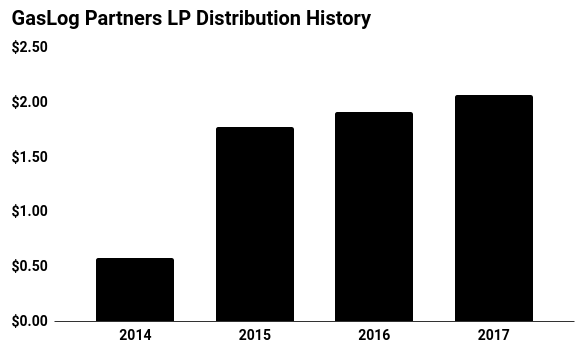

Stock Yields 9.1%, and Growing

To earn bigger yields, you have to take bigger risks.

Investors won’t find many big payouts among blue-chip dividend stocks. Income hunters need to scope out lesser-known niches, like real estate investment trusts (REITs) or business development corporations (BDCs).

Master limited partnerships (MLPs) provide one of the last sources of high yields in today’s stock market. These firms typically own infrastructure assets like pipelines, terminals, and toll roads. And because they’re required by law to pay out most of their profits to shareholders, they crank out some of the highest yields around.

One of my favorites: GasLog Partners LP Unit (NYSE:GLOP). GasLog Partners stock sits at the upper end of the risk spectrum, as you’d expect from anything yielding 9.1%. This name, however, could make for a tidy income supplement for those who can handle the ups and downs.

GasLog Partners owns ships that store and carry liquefied natural gas (LNG). These deals tend to get done through long-term contracts, which means analysts can project the partnership’s cash flow well into the future.

The company seems to be on a firm financial footing. Over the past 12 months, the business generated $124.5 million in distributable cash flow and paid out $90.4 million in distributions. That comes out to a payout ratio of 72.6%, sitting well within my comfort zone.

That payout will likely continue to grow. Right now, soaring energy production has sent U.S. natural gas prices to record lows. But overseas, the commodity still fetches a decent price in the marketplace.

This has created an opportunity for anyone who can buy gas cheap in America and sell it for a steep markup internationally. Regulators have approved dozens of new LNG export terminals across the country, creating a new “Made in America” export boom.

Ships, however, could become a bottleneck in that expansion. To accommodate soaring demand for new LNG tankers, GasLog Partners LP has invested billions of dollars to expand its business. This should allow management to grow cash flows—and, by rough extension, the distribution—at a high-single-digit clip over the next five years.

(Source: “Distributions,” GasLog Partners LP, last accessed June 28, 2018.)

In fact, interest rates present the only real thing that would point to a downgrade in the near future.

Because GasLog Partners’s cash flows resemble bond coupons, the partnership competes directly with fixed-income securities for capital. If interest rates rise, investors might dump their stocks for safer returns in the bond market.

That said, GasLog Partners stock’s almost-double-digit payout more than compensates shareholders for the risk here. For those willing to handle the higher risk, the payout looks like it’s worth it.