GasLog Partners LP: This Stock Yields 8.7% (and Growing)

Little-Known Stock Yields 8.7%

In recent posts, I’ve told you all about my favorite place for safe, outsized yields: cash cows.

These firms represent mature businesses. Because they have less in the way of growth potential, owners milk these firms for extra-large income.

Cash cows don’t come with a “cool factor.” These stocks, however, have quietly beaten the market for decades. And it’s not rare to find yields of up to 21%.

Case in point: GasLog Partners LP (NYSE:GLOP). This partnership owns a fleet of tanker ships that move liquefied natural gas from Point A to Point B. And with a yield nearing nine percent, some investors have taken notice.

You don’t need an MBA to wrap your head around this operation.

GasLog owns 11 vessels. Management then leases these carriers out to energy companies.

These deals get done under fixed, long-term contracts. In some cases, executives lock in agreements for up to 10 years (or more).

In other words, we can circle the dates for when this partnership gets paid—for years to come.

Better still, GasLog Partners has little in the way of volume or commodity price risk. This results in a predictable stream of cash flows which resembles bond coupons.

Those cash flows should continue to grow, too.

New drilling methods have unlocked vast swaths of gas supplies in the United States. Prices have dropped so low, drillers literally burn the stuff off at well heads.

Overseas, in contrast, the industry still struggles with limited inventory and high demand. Across Asia and Europe, the commodity still trades at a premium.

This spread has created a bonanza for investors.

Across the industry, we’ve seen booming profits for any company that can ship, store, or process natural gas. Analysts project that U.S. shipments will quintuple by 2019, making the country the world’s third-largest natural gas exporter.

For investors, this has created a stable income stream.

Tanker ships cost a lot of money upfront. They don’t, however, cost a lot of money to maintain.

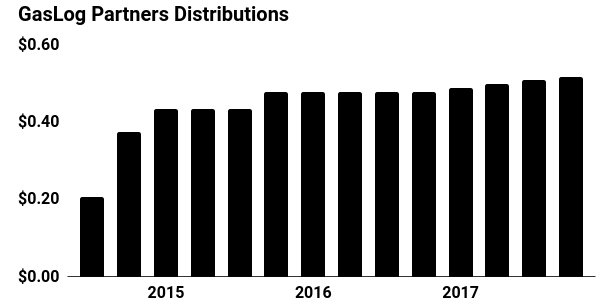

As a result, management can pay out most of their profits to unitholders. Today, GasLog Partners pays out a quarterly distribution of $0.52 per unit, which comes out to an annual yield of 8.7%.

Higher demand for energy tanker ships should boost cash flows in the years to come. Over the next five years, the street expects GasLog to boost its payout at a high single-digit clip.

(Source: “GasLog Partners Common Unit Distributions,” GasLog Partners LP, last accessed May 15, 2018.)

Exciting stuff? Hardly.

But here’s the thing: GasLog’s near nine-percent yield represents one of the highest, safest payouts around. Investors who sit around reinvesting their distributions will beat the pants off the market as the years tick by.

It’s a pretty amazing thing to watch.