Enterprise Products Stock: 7.8%-Yielder Has Raised Payout for 24 Consecutive Years

Why EPD Stock Is Worthy of Investors’ Attention

Enterprise Products Partners LP (NYSE:EPD) might have a nondescript name, but it was one of the best-performing, ultra-high-yielding energy stocks of 2022. The company is a leading North American provider of midstream energy services to producers and consumers of natural gas, natural gas liquid (NGL), crude oil, refined products, and petrochemicals.

It’s good at what it does, too. Since Enterprise Products Partners completed its initial public offering (IPO) in 1998, it has grown its asset base from $715.0 million to an eyewatering $64.0 billion. The partnership achieved this by pursuing a series of acquisitions and organic growth opportunities. (Source: “Investor Deck: November 2022,” Enterprise Products Partners LP, last accessed January 4, 2023.)

Enterprise Products Partners LP’s combined portfolio includes:

- 50,000 miles of natural gas, NGL, crude oil, refined product, and petrochemical pipeline

- 260.0 million barrels of NGL, refined product, and crude oil storage capacity

- 14.0 billion cubic feet of natural gas storage capacity

- 24 natural gas processing plants

- 18 NGL and propylene fractionators

- 20 deepwater docks that handle NGL, petrochemicals, crude oil, and refined products

Enterprise Products Partners LP Reported Another Strong Quarter

Oil and gas companies’ fortunes are often tied to oil demand, supply, and prices. That’s not the case with Enterprise Products, though. It’s a tollkeeper that collects a set fee for the use of its pipelines and natural gas processing facilities. It doesn’t matter if commodity prices fall or we’re knee-deep in a recession; the company continues to collect what it’s been promised. This helps the partnership achieve solid quarterly financial results.

For the third quarter ended September 30, Enterprise Products announced that its net income increased by 16.6% year-over-year to $1.4 billion, or $0.62 per share. At the same time, the company’s distributable cash flow increased by 16% to $1.9 billion, compared to $1.6 billion in the third quarter of 2021. It also retained $826.0 million of distributable cash flow to reinvest in the partnership, reduce debt, and buy back its own common units. (Source: “Enterprise Reports Results for Third Quarter 2022,” Enterprise Products Partners LP, November 1, 2022.)

During the third quarter, Enterprise Products Partners LP’s pipelines transported a record 11.3 million barrels equivalent of NGL, crude oil, natural gas, refined products, and petrochemicals per day . The company’s natural gas pipelines transported a record 17.5 trillion British thermal units (Btu) per day.

Also in the third quarter, the partnership set quarterly volume records for NGL fractionation, ethane exports, butane isomerization, and fee-based natural gas processing.

Enterprise Products Partners LP expects the good times to continue in 2023, which should be great for Enterprise Products stock’s price and dividends.

Management is bullish in its outlook for a number of reasons. Despite the push for alternative energy sources such as wind, solar, and hydro—as well as electric vehicles (EVs)—the demand for fossil fuels has increased, fueled by global population growth.

Exports from Enterprise Products Partners LP’s facilities have been resilient, accounting for 22% of the U.S. crude oil exports and approximately 36% of the U.S. NGL exports in 2022. As one of the world’s largest liquefied petroleum gas (LPG) exporters, the company made 32% of the global LPG exports and 65% of the U.S. LPG exports last year.

The U.S. is responsible for virtually all LPG export growth globally, driven by the residential market, which accounts for more than 70% of the world’s LPG demand.

On top of that, market fundamentals point to tighter energy markets in 2023. Enterprise Products Partners LP expects “significant growth in commodity supply forecasts” as the post-COVID demand for energy recovers and grows. (Source: “Investor Deck: November 2022,” Enterprise Products Partners LP, op. cit.)

To meet the growing demand for oil and gas, the company has $5.5 billion worth of organic growth under construction, including the following:

- A natural gas processing plant in the Midland Basin

- A natural gas processing plant in the Delaware Basin

- The 12th NGL fractionator in Chambers County, TX

- A 400.0-million cubic foot per day expansion of its Acadian Gas System

- Expansion of its ethane marine export terminal

- Expansion of its ethylene marine export terminal

Enterprise Products Stock’s Distribution Keeps Rising

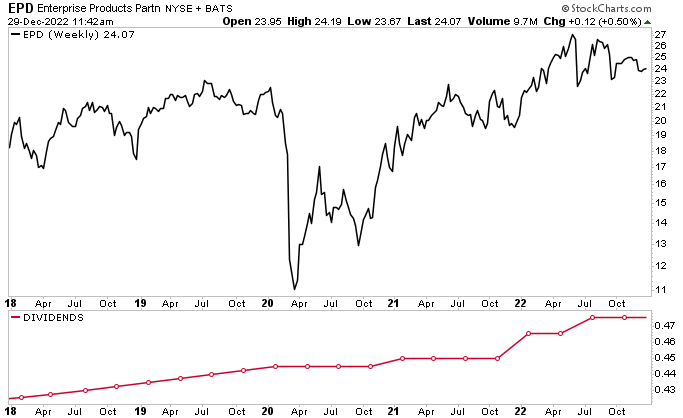

Enterprise Products’ excellent financial results have allowed the company to hand out annual dividend raises to EPD stockholders. In fact, the company has raised its payouts for the last 24 consecutive years. That’s just one year short of the stock being declared a dividend aristocrat.

In October 2022, the company declared a quarterly distribution of $0.475 per unit, for a yield of 7.8%. This distribution represents a 5.6% increase over the $0.45 it paid out in the third quarter of 2021 and its second increase in 2022. The partnership paid out $0.465 per unit in both the first and second quarters of last year. (Source: “Enterprise Declared Quarterly Distribution,” Enterprise Products Partners LP, October 4, 2022.)

Moreover, Enterprise Products Partners LP repurchased approximately $95.0 million worth of its own common units on the open market in the third quarter of 2022 and $130.0 million worth of its own common units in full-year 2022. Inclusive of these purchases, the company has utilized 31% of its authorized $2.0-billion buyback program.

With inflation still at decades-high levels, interest rates climbing, and fears of a looming recession, the only thing better than a safe, growing, high-yield dividend is share-price appreciation that trounces the broader market. Enterprise Products stock was on fire in 2022, up by about 20% year-over-year. Meanwhile, the S&P 500 was in a bear market, down by about 20% last year. Furthermore, the S&P 500 has a dividend yield of just 1.7%.

Chart courtesy of StockCharts.com

The Lowdown on Enterprise Products Partners LP

Energy was the best-performing sector of the stock market in 2022. The energy component of the S&P 500 rallied by a whopping 50% last year. The next-best S&P 500 component, utilities, advanced less than one percent. Analysts expect energy stocks to be some of the top performers in 2023, and by all accounts, it will be another exceptional year for Enterprise Products Partners stock.

Enterprise Products Partners LP continues to report tremendous financial results, organically expand operations, and announce strategic acquisitions. Its pipelines continue to transport a record amount of oil and natural gas—and with $5.5 billion worth of projects under construction, the company’s numbers are only going to grow.

All this should help increase Enterprise Products Partners LP’s position as a leading midstream energy-industry operator and reward buy-and-hold EPD stockholders with high share-price gains and growing, high-yield dividends.

If this dividend stock’s payout can rise during the worst economic crisis of the last 100 years, there’s every reason to believe its payout will be hiked again in 2023.