Is GasLog Partners LP’s 12% Yield Safe?

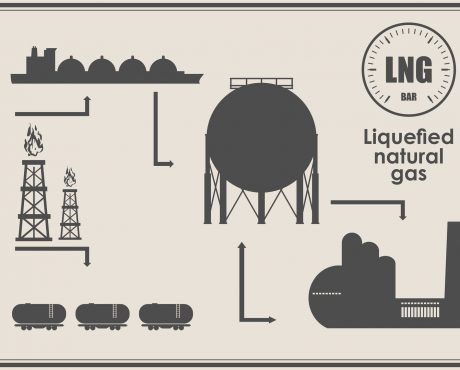

If you want to make a lot of money over the next few years, then you need to pay attention to liquefied natural gas (LNG). The U.S. shale revolution has unlocked vast swaths of natural gas. Yet overseas, limited supplies have resulted in shortages.

This has created a “Made in America” export boom. In July, the country exported 6.0 billion cubic feet per day of LNG. The represents a sixfold increase from early 2017, and analysts believe this could just be the beginning. (Source: “EIA: Natural gas deliveries to U.S. LNG export facilities set a record in July,” World Oil, August 19, 2019.)

Good news for GasLog Partners LP (NYSE:GLOP).

The partnership owns a fleet of tankers that generate steady fees from shipping LNG. And with natural gas shipments surging, this has emerged as a lucrative business. Since 2014, the partnership’s distribution has more than doubled. (Source: “Distributions,” GasLog Partners LP, last accessed August 29, 2019.)

And today, GasLog stock pays a yield of almost 12%.

But can the company really afford such a generous payout? Savvy investors will want to dive into the financials before pulling the trigger on such a stock. Let’s take a look at the numbers.

Management has left themselves some financial wiggle room, to begin with. Last year, GasLog generated $109.0 million in cash flow. From this total, executives paid out $101.0 million in distributions. (Source: “GasLog Partners LP Q2 2019 Results Presentation,” GasLog Partners LP, July 25, 2019.)

Generally, you like to see a company pay 90% or less of its earnings as distributions. So GasLog’s 93% payout ratio sits at the upper end of my comfort zone. But given that management has locked in customers to long-term contracts, unitholders don’t have too much to worry about.

GasLog executives continue to shore up the company’s balance sheet, too.

The partnership has a reasonable debt load, with $5.50 in liabilities for every dollar generated in adjusted earnings before interest, tax, depreciation, and amortization (EBITDA). While not quite conservative, it’s a more conservative balance sheet than some of the firm’s peers.

Management, though, seems to be taking steps to improve this situation. Over the past few years, executives have dialed back expansion plans and have paid off $332.0 million in long-term debt. This has saved the business millions of dollars each year in interest payments.

Looking forward, executives aim to cut the partnership’s debt-to-adjusted-EBITDA ratio to 4.25×. (Source: Ibid.)

(Source: Ibid.)

So what could go wrong here?

The boom in LNG exports comes down to the difference between international and U.S. natural gas prices. If the spread between these two markets tightens, that will reduce the demand for tanker vessels. And by extension, that would also reduce the rate at which GasLog can boost its distribution.

That doesn’t seem to be in the cards. In the company’s most recent investor presentation, management vowed to keep boosting the distribution at a low single-digit clip. They would not have gotten their unitholders’ hopes up unless they were confident they could deliver. Still, it’s something to keep an eye on.

Bottom line: GasLog Partners LP has a high payout ratio and a moderately levered balance sheet. That means you can’t call this distribution the safest around. But with the partnership smack dab in the middle of America’s energy export boom, these payouts will likely keep rolling in for now.