Federal Realty Investment Trust Stock’s Payout Hiked for 55 Straight Years

FRT Stock’s Dividend Set to Rise for 56th Consecutive Year

When it comes to reliable, high-yield dividends, consistency is key. And on that level, no real estate investment trust (REIT) can compete with Federal Realty Investment Trust (NYSE:FRT).

The trust is a dividend king, a company that has raised its dividend for at least 50 consecutive years. In fact, it has raised its dividends for 55 consecutive years, the longest such record in the REIT industry. And by all accounts, it looks like Federal Realty Investment Trust will raise its payout again in 2023.

One of the oldest U.S. REITs, Federal Realty is a leading owner, operator, and developer of high-quality retail properties. Its real estate is primarily located in major coastal cities, including Boston, Chicago, Los Angeles, Miami, San Francisco, and Washington, D.C. (Source: “Investor Presentation: First Quarter 2023,” Federal Realty Investment Trust, last accessed July 5, 2023.)

The company’s 102 open-air properties comprise about 26 million square feet (about 434 NFL fields), including about 3,100 residential units. As of the end of the first quarter, 76% of the company’s property portfolio was retail, 12% was office, and 12% was residential.

Federal Realty Investment Trust has about 3,200 commercial tenants in a diverse range of sectors, including apparel/accessories, banks/financial services, beauty/cosmetics, entertainment, fitness, grocery/pharmacy, hobby/sports, home improvement, medical, personal services, and restaurants.

Roughly 75% of the company’s properties have a grocery component, and no single tenant accounts for more than 2.8% of the portfolio’s annualized base rent (ABR). Moreover, only eight tenants account for more than one percent of the REIT’s exposure.

Federal Realty Investment Trust’s tenant agreements include annual rent bumps of two to three percent. Some of the contracts also include rent increases of 10% in year five of a 10-year term.

The trust’s real estate portfolio is always in flux, due to purchases, sales, and redevelopments.

Federal Realty Investment Trust recently acquired Kingstowne Towne Center in Northern Virginia for $200.0 million and the Pembroke Pines shopping plaza in Southern Florida for $180.5 million. Last October, it acquired a 47.5% interest in two regional shopping centers in the Phoenix metro area for $58.9 million.

The REIT has $230.0 worth of redevelopment projects in progress. It’s also currently involved in $515.0 worth of mixed-use expansion projects in Washington, D.C. and San Jose, California.

Best First-Quarter Results in Company’s 60-Year History

Income definitely matters in an inflationary environment. Consumers are still spending these days, but economic headwinds have been affecting the shopping habits of what Federal Realty calls “lower-income” shoppers (those with household incomes of $75,000 or less). These consumers have been switching to less-expensive items, while the shopping habits of middle-and-higher-income shoppers have been less affected by inflation.

In its peer group, Federal Realty Investment Trust has the lowest percentage of gross leasable area with a median household income of $75,000 or less: 10%. In comparison, Kimco Realty Corp‘s (NYSE:KIM) figure sits at 33%, while Brixmore Property Group Inc’s (NYSE:BRX) figure sits at 53%.

This helps explain why Federal Realty was able to report the best first-quarter financial results in its 60-year history.

The company reported first-quarter net income of $53.3 million, up by 6.6% from its 2022 first-quarter net income of $50.0 million. Its earnings per diluted share were $0.65, up from $0.63 in the first quarter of 2022. (Source: “Federal Realty Investment Trust Announces First Quarter 2023 Operating Results,” Federal Realty Investment Trust, May 4, 2023.)

Its funds from operations (FFO) in the first quarter of 2023 were $130.3 million, or $1.59 per diluted share, up by six percent from $119.1 million, or $1.50 per diluted share, in the first quarter of 2022.

During the first quarter, Federal Realty Investment Trust’s leasing volume exceeded its pre-pandemic level by 20% to 30%. It had 101 signed leases for 504,502 square feet of comparable space. The REIT’s property portfolio was 92.6% occupied and 94.2% leased, representing year-over-year increases of 140 and 50 basis points, respectively.

For full-year 2023, the company expects to report earnings per diluted share in the range of $2.59 to $2.79 and FFO per share in the range of $6.38 to $6.58.

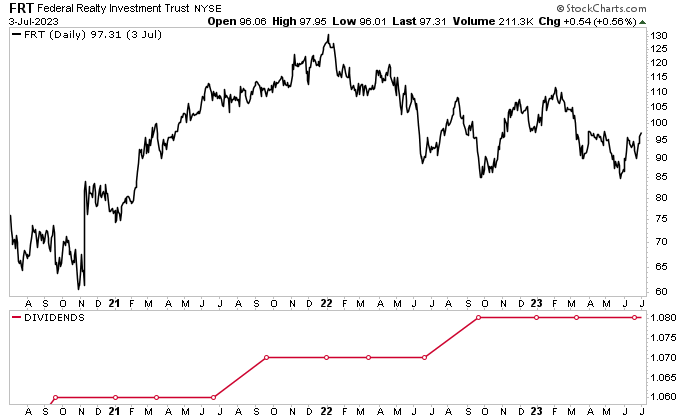

Federal Realty Investment Trust Stock’s Dividends & Share Price

During the first quarter, Federal Realty declared a quarterly dividend of $1.08 per share, for a current yield of 4.6%. In comparison, the U.S. inflation rate is currently about 4.1%.

As for FRT stock’s price, it’s been a little volatile this year. As of this writing, it’s up by more than eight percent month-over-month and 4.5% year-over-year, but down by 1.5% year-to-date. The year-to-date decline has more to do with rising interest rates and fears of a recession than anything going on at the company.

Wall Street analysts are bullish on Federal Realty Investment Trust stock, with a 12-month share-price target of $108.00 to $125.00. This points to potential upside of approximately 11% to 28%.

Chart courtesy of StockCharts.com

The Lowdown on Federal Realty Investment Trust

REITs have taken a hit over the last year due to rising interest rates. The good news is that this has put the shares of high-performing REITs like Federal Realty Investment Trust in a better trading range.

Despite industry headwinds, the trust announced the best first-quarter results in its 60-year history and provided impressive full-year guidance.

While FRT stock’s price may be trailing that of the S&P 500, it makes up for it with 55 consecutive years of dividend increases. This makes Federal Realty Investment Trust stock the strongest, most reliable dividend stock in the REIT industry.