This Hard Asset Yields Up to 7%

Wealthy Investors Buying This

I think you’ll argee with me when I say:

The government has printed too much money. Years of deficits have propped up the economy, which has finally resulted in soaring inflation across the county.

As a result, we’ve seen a mad scramble to own real assets: stocks, oil wells, real estate, etc. The media has even reported bidding wars for things like artwork and collectibles. These investments have soared in value, as they provide owners the best shot of preserving their wealth.

I’m a proponent of owning quality dividend stocks to protect your money from inflation. However, there’s another way to get out of paper dollars and into productive, “hard” assets. In fact, it’s a long-held strategy of the world’s wealthiest investors.

Own timberland.

High-net-worth individuals have long stored their wealth in tracts of forest. And with growing fears of inflation, we’ve seen more wealthy people looking at timberland for purely investment purposes.

Hedge funds have gotten into the business too. Around the world, institutional firms plow $100.0 billion into timberland annually. In more recent years, the pace of those investments has accelerated.

Inflation protection provides a big appeal.

The government can double the number of dollars in circulation. They can’t, however, immediately double the amount of lumber in existence.

For this reason, the price of wood has grown at a consistent rate over time. According to legendary money manager Jeremy Grantham, “stump rates” have increased by about six percent annually over the last 100 years. Based on his analysis, the value of all the wood on the tree has beaten inflation by three percent a year over the last century.

And the thing about trees is that they just keep growing. Forests don’t care about recessions, interest rates, or Washington gossip. They just grow, year in and year out, providing steady returns for owners.

Timberland also provides a tidy income stream.

Forested land can earn profits through hunting leases, watershed rights, and energy exploration. Managed properties can also harvest the straw and seeds that fall from the trees.

Owners harvest a tract of land every 15 to 25 years. Returns, of course, vary depending on wood prices. But a diversified portfolio of timberland can throw off dividend income of up to seven percent each year.

And unlike owning gold mines or oil wells, you don’t need to constantly spend money on exploration and development. Timberland represents a renewable investment, as the tress will grow back. The means bigger profits over time.

For owners, these advantages have produced impressive returns.

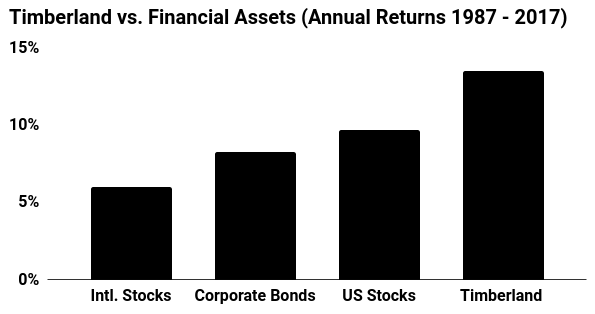

From 1987 to 2017, timberland generated a compounded annual gain of over 14%. That would turn a $10,000 initial investment into over $510,000.

Those returns came from a combination of tree growth, higher stump prices, and growing land values. And as you can see in the chart below, that performance crushed profits from stocks and bonds:

For individual investors, the best way to invest is through the well-established, timber real estate investment trusts: Potlatch Corp. (NASDAQ:PCH), Rayonier Inc. (NYSE:RYN), and Weyerhaeuser Co. (NYSE:WY).

With these firms, you get a professional management team to plant the trees, look after the land, and harvest the timber periodically. Teaming up with a large firm also provides diversification, which results in more consistent returns.

These names also pay out steady distributions. Because these executives have structured their businesses as investment partnerships, they must pay out almost all of their profits to owners. As a result, this quiet niche pays out dividend yields in the mid- to high-single digits.

For investors worried about inflation, this little-known section of the financial market is worth investigating further.