5.6%-Yielding Gaming and Leisure Properties Stock: Special Dividends & Record Q4 Results

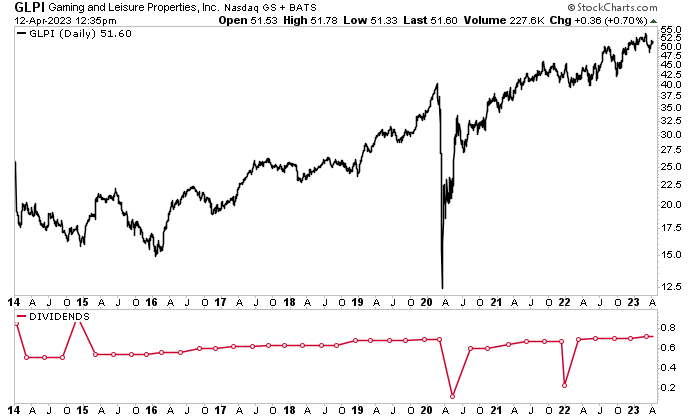

GLPI Stock Up 18.6% Year-Over-Year

While the tourism industry took a hit during the COVID-19 pandemic, the gaming industry held up pretty well—in spite of quarantine orders.

That doesn’t mean gaming stocks like Gaming and Leisure Properties Inc (NASDAQ:GLPI) weren’t affected by the carnage. During the February/March 2020 stock market crash, Gaming and Leisure Properties stock cratered by roughly 70%.

But you can’t hold a good stock down.

It only took GLPI stock about a year to recover from the March 2020 stock market crash. And, thanks to the company’s diverse real estate portfolio, rash of acquisitions, and gambling-loving customers, Gaming and Leisure Properties stock has trended steadily higher.

On March 6, the stock hit a new record high of $55.13. That represents a 25% increase from its price of $43.90 at the time I wrote about Gaming and Leisure Properties Inc in February 2021.

The first gaming-focused real estate investment trust (REIT) in the U.S., Gaming and Leisure Properties has a portfolio of 59 gaming facilities in 18 states. It has more than 14,700 hotel rooms (covering more than 6,000 acres) and 31.1 million square feet of property. (Source: “About Us,” Gaming and Leisure Properties Inc, last accessed April 13, 2023.)

The company’s geographically diverse portfolio includes Boyd Gaming Corporation (NYSE:BYD), Casino Queen, Caesars Entertainment Inc (NASDAQ:CZR), The Cordish Companies, and Penn Entertainment Inc (NASDAQ:PENN).

Trading at $51.60 as of this writing, GLPI stock is up by 14% over the last six months and 18.6% year-over-year.

Chart courtesy of StockCharts.com

Gaming and Leisure Properties Inc’s Recent Property Acquisitions

Gaming and Leisure Properties has announced a number of acquisitions and leaseback agreements in the last several quarters.

During the second quarter of 2022, the company completed its acquisition of the land and real estate assets of Bally’s Corp’s (NYSE:ALY) three casinos in Black Hawk, Colorado, as well as the Bally’s Quad Cities Casino & Hotel in Rock Island, Illinois, for $150.0 million. These properties were added to the Bally’s Corp master lease, with the rent in that lease increasing by $12.0 million on an annual basis. (Source: “Gaming and Leisure Properties, Inc. Reports Second Quarter 2022 Results and Initiates 2022 Full Year AFFO Guidance,” Gaming and Leisure Properties Inc, July 28, 2022.)

During the fourth quarter of 2022, Gaming and Leisure Properties entered a new master lease with PENN Entertainment Inc for seven of PENN’s properties. The initial term of the new master lease will expire on October 31, 2033, with three five-year extensions at PENN’s option. (Source: “Gaming & Leisure Properties and PENN Entertainment Agree to New Master Lease Terms and Development Funding,” Gaming and Leisure Properties Inc, October 10, 2022.)

All of the rents in the new master lease will be fixed with an annual escalation of 1.5%, with the first escalation occurring for the lease year beginning on November 1. The base rent for the new lease will be $232.2 million. The rent for the original PENN Entertainment master lease will be $284.1 million.

In January of this year, Gaming and Leisure Properties completed its previously announced purchase from Bally’s Corp of the land and real estate assets of the Bally’s Tiverton Casino & Hotel in Tiverton, Rhode Island and the Bally’s Hard Rock Hotel & Casino Biloxi in Biloxi, Mississippi for $635.0 million. (Source: “Gaming and Leisure Properties, Inc. Completes Previously Announced Sale Leaseback Transaction with Bally’s for Tiverton, RI and Biloxi, MS Properties,” Gaming and Leisure Properties Inc, January 4, 2023.)

Those two properties were added to Gaming and Leisure Properties’ existing master lease with Bally’s Corp. And like all good landlords, Gaming and Leisure Properties increased its initial rent for the lease by $48.5 million on an annual basis. The master lease has an initial term of 15 years (with 14 years remaining) and four five-year renewals at the tenant’s option.

The REIT also has the option to acquire the real property assets of the Bally’s Twin River Lincoln Casino Resort in Lincoln, Rhode Island before December 31, 2024, for a purchase price of $771.0 million and additional rent of $58.8 million.

Record Fourth-Quarter Financial Results; Dividend Hike

Gaming and Leisure Properties has continued its run of reporting record quarterly financial results. For the fourth quarter of 2022, it announced that its revenue increased by 12.7% year-over-year to $336.4 million. Its income from operations grew by 34.7% to $275.5 million. (Source: “Gaming and Leisure Properties, Inc. Reports Record Fourth Quarter Results,” Gaming and Leisure Properties Inc, February 23, 2023.)

The REIT’s net income jumped in the fourth quarter by 67% year-over-year to $199.6 million, or $0.75 per share. Its funds from operations (FFO) advanced 46% year-over-year to $258.8 million, or $0.97 per share, while its adjusted FFO (AFFO) rallied by 16.5% to $239.1 million, or $0.89 per share.

Its full-year 2022 AFFO was $924.0 million, or $3.55 per share.

Peter Carlino, Gaming and Leisure Properties Inc’s chairman and CEO, commented, “We ended 2022 with record fourth quarter results and increased dividends as our deep, long-term knowledge of the gaming sector has allowed us to continually expand and diversify our tenant base, geographic footprint and rental streams.” (Source: Ibid.)

He added, “Fourth quarter results again highlight the durability of our rental streams…combined with our initiatives to position the Company for further growth through the active management of all aspects of our business and capital structure.”

For full-year 2023, Gaming and Leisure Properties expects to report AFFO in the range of $980.0 to $997.0 million, or $3.61 to $3.67 per diluted share.

Thanks to the REIT’s strong FFO numbers, Gaming and Leisure Properties stock is able to provide investors with reliable, high-yield dividends. In December 2022, it paid a quarterly dividend of $0.705 per share. In March 2023, GLPI stock paid a quarterly dividend of $0.72 per share, for a current inflation-crunching yield of 5.6%.

Gaming and Leisure Properties Inc also paid special dividends of $0.25 per share in March. Those payments were related to the company’s sale of the Tropicana Las Vegas building. This was the second special dividend that Gaming and Leisure Properties has paid out in just over a year. In January 2022, the REIT paid special dividends of $0.24 per share.

The Lowdown on Gaming and Leisure Properties Stock

Gaming and Leisure Properties is a great specialty REIT with a growing, diverse portfolio of gaming properties across the U.S. The company reported another quarter of record revenues, as well as high earnings, FFO, and AFFO growth. This helped juice GLPI stock’s high-yield dividend.

Looking ahead, Gaming and Leisure Properties Inc’s management believes that, because of its strong balance sheet and liquidity, the company is well positioned to deliver long-term growth, consistently grow its cash flow, and “build value for shareholders in 2023 and beyond.”

That’s another good sign that Gaming and Leisure Properties stock could continue to rally and that the REIT’s board will continue to reward buy-and-hold investors with growing, high-yield dividends.