Gaming and Leisure Properties Inc: Time to Gamble on This 7.3% Yield?

Is This 7.3% Yield Safe?

As they say in Vegas, “the house always wins.” And in the case of Gaming and Leisure Properties Inc (NASDAQ:GLPI), investors literally own the house.

Gaming and Leisure Properties Inc owns a sprawling empire of casinos nationwide, which it rents out to operators for regular rental payments. And because tenants pay for almost all of the operating costs, most of the rental income flows straight to GLPI’s bottom line.

This has created quite the income stream for shareholders. At the time of this writing, GLPI stock paid a distribution yield of 7.3%. No wonder dividend investors have taken notice of this once-little-known business.

But can such a high payout possibly be safe? Savvy readers will want to answer that question before reaching for a big yield. Let’s dig into the financials.

Management has maintained a conservative payout ratio, to begin with.

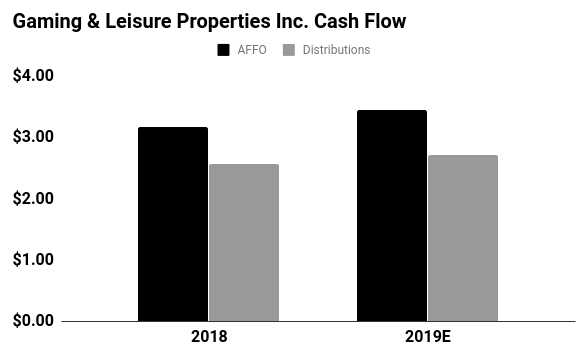

In 2018, Gaming and Leisure Properties generated $3.18 per unit in adjusted fund flow from operations (AFFO), a common measure of profitability in the real estate business. (Source: “Gaming and Leisure Properties, Inc. Announces Fourth Quarter and Full Year 2018 Results,” Gaming and Leisure Properties Inc, February 13, 2019.)

From this total, GLPI paid out $2.72 per unit, for a payout ratio of 85%.

Generally, I like to see companies pay out 90% or less of their earnings as dividends. That leaves management a little bit of breathing room in the event of a downturn.

This represents an especially big concern when discussing a cyclical business like gaming. That said, the partnership’s current payout ratio allows investors to rest easy at night.

Those payouts will likely continue to grow.

Late last year, Eldorado Resorts Inc (NASDAQ:ERI) completed its acquisition of Tropicana Entertainment Inc. for $1.9 billion. To finance the deal, Eldorado sold most of Tropicana’s real estate to GLPI in a sale-leaseback transaction. (Source: Ibid.)

This will provide a big boost to cash flow. In total, Gaming and Leisure Properties Inc expects the acquisition to add $110.0 million in rental income annually. Better still, the deal diversifies the partnership’s tenant base by adding another high-quality renter to the portfolio.

(Source: “Stock Information,” Gaming and Leisure Properties Inc., last accessed February 19, 2019.)

The big risk here? The economy.

Gaming is a cyclical business. If GPLI’s tenants run into financial trouble, the partnership could be left with a bunch of worthless buildings with few other uses.

Investors need to understand the potential issues here. That said, GPLI stock’s 7.3% yield more than compensates investors for the risks they’re taking. Furthermore, management has done everything needed to prepare the business for any unexpected recession.

Therefore, this distribution looks reasonably safe.