The Hottest Real Estate Investment Isn’t What You’d Think

Big Profits in…Storage Space?

Many Baby Boomers now want to downsize their lifestyle and move into retirement. But selling a home and moving into a smaller dwelling presents one big challenge: What do you do with all that stuff?

My folks ran into the same issue this spring. Big Dave, now in his late 60s, wants to sell his suburban house and move into a condo. Aside from unlocking a little bit of equity, a smaller place will also be a lot easier to maintain. But after 30 years of living in one place, you’d be surprised at how much junk you accumulate.

“What do we keep? What gets chucked into the trash? What do I do with my Larrivée guitar collection? Will my daughter want this old cherry wood table? Could Rob use an extra dining room set?” (By the way, the answer is “no” and no one else wants their stuff either—though I may take a guitar and some old Bob Dylan records off their hands.)

So what did they do? They rented a 10-by-15-foot locker at the nearest self-storage depot and stashed all their extra stuff in there. Hey, you never know. You just might need that fourth television and 10-year-old cellphone someday.

Apparently, my folks aren’t the only ones that need some extra space. In the United States today, we have more self-storage facilities than McDonald’s Corporation restaurants. Those sites hold 2.6 billion square feet of rentable space—an area roughly the size of Sacramento, California.

And business, it seems, is booming. The self-storage industry brought in more than $32.7 billion in sales last year, making more money than box movie ticket sales in North America over the last three years combined. But aside from one reality show on A&E, storage lockers made that money with a lot less fanfare than Hollywood.

Case in point this month: Extra Space Storage, Inc. (NYSE:EXR). The partnership has quietly built a massive property empire over the years, now ranked as the second-largest provider of self-storage units in the country. The trust owns over 1,400 locations, totaling some 910,000 units. And with industry profits booming, this stodgy company could deliver sexy returns for dividend investors. (Source: “Learn More About Extra Space Storage®,” Extra Space Storage Inc., last accessed July 20, 2018.)

The Business

In the world of commercial real estate, self-storage has none of the cool factor of the Empire State Building or Ritz Hotel of London. President Donald Trump brags about his 57-story mixed-use skyscraper in Midtown Manhattan, not some unremarkable warehouses where people keep their extra stuff. But even though self-storage may have the excitement of a mashed potato sandwich, the industry has generated solid returns for shareholders—owing to a number of characteristics unique to this business.

Why? It is recession-proof, or at least recession-resistant. The movement of people drives demand for self-storage demand. In the industry lingo, they call these factors the four-Ds: death, divorce, dislocation, and downsizing. These variables tend to stay pretty consistent from year to year, in good economies and bad. People always need a convenient place for the clutter they can’t bear to toss out.

That has resulted in steady, reliable profits for investors. Even through the height of the financial crisis in 2008, the industry managed to post positive returns for owners. That year, the FTSE NAREIT Equity Self Storage delivered a gain of five percent, including distributions. According to the National Association of REITs, not a single real estate industry posted a positive return that year, with the exception of self-storage trusts.

Moreover, analysts love this business because customers tend to be “sticky.” Moving requires scouting out new storage locations, hiring a moving team, and wasting a day hauling stuff to a different depot. Most people won’t go through this hassle just to save $10.00 or $15.00 a month.

This allows landlords like Extra Space Storage to pass on big rent hikes to customers each year. A typical tenant receiving a rent increase letter for eight percent or 10% likely won’t move to a cheaper space across town. Given the headache factor, self-storage customers have long been tolerant of rent increases.

Finally, existing facilities also make good money. Self-storage depots require only a small investment upfront, especially compared to other types of commercial real estate like malls or office buildings. They also cost next to nothing to maintain.

Tenants, after all, don’t care about maintaining fancy lawns or high-end amenities. Ongoing expenses amount to keeping a few employees on staff and sweeping out a locker after a tenant moves out. Most facilities can break even with just 45% occupancy—far below almost any other real estate business.

But if owners can keep their units full, these properties mint cash flow. In the case of Extra Space Storage, management has maintained an occupancy rate of over 94%. For shareholders, low operating costs and high demand have translated into fat margins.

Extra Space Storage booked $285.5 million in revenue during the first three months of this year, against $151.6 million in operating costs. That’s good for an operating margin of 50%—more than double that earned by large apartment or office landlords. (Source: “Extra Space Storage Inc. Reports 2018 First Quarter Results,” Extra Space Storage Inc., May 1, 2018.)

The Opportunity

But while most people may not pay attention to the self-storage industry, Wall Street has certainly taken notice. As more Americans downsize and declutter, this quiet niche of the real estate market has boomed.

The industry invested just under $4.0 billion building new depots last year, double what it spent in the prior year. And those facilities continue to become more profitable. The cost to rent a square foot of self-storage space in the U.S. increased by 1.5% according to a recent Bloomberg report. In total since 2015, prices have shot up more than 10.2%. (Source: “The $38 Billion Business of Storing Your Junk Is Getting Tougher,” Bloomberg, March 19, 2018.)

Several factors have driven this bonanza, though most credit the boom to America’s relentless accumulation of stuff. University of California researcher Jeanne Arnold highlighted the problem in her book, Life at Home in the Twenty-First Century, “[…] the contemporary U.S. household have more possessions per household than any society in global history.”

Co-author Anthony Graesch added that “Hyper-consumerism is evident in many spaces, like garages, corners of home offices, and even sometimes in the corners of bedrooms, the kitchens, and even on top of the dining room table.” (Arnold, J. E., A. Graesch, E. Ragazzini, and E. Ochs. Life at Home in the Twenty-First Century: 32 Families Open Their Doors. Cotsen Institute Press, Los Angeles, 2017.)

The data supports those observations. Between 1977 and 2017, American spending on durable goods—things like electronics, furniture, tools, and home appliances—grew more than sevenfold. The average American home now has more than 300,000 items, according to the Los Angeles Times. But while the average size of the American home has nearly tripled in size over the past 50 years, one out of every 10 Americans now rent offsite storage. (Source: “The $38 Billion Business of Storing Your Junk Is Getting Tougher,” Los Angeles Times, March 21, 2014.)

But America’s conscription to consumerism isn’t the only factor in the self-storage boom. The business also benefits from disruption, serving as a temporary holding spot for the recently dislocated, the divorced, and the downsizers. According to a survey by Realtor.com, about 15% of Boomers indicated that they are planning to sell their home within the next year. (Source: “The Housing Shortage Part I: Boomers Holding Onto Inventory,” Realtor.com, last accessed July 20, 2018.)

Most of these moves will likely be to smaller, more affordable homes. At the same time, millennials have become an increasingly large part of the market. While this generation is settling down later in life as compared to their parents, they’re still accumulating stuff. Self-storage facilities have become a safe haven for material goods between moves and a solution to smaller living accommodations.

Those factors have created a supply crunch for self-storage space, even amid a tepid economy. Rival Life Storage Inc (NYSE:LSI), based in Williamsville, New York, said 91.2% of its space was occupied at the end of the first quarter, up from 90.9% a year earlier. Strong demand has also meant that landlords no longer need to offer discounts or incentives to fill up unit spaces, which has resulted in soaring profits. Industry behemoth Public Storage (NYSE:PSA), for example, reported a 4.6% year-over-year increase in fund flows from operations, a common measure of profitability in the real estate business, during the first quarter.

Analysts credit some of the self-storage boom to a severe supply crunch, too. New facilities can take years to build. In one example, it took Extra Space more than a decade to bring a single depot online in Southern California.

The reason has nothing to do with construction (nondescript warehouses don’t cost much or take long to build). Instead, the problem comes down to red tape. For many communities, self-storage facilities seem tacky. New depots won’t create many jobs, as they only need a couple of guys to run the place. And they don’t pay much in the way of property taxes, either. In areas where land is scarce, residents argue that space would be better allocated to manufacturing and logistics companies that create more jobs.

For Extra Space Storage, the supply/demand mismatch has created a bonanza for unitholders. Since 2006, the real estate company has grown core fund flows from operations per share more than sevenfold. Over that period, revenues from individual facilities have increased at a 4.7% compounded annual clip.

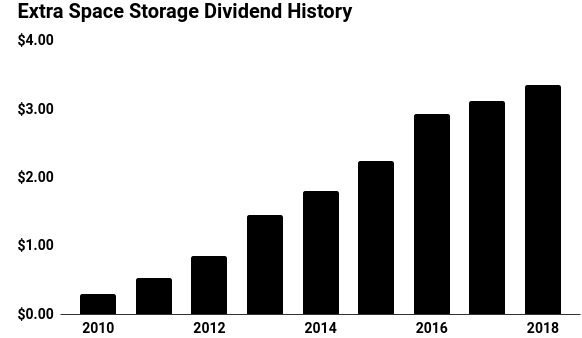

That growth has resulted in outstanding profits for investors. Over the past 10 years, Extra Space Storage units have delivered a total return, including distributions, of 707.9%. Over the past five years alone, the dividend has grown more than threefold.

(Data Source: Extra Space Storage)

The Risks

While the underlying fundamentals of the self-storage business look promising, three risks could upset the industry’s current trajectory: rent fatigue, more competition, and higher interest rates.

Over the past few years, customers have put up with double-digit price increases across many markets. Some tenants, facing mounting rental fees, might opt to ditch their stuff rather than continue storing it. With occupancy at peak levels, the industry likely won’t be able to continue its pace of price hikes we’ve seen in recent years. Though in supply-restricted markets, however, companies should still be able to pass on mid- to high-single-digit rent hikes each year for the foreseeable future.

The other risks seem more mundane. Some analysts fear a wave to new construction could swamp the market with too many facilities. Indeed, I expect that could become a problem for companies with properties in the South or Midwest, where ample supplies of cheap land allow for new construction.

Extra Space, in contrast, earns most of its property revenue from markets like California, Virginia, and New York. In these market, developers struggle to bring on new supply due to zoning restrictions and a scarcity of affordable land. An entrenched position in such prime marketplaces should allow management to continue raising rents year in and year out.

Higher interest rates could also clip unit prices, too. Because Extra Space Storage’s cash flows resemble bond coupons, these units compete directly with fixed-income securities for capital. If yields rise, investors will likely dump their risky shares for safer interest income. That said, higher rates will likely have little impact on our income stream here. I would view any selloff as a result of higher interest rates as a chance to scoop up more shares at a bargain price and lock in higher yields.

The Bottom Line

A stock like Extra Space Storage probably won’t generate much interest around the office water cooler. The business, however, cranks out an enormous amount of cash flow and its 3.5% yield, while not stellar, will almost certainly continue to grow. In short, self-storage might not be the most glamorous business, but it will likely generate some of the sexiest returns around. That’s exactly the kind of companies we look for at Income Investors.

And no, Dad, I still don’t want your extra dining room set.