Falcon Minerals Stock: Bullish Oil & Gas Trust Provides 11.2% Dividend

Falcon Minerals Corp Increases Dividend for 7 Straight Quarters

When it rains, it pours. And right now, a few industries are ripping higher while the rest of the stock market trembles on fears of inflation, interest rate hikes, and black swan events. With West Texas Intermediate (WTI) crude oil trading at its highest levels since 2014, oil and gas is the industry du jour.

One of the most interesting oil and gas stocks at the moment is Falcon Minerals Corp (NASDAQ:FLMN). With a market cap of $254.6 million, Falcon Minerals is a trust that owns some of the most enviable mineral and royalty interests in the Eagle Ford Shale in south Texas and the Marcellus Shale in Pennsylvania. (Source: “Our Assets,” Falcon Minerals Corp, last accessed February 18, 2022.)

What sets a trust apart from a typical oil and gas company is that, instead of exploring and drilling for oil and gas, it owns the property and lets major operators do all the heavy lifting.

Falcon Minerals owns 256,000 gross unit acres in the core of the Eagle Ford Shale, which is one of the top U.S. oil basins. As of December 31, 2020, the company had net proven oil and gas reserves of approximately 20.0 million barrels of oil equivalent (MMboe). (Source: “Falcon Minerals Corporation Reports Fourth Quarter and Full Year 2020 Financial Results,” Falcon Minerals Corp, March 3, 2021.)

Falcon Minerals invests virtually nothing in oil and gas wells. Operators like ConocoPhillips (NYSE:COP), BP plc (NYSE:BP), and Devon Energy Corp (NYSE:DVN) do all the work. Falcon Minerals collects fees, which provide it with immediate and reliable cash flow that it uses to pay ultra-high-yield dividends.

On February 17, the trust announced that its board declared a dividend of $0.145 per share, for a yield of 11.2%. (Source: “Falcon Minerals Declares Dividend for Fourth Quarter 2021,” Falcon Minerals Corp, February 17, 2021.)

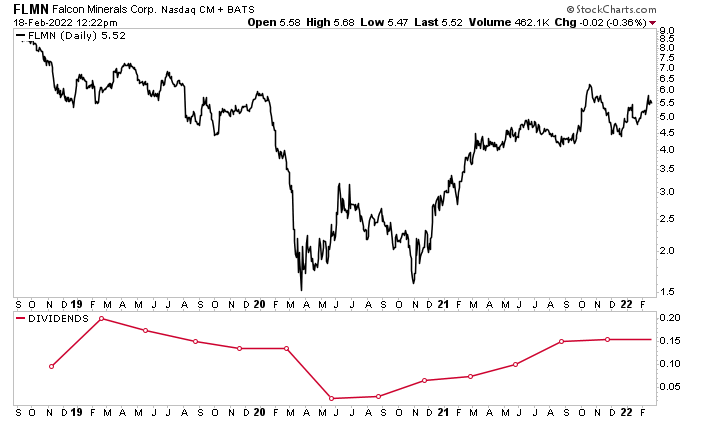

Thanks to rising oil and gas prices, the company has been able to raise its dividends for the last seven consecutive quarters, from $0.025 in the second quarter of 2020 to $0.145 in the first quarter of 2022, for an increase of 480%. (Source: “Dividend and Split History,” Falcon Minerals Corp, last accessed February 18, 2022.)

High commodity prices have helped boost FLMN stock’s dividends and share price. As of this writing, Falcon Minerals stock is up by 30% over the last six months and 49% year-over-year.

Those are solid gains, but FLMN stock still has plenty of room to run. Analysts have an average 12-month share-price target of $6.35 and a high estimate of $8.00. That points to potential upside of 15% and 45%, respectively.

That doesn’t necessarily mean it’s going to be smooth sailing for this dividend stock. Since Falcon Minerals Corp is in the energy industry, its share price fluctuates based on oil and gas prices, which also impacts its dividends. This is why it’s imperative that investors keep a close eye on their holdings (much like with any equity, frankly).

Chart courtesy of StockCharts.com

$1.9-Billion Merger With Desert Peak Minerals

Falcon Minerals Corp is a big name in the Eagle Ford Shale, and it’s about to become an even bigger name in the Permian Basin.

In early January, the company announced plans to merge with Desert Peak Minerals, the largest independent Permian Basin pure-play mineral and royalty company. (Source: “Desert Peak Minerals and Falcon Minerals Corporation to Combine in $1.9 Billion All-Stock Merger, Creating a Premier, Shareholder Returns-Driven Mineral and Royalty Consolidation Company,” Falcon Minerals Corp, January 12, 2022.)

The $1.9-billion all-stock merger is expected to create a premier mineral and royalty company with low leverage, an emphasis on shareholder returns, and a significant footprint in the Permian Basin and Eagle Ford Shale.

With the merger, Falcon Minerals Corp will own over 139,000 net royalty acres (normalized to a one-eighth royalty equivalent), more than 105,000 of which are in the Permian Basin. On a combined basis, the company’s production rate is expected to climb to 13,500–14,500 barrels of oil equivalent per day (Boe/d) in the first half of 2022. Of that, 50%–53% is expected to be crude oil and roughly 73% is expected to come from the Permian Basin.

To put that in perspective, in 2020, Falcon Minerals generated net production of 4,566 Boe/d and $38.8 million in total revenue. (Source: Falcon Minerals Corp, March 3, 2021, op. cit.)

With the combined production expected to more than triple and the 2022 forecast for WTI crude oil at $80.00 per barrel, it’s possible that the merger could generate as much as 14,500 Boe/d, or in excess of $400.0 million, in oil and gas sales. In addition to increasing Falcon Minerals Corp’s production, the deal will significantly reduce the company’s general and administrative expenses from approximately 12% of its revenue to just four percent.

For dividend hogs, the acquisition is expected to be accretive to Falcon shareholders on a cash-flow-per-share basis for 2022. The capital allocation model is balanced between returning capital to shareholders and reinvesting funds for growth.

The transaction is expected to close in the second quarter of 2022. Immediately prior to the closing of the deal, Falcon Minerals will execute a one-for-four stock split.

The Lowdown on Falcon Minerals Stock

Falcon Minerals Corp is known for having a strong position in the Eagle Ford Shale and providing investors with ultra-high-yield dividends.

Thanks to its merger with Desert Peak Minerals, Falcon Minerals is about to be an even bigger player in the oil-rich Permian Basin. The move is expected to triple production, significantly slash general and administrative expenses, improve capital, and reduce the volatility caused by asset concentration. It should also allow FLMN stock to continue to provide investors with high-yield dividends.