Enterprise Products Partners L.P.: Oil Tycoon Buying This 7% Dividend Stock

Billionaire Making 7% Here

This month, I want to highlight a big trade by one of my favorite investors, oil tycoon T. Boone Pickens.

Pickens got his start in the oil patch as a wildcatter, a driller of wildcat wells, during the 1960s. Over the following decades, he grew his wealth both as a corporate raider and an energy speculator.

Few know the oil business as well as Pickens. For this reason, I always watch to see where the now-hedge fund manager puts his money to work. And in recent months, he has made a large bet on pipelines, including Williams Partners LP (NYSE:WPZ), Phillips 66 Partners LP (NYSE:PSXP), and Energy Transfer Partners LP (NYSE:ETP).

Pickens has also built a big stake in another company. According to the fund’s most recent Securities and Exchange Commission (SEC) filings, he boosted his position in Enterprise Products Partners L.P. (NYSE:EPD) by 34%. His fund now owns more than 537,000 units, representing the portfolio’s largest position. (Source: “Hedge Fund – BP Capital,” Insider Monkey, last accessed April 25, 2018.)

Smart investors might want to follow suit.

The Business

Enterprise Products Partners owns and operates 50,000 miles of petroleum pipelines, representing enough length to cross the continental U.S. 18 times. (Source: “Business Profile,” Enterprise Product Partners L.P., last accessed April 27, 2017.)

This network serves as the arteries and veins of the American economy, carrying oil, natural gas, and other energy products around the country. It connects some of the largest supply basins in North America to terminals, refineries, and, eventually, the consumer. Without the commodities that Enterprise ships through its network, our way of life would come to an end.

Pipelines, though, only represent one part of the partnership’s operations. Enterprise also has its hands in a number of other businesses, including storage facilities, processing plants, and marine transportation. In recent years, management has invested in a number of import/export terminals along the Gulf Coast.

These properties could become veritable cash cows in the coming decades, as the United States begins exporting more energy products to the rest of the world.

I often describe these businesses as the “toll roads” and “highway convenience stores” of the energy industry.

Rather than betting the farm on the next big oil strike, Enterprise collects a fee on every barrel of crude that flows through its network. Management pads this income further by offering other services, like storage and processing. So, while the prices of raw commodities swing from year to year, actual volumes remain fairly consistent.

If that didn’t sound attractive enough, these operations throw off a lot of cash flow.

New pipelines cost billions of dollars to construct. But once you have one up and running, they’re not that costly to maintain. Once underground, they just sit there delivering oil to customers and collecting fees for owners. Ongoing costs—a little bit of maintenance and labor—comes in at just a fraction of sales. The rest can be paid out to share owners as dividends.

Better still, existing routes rarely face direct competition. Aside from the large upfront costs, any new rival would have to secure rights-of-way from landlords and regulators. As anyone following politics can attest, these proposals have become heated battles between industry and environmentalists, leaving owners of existing pipelines already in the ground with virtual monopolies.

And while I love the pipeline business, Enterprise’s asset base stands head and shoulders above the competition. Its network connects to every major U.S. shale basin, most refineries east of the Rocky Mountains, and several export facilities out of the Gulf Coast. For drillers looking to market their product, Enterprise offers an extensive menu of options.

Management can optimize the flow of hydrocarbons through their facilities to capture price spreads across the country and over time. In other words, the sum of the whole is worth more than all of the individual parts. Enterprise’s vast network allows it to earn returns far higher than traditional pipeline businesses.

To see the power of this business, you need to take a quick glance at the financials. Over the past decade, investors in the oil business have earned an average return on invested capital (ROIC) of about five percent per year. I’d call that okay, but it won’t knock your socks off.

And when you consider the sleepless nights that come from holding oil stocks, those returns look downright appalling. Drillers earn such poor returns because they work in a capital-intensive, commodity business. While a few wildcatters might strike it rich on a big find, most firms struggle just to keep the lights on.

You have a different story in the pipeline business. Tall barriers to entry allow pipeline companies to earn outsized profits year after year. In the case of Enterprise, the partnership’s return on invested capital has come in at around the mid-teens over the past 10 years.

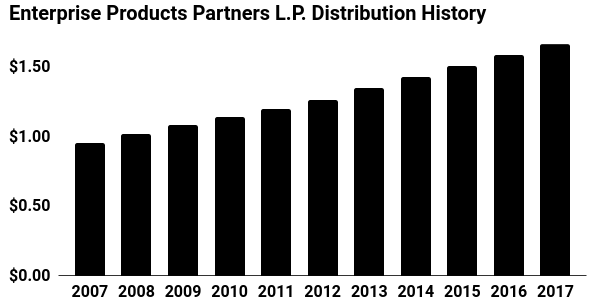

This has resulted in large returns for investors. Since going public in 1998, Enterprise units have increased in value at a double-digit compounded annual clip. And, as you can see in the chart below, management has boosted the distribution at roughly the same rate.

(Source: “Distribution Payments,” Enterprise Products Partners L.P., last accessed May 9, 2018.)

Those small steady hikes have created quite the income stream. Today, Enterprise pays out a quarterly distribution of $0.43 per unit. That comes out to an annual yield of nearly seven percent.

The Dividend

Can Enterprise keep those dividends rolling in? Probably.

The company operates a cash cow business. Management has maintained a modest debt load that is below average, compared to the rest of the industry. And if the partnership ever did find itself in a financial pinch, it has lots of access to liquidity.

Last year, Enterprise generated $4.5 billion in cash flow. At the same time, management paid out $3.6 billion in distributions. That comes out to a payout ratio of 80%.

I’d prefer to see a bit more wiggle room. In a cyclical business like mining or automotives, such a high payout ratio would be a red flag. But given the stable nature of Enterprise’s asset base, unitholders don’t have too much to worry about.

That payout will likely continue to grow too.

In the energy sector, most of the attention and investment dollars chase two big commodities: oil and natural gas. Enterprise, though, sees a big opportunity in natural gas liquids (NGLs), the industry’s lesser-known stepchild. This includes a whole family of hydrocarbons closely related to natural gas, like ethane, propane, butane, isobutane, and pentane.

Over the past few years, Enterprise has built out a dominant position in this space. This includes the partnership’s Beaumont Terminal, Houston Ship Channel, and Mont Belvieu system, which includes a host of NGL pipelines, storage tanks, and processing facilities.

Because it has a lot less in the way of competition, this business generates outrageous profits (60% gross operating margins last year). And with U.S. NGL exports poised to surge over the next few years, Enterprise could have a veritable cash cow on its hands.

Investments in other businesses should continue to drive earnings as well. Analysts predict America’s oil and gas production will hit new records in the upcoming years, outstripping current energy infrastructure. To address this opportunity, Enterprise plans to plow $5.0 billion back into operations over the next two years. Management will focus most of these investment dollars in West Texas, where energy output has grown the fastest. (Source: “Mizuho Energy Summit,” Enterprise Products Partners L.P., April 9, 2018.)

For investors, the combination of a high upfront yield and steady distribution growth should translate into solid returns. At today prices, the unit payout is just under seven percent. If we assume a dividend growth rate in the mid-single digits, our total return potential comes in at around 13% to 14% per year.

With the stock market at record highs, Enterprise represents one of the best values around. And even if the partnership fails to meet our growth targets (always possible even with great businesses), we’ve accounted for some margin of error.

The Risks

So, what might cause Enterprise to fall short of our growth target? While I love this business, the partnership faces three big risks: changing regulations, commodity prices, and higher interest rates.

In March, the Federal Energy Regulation Commission proposed a number of policy changes. Specifically, the measure would eliminate a number of tax loopholes that have benefited master limited partnerships (MLPs), potentially leading to lower tariffs, revenue, and earnings.

The extra uncertainty has hammered unit prices, pushing the industry to some of the lowest valuations we’ve seen since the financial crisis.

Traders didn’t spare Enterprise during the sell-off. I should point out, however, that the partnership will only see a minor hit to profits as a result of these legal changes. (Source: “Energy MLP shares plunge on revised U.S. pipeline tax rules,” Reuters, March 15, 2018.)

Still, this event proves that investors need to keep their eyes on Washington almost as much as the oil patch.

Moreover, Enterprise faces some commodity price risk. Lower energy prices eventually result in lower production, reducing demand for oil and gas infrastructure. Executives manage this risk by locking customers into long-term contracts. Eventually, though, a prolonged slowdown in the oil patch would reduce the pace of distribution hikes for unitholders.

Commodity price spreads present a much bigger risk. Enterprise’s processing businesses buy raw commodities cheap and sell the finished products for a premium. These margins can ebb and flow with swings in the energy market.

Here too, management insulates the business from risks through hedges. Still, narrower spreads (either through higher input prices or lower rates for finished products) would eventually hurt profits. You see these problems pop up in some quarters.

Finally, Enterprise also has above-average exposure to interest rates. Because these distributions resemble bond coupons, units compete directly with fixed-income investments. If interest rates rise, investors will swap out of riskier MLPs like Enterprise for safer income elsewhere.

I don’t lose too much sleep over this issue. Investors really shouldn’t watch the value of their stock portfolio day to day. When I become a partner in an operation, I focus more on the performance of the business. If rates rise, I get to buy more units in a wonderful firm at a cheaper price. Still, it’s a risk worth considering.

The good news here? At today’s prices, MLPs like Enterprise come with a large margin of safety. With the downturn in the oil patch, traders have dumped even relatively stable pipeline businesses. Regulatory uncertainty hasn’t help investor confidence, either. No doubt, weaker MLPs will struggle through this period. The situation, however, has created the opportunity to scoop up the very best assets on the cheap.

The Bottom Line

Of course, I’m not the first person to have spotted this opportunity.

Company insiders have backed up the truck. In the past few weeks, a number of Enterprise executives and directors have purchased large blocks of units in the open market.

And aside from T. Boone Pickens, we’ve also seen an uptick in hedge fund activity. Over the past few quarters, hedge fund manager James Dondero has quietly built a position in the partnership. Other money mavens—including George Hall, Russell Lucas, and Israel Englander—initiated or increased the size of their stakes.

What could have these guys so excited? I’d say it means one thing: there’s a lot of upside ahead.