FLEX LNG: 11%-Yielder Trading Near Record Levels

FLEX LNG Outlook Bullish on Industry Tailwinds

Industry tailwinds and a multi-decade backlog are two great reasons to put FLEX LNG Ltd (NYSE:FLNG), a liquified natural gas (LNG) marine shipping company, on your radar.

Exxon Mobil expects global natural gas demand to increase by more than 21% from 2024 to 2050. This big spike in demand will be fueled by growing electricity demand in emerging markets and a transition away from coal. (Source: “Exxon sees natural gas demand surging in outlook to 2050,” Reuters, August 28, 2025.)

This helps explain why demand for natural gas has more than doubled over the last 10 years. Over the near term, domestic demand for natural gas here in the U.S. is projected to reach record levels in 2025.

Greater demand for natural gas means greater demand for LNG shipping companies. And that’s where FLEX LNG comes in.

FLEX LNG is a marine shipping company focused on the LNG market. Its fleet consists of 13 LNG carriers with an average fleet age of just 5.5 years. It has built up a significant contract backlog, with 11 of its 13 vessels on long-term, fixed-rate charter contracts and one vessel on variable hire time charter. (Source: “Company Profile,” FLEX LNG Ltd, August 20, 2025.)

In late 2024, the company strengthened its earnings foundation by securing up to 37 years of new contract backlog for three of its vessels. As a result, its total minimum firm backlog now stands at 56 years. With extensions options, this number could potentially expand to 85 years.

A backlog of 56 years to maybe 85 years obviously provides FLEX, and shareholders, with strong earnings visibility.

Another Earnings Beat

For the second quarter ended June 30, 2025, FLEX LNG reported vessel operating revenue of $86.0 million, down slightly from $88.4 million in the first quarter of 2025. The average time charter equivalent (TCE) rate was $72,012 per day, down from $73,891 per day in the first quarter. (Source: “Second Quarter 2025 Results Presentation,” FLEX LNG Ltd, August 20, 2025.)

The company’s net income came in at $17.7 million, or $0.33 per share. Its adjusted net income was $24.8 million, or $0.46 per share.

FLEX’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) slipped to $62.6 million from $65.6 million in the first quarter. It finished the quarter with, in management’s words, “a fortress balance sheet with $413 million in cash and no debt maturities prior to 2029.”

During the quarter FLEX completed two of four drydockings. The first two vessels finished their five-year special surveys in June and went straight back into service. The other two are expected to wrap up their special five-year surveys by mid-September.

Commenting on the second-quarter results, Marius Foss, the company’s interim chief executive officer, said, “Although the second quarter is historically the weakest of the year, spot earnings bottomed out in the first quarter, making 2025 one of the rare years where Q2 rates exceeded Q1 levels.”

With that said, the spot market remained soft, which negatively impacted the quarterly earnings for the vessel Flex Artemis, which is on a variable charter, as well as Flex Constellation, which is trading in the spot market; though that vessel will begin a 15-year time charter in the first half of 2026.

Quarterly Dividend of $0.75/Share

Thanks to solid earnings, a substantial backlog, and a strong balance sheet, FLEX LNG has been able to provide investors with a reliable dividend payout. (Source: “Dividend,” FLEX LNG Ltd, last accessed September 2, 2025.)

This includes a second-quarter payout of $0.75 per share, or $3.00 per share on an annual basis, for a current forward dividend yield of 11.01%. This represents FLNG stock’s 16th ordinary quarterly dividend of $0.75 per share. Including special dividends, the company has paid out approximately $690.0 million since the fourth quarter of 2021.

FLNG Stock Up 24% in 2025

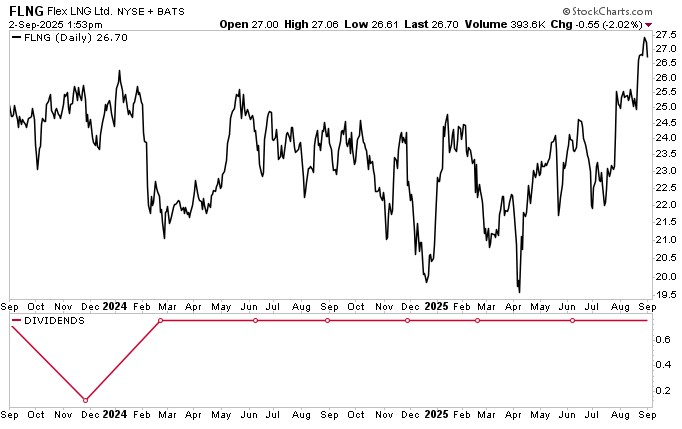

FLNG has been a little volatile over the last number of years, though that’s not a big surprise, as these kinds of stocks tend to fluctuate with supply/demand metrics and underlying commodity prices.

While FLNG has experienced periods of volatility since the start of 2025, due to broader economic uncertainties, it has been rallying since early April.

As of September 2, FLNG stock is up:

- 41.5% since early April

- 24% year to date

- 10% year over year

On August 29, the stock hit a new 52-week intraday high of $27.67, putting it within striking distance of its December 2022 all-time record high of $28.90.

Chart courtesy of StockCharts.com

The Lowdown on FLEX LNG

FLEX LNG continues to be a great marine shipping company with a modern fleet of vessels that should help it take advantage of significantly growing demand for LNG. It has a “fortress balance sheet,” which includes stable cash flows, available capital, and ample liquidity.

FLEX LNG also has an incredible, minimum firm backlog of 56 years, which could grow to 85 years with charterers’ extension option. This bodes well for longer-term earnings and cash flow growth, which should support a growing dividend as well.

That’s good news for the 240 institutions that hold 20.9% of outstanding FLNG shares. Some of the biggest holders include BlackRock Inc, The Vanguard Group Inc., and Renaissance Technologies, LLC. (Source: “FLEX LNG Ltd. (FLNG), Yahoo! Finance, last accessed September 2, 2025.)

The percentage of shares held by institutions isn’t huge, but that’s balanced out by the high insider ownership of 42.5%. This kind of high insider ownership suggests insiders are more motivated to deliver.