Enviva Stock Up 27% Year-Over-Year; Dividend Up 11%

Why EVA Stock Is Worth Considering

There’s more to energy than oil, natural gas, coal, wind, and solar. In fact, the future of sustainable energy production may rest with woody biomass, a renewable energy source. Industrial wood pellets can be used to supplement or replace coal or natural gas at energy production plants. Moreover, while wood pellets aren’t a popular way to heat homes in North America, they’re increasingly popular for that purpose in the rest of the world.

The world’s largest producer of industrial wood pellets is Enviva Inc (NYSE:EVA). The company owns and operates 10 plants in Virginia, North Carolina, South Carolina, Georgia, Florida, and Mississippi. The plants have a combined production capacity of approximately 6.2 million metric tons per year (MTPY). (Source: “Q2 2022 Update,” Enviva Inc, August 16, 2022.)

In September, the company opened a wood biomass facility in Lucedale, MS. This is the company’s second operating plant in Mississippi. In Epes, AL, Enviva Inc is constructing its 11th plant. The company plans to build six more large-scale plants over the next five years, doubling its production capacity from 6.2 MTPY to approximately 13 MTPY.

The company exports its wood pellets globally from its deep-water marine terminals at the Port of Chesapeake, VA; the Port of Wilmington, NC; and the Port of Pascagoula, MS—as well as from third-party deep-water marine terminals in Savannah, GA; Mobile, AL; and Panama City, FL.

Enviva Inc sells most of its wood pellets through long-term, take-or-pay off-take contracts with customers in the U.K., the European Union (EU), and Japan. It currently has a take-or-pay contracted backlog in excess of $21.0 billion, with a total weighted-average remaining contract term of 14.5 years.

The company’s business in Europe could get bigger. The European Parliament recently voted again to recognize primary woody biomass as a renewable energy source. Enviva says primary woody biomass is essential for meeting the European Parliament’s goal of increasing renewable energy to 45% by 2030 and the EU’s goal of carbon neutrality by 2050. (Source: “European Parliament Continues to Recognize Primary Woody Biomass as a Renewable Energy Source,” Enviva Inc, September 14, 2022.)

Enviva Inc Reports Solid Q2 Results & Reaffirms 2022 Guidance

For the second quarter ended June 30, Enviva announced financial results that were at the top end of its expectations.

The company’s second-quarter revenue increased by four percent year-over-year to $296.3 million. The revenue increase was fueled primarily by an increase in the average sales price per ton of wood pellets. Enviva Inc reported a second-quarter 2022 net loss of $27.3 million, compared to a net loss of $24.9 million in the same period of last year. (Source: “Enviva Reports 2Q 2022 Results, Reaffirms 2022 Guidance, and Announces Customer Contract Updates,” Enviva Inc, August 3, 2022.)

The company’s second-quarter adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) increased by 53% year-over-year from $25.7 to $39.5 million. Its distributable cash flow in the second quarter of 2022 was $21.3 million, compared to $5.7 million in the second quarter of 2021.

Similar to in previous years, Enviva Inc expects its net income, adjusted EBITDA, and distributable cash flow in the second half of 2022 to be significantly higher than in the first half of the year. That’s due to the predictable seasonality of its business and the ramp-of production at its plant in Lucedale, MS.

As in previous years, Enviva Inc expects more than two-thirds of its annual adjusted EBITDA to be generated in the second half of the year. To that end, management is projecting that its adjusted EBITDA in the third quarter will be roughly 50% higher than in the second quarter.

In August, the company reaffirmed its 2022 financial guidance:

- Third-quarter net loss in the range of $10.0 to $15.0 million

- Third-quarter adjusted EBITDA in the range of $60.0 to $65.0 million

- Fourth-quarter 2022 net income in the range of $35.0 to $50.0 million

- Fourth-quarter adjusted EBITDA in the range of $105.0 to $120.0 million

- Full-year net loss in the range of $35.0 to $55.0 million

- Full-year adjusted EBITDA in the range of $240.0 to $260.0 million.

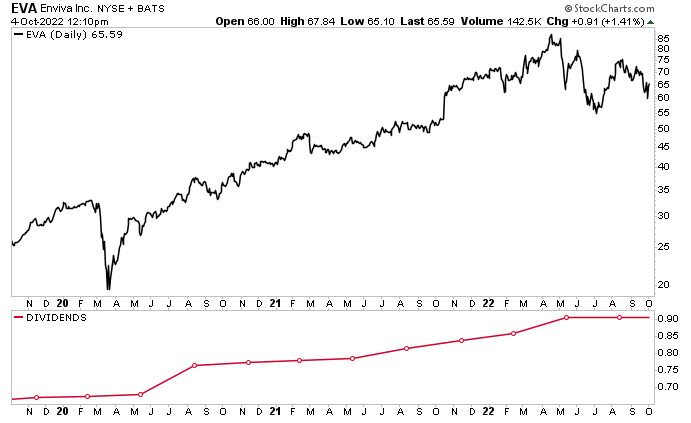

Enviva Stock’s Dividend Hiked 11% Year-Over-Year

Enviva has a long history of raising its quarterly dividends; it has done so for 27 of its last 28 quarters. In May and August of this year, Enviva paid dividends of $0.905 per share, for a current yield of 5.6%. That’s an 11% increase over EVA stock’s August 2021 dividend of $0.815 per share. (Source: “Dividend Information,” Enviva Inc, last accessed October 13, 2022.)

Chart courtesy of StockCharts.com

In addition to paying enviable high-yield dividends, Enviva stock has been rewarding investors with share-price appreciation. Over the last three years, EVA stock outperformed the S&P 500 by 144% and the MSCI ESG Index by 153% (on a total return basis). In 2021, the stock outperformed the S&P 500 and the MSCI ESG Index by 36% (also on a total return basis).

Despite inflationary pressures and fears of a recession, Enviva stock continues to do well, down by just 3.5% year-to-date and up by roughly 27% year-over-year. For its part, the S&P 500 is down by 21% year-to-date and 12% year-over-year.

The Lowdown on Enviva Inc

Enviva Inc is a high-growth, pure-play renewable energy company with a durable long-term contracted cash flow that supports stable, growing dividends.

The growth in its production-volume outlook, coupled with a strong pricing environment for biomass, is driving expectations for an adjusted EBITDA compound annual growth rate (CAGR) of more than 25% from 2022 to 2024.

Even in an environment of potential economic contraction, Enviva continues to be well positioned for robust cash flow growth, and EVA stock continues to generate significant returns for investors.