5.4%-Yielding Gaming and Leisure Properties Stock Up 29% Year-Over-Year

Gaming and Leisure Properties Inc Maintains Quarterly Dividend of $0.75 Per Share

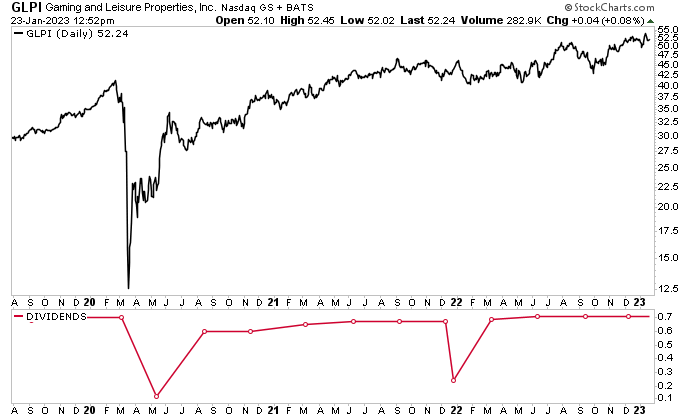

The tourism industry was decimated during the COVID-19 pandemic, taking the wind out of the sails of companies like Gaming and Leisure Properties Inc (NASDAQ:GLPI).

The first gaming-focused real estate investment trust (REIT) in the U.S., Gaming and Leisure Properties has a real estate portfolio of 59 facilities in 18 states. Those facilities include 14,700+ hotel rooms on 31.1 million square feet. (Source: “About Us,” Gaming and Leisure Properties Inc, last accessed January 26, 2023.)

In April 2022, the REIT completed its acquisition of the land and real estate assets of Bally’s Corp (NYSE:BALY) for $150.0 million. Those assets comprise three casinos in Black Hawk, Colorado and a hotel/casino in Rock Island, Illinois. These properties were added to the Bally’s Corp master lease, which has the rent increasing by $12.0 million on an annual basis. (Source: “Gaming and Leisure Properties, Inc. Reports Second Quarter 2022 Results and Initiates 2022 Full Year AFFO Guidance,” Gaming and Leisure Properties Inc, July 28, 2022.)

In June 2022, Gaming and Leisure Properties Inc expanded its relationship with Bally’s by acquiring the real estate of Bally’s Corp’s two Rhode Island casino properties for $1.0 billion. Both properties are expected to be added to the existing Bally’s Corp master lease, with an additional annual rental stream of $76.3 million.

In October 2022, Gaming and Leisure Properties announced that it had entered a new master lease with PENN Entertainment Inc (NASDAQ:PENN) for seven of PENN Entertainment’s current properties. (Source: “Gaming & Leisure Properties and PENN Entertainment Agree to New Master Lease Terms and Development Funding,” Gaming and Leisure Properties Inc, October 10, 2022.)

The initial term of the new lease expires on October 31, 2033, but PENN Entertainment has the option of three five-year extensions. The base rent for the new lease is $232.2 million. In the meantime, the rent for the original PENN Entertainment master lease is $284.1 million. The rent in the new lease is fixed with an annual escalation of 1.5%. The first escalation will be for the lease year beginning on November 1.

In November 2022, Gaming and Leisure Properties’ board declared a fourth-quarter cash dividend of $0.75 per share, for a current yield of 5.4%. The company last increased GLPI stock’s quarterly distribution in May 2022, from $0.69 to $0.705 per share. (Source: “Dividend History,” Gaming and Leisure Properties Inc, last accessed January 26, 2023.)

In addition to its regular dividends, Gaming and Leisure Properties stock sometimes pays special dividends. The last time the REIT did that was in January 2022, when it paid a special dividend of $0.24 per share, boosting its fiscal 2021 payout to $2.90 per share.

GLPI Stock Recently Hit New Record High

Despite quarantine orders during the pandemic, shares of Gaming and Leisure Properties Inc have been quite resilient.

It took Gaming and Leisure Properties stock a year to recover from its March 2020 sell-off, but it rebounded fairly quickly and has been trending higher ever since. In fact, GLPI stock is currently trading at record levels. Its quarterly payout has been on the rise, too. This combination comes on the heels of back-to-back record financial results—not something a lot of companies have been reporting lately.

In 2022, a year in which the S&P 500 lost 19.4% of its value, Gaming and Leisure Properties stock rallied by 13.8%. Its momentum has continued in 2023, hitting a new 52-week high of $53.91 on January 12. As of this writing, shares of Gaming and Leisure Properties Inc are up by:

- 15% over the last three months

- Six percent over the last six months

- 29% over the last year

Those are outsized gains, and the outlook for GLPI stock remains solid. It goes to show that investors are willing to reward the stocks of companies that perform well and provide strong guidance.

All 10 analysts that follow Gaming and Leisure Properties Inc have a “buy” rating for its shares. Their 12-month share-price target is in the range of $56.45 to $60.00, pointing to potential gains in the range of about eight percent to 15%.

Chart courtesy of StockCharts.com

Record Third-Quarter 2022 Results

Gaming and Leisure Properties followed its record second-quarter financial results with record third-quarter results. In the three months ended September 30, 2022, the company’s revenues climbed by 11.7% year-over-year to $333.8 million. Its income from operations went up by 41% year-over-year to $317.6 million. (Source: “ Gaming and Leisure Properties, Inc. Reports Third Quarter 2022 Results and Updates 2022 Full Year Guidance,” Gaming and Leisure Properties Inc, October 27, 2022.)

The REIT’s third-quarter 2022 net income grew by 51% year-over-year to $226.2 million, or $0.85 per share. Its funds from operations (FFO) advanced in the quarter by 11.3% to $232.8 million, or $0.88 per share. Meanwhile, its adjusted FFO (AFFO) rallied by 13.5% to $235.0 million, or $0.89 per share.

Peter Carlino, Gaming and Leisure Properties Inc’s chairman and CEO, commented, “The third quarter represented another period of disciplined expansion and diversification of our portfolio of top-performing regional gaming assets, which drove another quarter of record operating results along with strong capital returns and yields for our shareholders.” (Source: Ibid.)

He added, “Looking forward to the balance of 2022, GLPI is on track to generate record results based on the ongoing initiatives we are undertaking to further expand and diversify our portfolio while benefiting from recently completed transactions and rent escalators…We remain well positioned to further grow our cash dividend and to drive long-term shareholder value.”

For full-year 2022, Gaming and Leisure Properties expects to report AFFO between $918.0 and $923.0 million, or $3.52 to $3.54 per diluted share. In 2021, it reported AFFO of $812.0 million, or $3.44 per share.

The Lowdown on Gaming and Leisure Properties Stock

Gaming and Leisure Properties Inc is a great specialty REIT with a growing, diverse portfolio of gaming properties across the U.S. It continues to report record financial results, which helps juice its high-yield dividend.

The company has provided strong AFFO guidance for fiscal 2022, and it expects to perform well again in 2023.