Gaming and Leisure Properties Inc: 5.7% Yielding Stock Resumes Dividend Hikes

GLPI Stock Raises Its High-Yield Dividend

On Wall Street, there are periods of fallow and fruitful. For income investors, it’s been the former—for a long time. During the 2008 financial crisis, the Federal Reserve sent short-term interest rates to near-zero. Then there was the COVID-19 pandemic. Interest rates have yet to recover.

Sure, the easy money helped fuel economic growth and juice the stock market, but for yield-hungry investors, it’s been abysmal. The yield on 10-year Treasuries is less than 1.5%. The yield on investment-grade bonds is about 1.4%, and the yield on certificates of deposit (CDs) is virtually nothing.

If you’re looking for an investment that provides you with a big, reliable, growing dividend yield and share price—and a company that’s poised to rip higher once the U.S. economy fully opens—you might want to consider Gaming and Leisure Properties Inc (NASDAQ:GLPI), a specialty real estate investment trust (REIT) that invests in gaming and related facilities.

As you can imagine, Gaming and Leisure Properties stock took a big hit during the coronavirus pandemic. With quarantine rules in effect, hotels were either mostly empty or shut down, and one-armed bandits and roulette wheels were attracting nothing but dust and cobwebs.

But thanks to a successful vaccine rollout, the reopening of the U.S. economy, and the return of tourism, it looks like GLPI stock is poised to rebound. It’s already on its way. It was doing quite well before COVID-19 brought the global economy to a standstill.

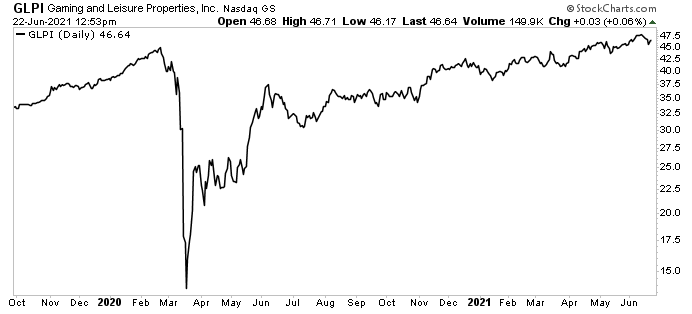

Between 2015 and 2019, Gaming and Leisure Properties stock rallied by approximately 110%. In the opening months of 2020, it advanced an additional 20%. But then COVID-19 hit. From the middle of February to the middle of March, GLPI stock cratered, losing 75% of its value.

It’s been rebounding since then, and is basically trading where it was before the pandemic sent it reeling. Gaming and Leisure Properties stock is up by 37% year-over-year and 13.5% year-to-date.

Solid gains indeed, but Wall Street thinks GLPI stock still has lots of room to run. Of the analysts providing a 12-month price forecast for Gaming and Leisure Properties Inc, their average share-price target is $51.72, with a high estimate of $55.00. That points to upside of 11% and 18%, respectively.

Wall Street analysts are notoriously conservative, though, so I think a 12-month price forecast of $65.25 is certainly within reach, which implies upside potential of 40%.

Chart courtesy of StockCharts.com

With the summer now upon us and more and more cooped-up Americans getting out and spending their money, it could be a mistake to ignore the upside potential of Gaming and Leisure Properties stock.

As Warren Buffett said in his 2020 letter to Berkshire Hathaway Inc. shareholders, “Despite some severe interruptions, our country’s economic progress has been breathtaking…Our unwavering conclusion: Never bet against America.” (Source: “2020 Shareholder Letter,” Berkshire Hathaway Inc., February 27, 2021.).

Gaming and Leisure Properties is a self-administered, self-managed REIT that buys, finances, and owns properties that are leased to gaming operators in triple net lease arrangements. (Source: “About Us,” Gaming and Leisure Properties Inc, last accessed June 24, 2021.)

With a triple net lease, the tenant pays all of the expenses on the property, including utilities, taxes, building insurance, and maintenance. This is on top of rent.

Gaming and Leisure Properties Inc’s current property portfolio consists of 48 gaming and related assets in 17 states. All of them are now open to the public in some capacity.

Its tenants include Caesars Entertainment Inc (NASDAQ:CZR), Penn National Gaming, Inc (NASDAQ:PENN), Boyd Gaming Corporation (NYSE:BOYD), and Bally’s Corp (NYSE:BALY).

Gaming and Leisure Properties has grown its extensive portfolio through a number of strategic acquisitions, even during the worst economic crisis in 100 years.

In October 2020, the company announced plans to acquire two regional gaming properties for $484.0 million. It also entered a new triple net master lease agreement with Bally’s. The master lease has an initial total annual cash rent of $40.0 million and an initial term of 15 years with four five-year tenant renewal options. (Source: “Gaming and Leisure Properties Completes Acquisition of Two Regional Gaming Properties, Enters Into Master Lease Agreement With Bally’s Corporation,” Gaming and Leisure Properties Inc, June 4, 2021.)

In April 2021, the company announced that it had entered a binding term sheet with Bally’s Corp to acquire the real estate assets of the Bally’s casino property in Black Hawk, CO—and the property it plans to acquire in Rock Island, IL—for $150.0 million. The acquisitions are expected to close in early 2022. (Source: “GLPI Expands Relationship With Bally’s Through Strategic Transactions,” Gaming and Leisure Properties Inc, April 13, 2021.)

Bally’s also plans to acquire both Gaming and Leisure Properties’ non-land real estate assets and Penn National Gaming, Inc’s outstanding equity interests in Tropicana Las Vegas Hotel and Casino, Inc. for an aggregate cash acquisition price of $150.0 million. Gaming and Leisure Properties will retain ownership of the land and will concurrently enter a 50-year ground lease with initial annual rent of $10.5 million.

Record First-Quarter Results

Despite the mandated shutdown of many hotels and casinos, Gaming and Leisure Properties was able to report record first-quarter financial results. Its total revenue increased by 6.3% year-over-year to $301.5 million. Its income from operations went up by 7.4% to $200.1 million. (Source: “Gaming and Leisure Properties, Inc. Reports First Quarter 2021 Results,” Gaming and Leisure Properties Inc, April 29, 2021.)

The company reported first-quarter net income of $127.2 million ($0.54 per share), a 31% increase over the $96.9 million recorded for the same prior-year period.

Its funds from operations (FFO) were $183.6 million ($0.79 per share), up by 23% from its first-quarter 2020 FFO of $151.2 million ($0.45 per share). The company’s adjusted FFO (AFFO) advanced 3.6% to $195.7 million ($0.84 per share).

Peter Carlino, Gaming and Leisure Properties Inc’s chairman and CEO, noted, “Our record first quarter financial results highlight our long-term focus on aligning with the industry’s top regional gaming operators, expanding and diversifying our portfolio of regional gaming assets, and supporting our tenants, resulting in the predictability and growth of our rental cash flows and dividends.” (Source: Ibid.)

Second-Quarter Cash Dividend to Rise

Speaking of dividends, on May 20, Gaming and Leisure Properties Inc announced that its board of directors declared a second-quarter cash dividend of $0.67 per share, a $0.02 increase over the first-quarter dividend. The company currently pays an annual dividend of $2.68 per share, for a yield of 5.8%.

It’s actually the second consecutive quarter in which GLPI stock has raised its dividend. In the first quarter, Gaming and Leisure Properties stock paid out $0.65 per share, a $0.05 increase over the fourth-quarter 2020 dividend.

Before COVID-19, Gaming and Leisure Properties Inc had a five-year track record of raising its dividends. In the second quarter of 2020, however, it lowered its quarterly dividend from $0.70 to $0.60. (Source: “GLPI Dividend History,” Nasdaq, last accessed June 24, 2021.)

That wasn’t a total surprise, what with the tourism industry getting hammered. The fact that the company was able to continue paying a quarterly dividend of $0.60 throughout the pandemic is a testament to its diverse portfolio and strong balance sheet.

A resumption in dividend hikes is certainly a positive sign for this dividend stock over the coming quarters and years.

The Lowdown on Gaming and Leisure Properties Inc

Gaming and Leisure Properties Inc is the owner of the country’s largest regional gaming property portfolio. Thanks to its diverse and growing portfolio, the company was able to successfully execute its long-term growth strategy and grow its rental cash flows in 2020. That momentum carried into 2021 with record first-quarter results.

Gaming and Leisure Properties expects its sector to experience tremendous growth as the U.S. economy reopens. That should allow the company to continue to grow its cash flow, which should help juice the price of GLPI stock and result in higher dividend payouts.