Enterprise Products Stock Is a 7.5%-Yield Dividend Aristocrat

EPD Stock a Great Widow Stock for Long-Term Income Investors

The dividend aristocrat club is exclusive; only the top dividend stocks are included. The two criteria for membership are raising dividends for at least 25 consecutive years and being part of the S&P 500 index.

One of the newest members of the dividend aristocrat club is Enterprise Products Partners LP (NYSE:EPD), after raising its dividend for the 25th straight year in 2023. (Source: “Distribution & DRIP,” Enterprise Products Partners LP, last accessed May 16, 2024.)

Following that, the company increased its dividend from $0.50 to $0.515 per share in early 2024.

Enterprise Products is one of the top providers of midstream energy services in North America. The company stores, processes, and distributes natural gas, natural gas liquids (NGLs), crude oil, refined products, and petrochemicals. (Source: “Investor Resources,” Enterprise Products Partners LP, last accessed May 16, 2024.)

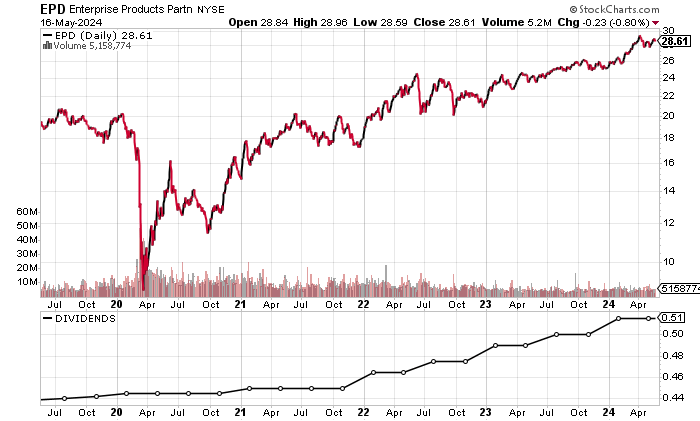

In terms of share-price performance, Enterprise Products stock has had relatively low volatility. As of this writing, the stock has been trading between $25.19 and $29.99 over the past 52 weeks.

EPD stock currently sits just below its 52-week high of $29.46 from April. Therefore, the stock has runway for more price appreciation.

Chart courtesy of StockCharts.com

Enterprise Products Partners LP Has Strong Fundamentals

Enterprise Products’ revenues more than doubled from 2020 to a record-high $58.19 billion in 2022. Trading around one times its 2022 revenues, the company is ideal for conservative income investors.

Analysts estimate that Enterprise Products will grow its revenues to $55.98 billion in 2024 and follow that with further growth to $58.88 billion in 2025. (Source: “Enterprise Products Partners L.P. (EPD),” Yahoo! Finance, last accessed May 16, 2024.)

| Fiscal Year | Revenues (Billions) | Growth |

| 2019 | $32.53 | N/A |

| 2020 | $26.67 | -18.0% |

| 2021 | $41.57 | 55.9% |

| 2022 | $57.97 | 39.5% |

| 2023 | $49.4 | -14.8% |

(Source: “Enterprise Products Partners L.P.” MarketWatch, last accessed May 16, 2024.)

Enterprise Products generally has gross margins in the range of 10% to 15%, which is typical of the business sector in which it operates. In 2019 and 2020, however, it had margins above 15%.

| Fiscal Year | Gross Margins |

| 2019 | 17.6% |

| 2020 | 21.0% |

| 2021 | 14.6% |

| 2022 | 11.6% |

| 2023 | 13.5% |

Enterprise Products Partners LP’s bottom line shows three straight years of growth in its generally accepted accounting principles (GAAP)-diluted earnings-per-share (EPS) profits to a record high in 2023.

Analysts expect the company to report earnings of $2.71 per diluted share for 2024 and $2.86 per diluted share for 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $2.07 | N/A |

| 2020 | $1.70 | -18.0% |

| 2021 | $2.09 | 22.8% |

| 2022 | $2.47 | 18.6% |

| 2023 | $2.50 | 0.9% |

(Source: MarketWatch, op. cit.)

Enterprise Products Partners LP is a free cash flow (FCF) machine.

It generated more than $6.0 billion in FCF in 2021 and 2022, prior to having a drop in FCF in 2023. The company’s FCF went down in 2023 because of capital expenditures of $3.27 billion that year, versus capital expenditures of $1.86 billion in 2022. (Source: MarketWatch, op. cit.)

| Fiscal Year | FCF (Billions) | Growth |

| 2019 | $2.05 | N/A |

| 2020 | $2.79 | 36.0% |

| 2021 | $6.34 | 127.0% |

| 2022 | $6.17 | -2.6% |

| 2023 | $4.35 | -29.6% |

(Source: MarketWatch, op. cit.)

Enterprise Products Partners LP’s balance sheet is healthy despite $29.4 billion in total debt at the end of March. The company’s strong profitability and FCF can easily deal with its debt obligations. (Source: Yahoo! Finance, op. cit.)

From 2020 through 2023, Enterprise Products easily covered its interest expenses via higher earnings before interest and taxes (EBIT). The company’s interest coverage ratio in 2023 was a healthy 5.5 times.

| Fiscal Year | EBIT (Billions) | Interest Expense (Billions) |

| 2020 | $5.05 | $1.29 |

| 2021 | $6.11 | $1.28 |

| 2022 | $6.94 | $1.24 |

| 2023 | $6.98 | $1.27 |

(Source: Yahoo! Finance, op. cit.)

Enterprise Products’ Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a relatively strong reading of 7.0, which is just below a perfect score of 9.0.

No Concerns Regarding Enterprise Products Stock’s Dividend Safety

For income investors, EPD stock is an ideal long-term investment. That’s because Enterprise Products Partners LP is focused on returning capital to its shareholders.

As mentioned earlier, the company currently pays quarterly dividends of $0.515 per share.

As of this writing, that represents a forward yield of 7.54%. That yield is just below Enterprise Products stock’s five-year average dividend yield of 7.82%. (Source: Yahoo! Finance, op. cit.)

Enterprise Products’ payout ratio of 78.6% looks high but manageable, given the company’s business performance, consistent profitability, and high FCF. I expect the company to extend its dividend growth streak.

| Metric | Value |

| Dividend Growth Streak | 26 Years |

| Dividend Streak | 27 Years |

| 7-Year Dividend Compound Annual Growth Rate | 3.1% |

| 10-Year Average Dividend Yield | 9.2% |

| Dividend Coverage Ratio | 1.8 |

The Lowdown on Enterprise Products Partners LP

EPD stock is one of the top midstream energy dividend stocks for income investors who are looking for steady income and share-price growth.

Moreover, with 32.7% of Enterprise Products Partners LP’s shares held by company insiders (as of this writing), it means the insiders will be more inclined to make sure the company runs smoothly. (Source: Yahoo! Finance, op. cit.)