Enterprise Products Partners L.P.: This “Trophy Asset” Yields 7%

Own One of the World’s “Trophy Assets”

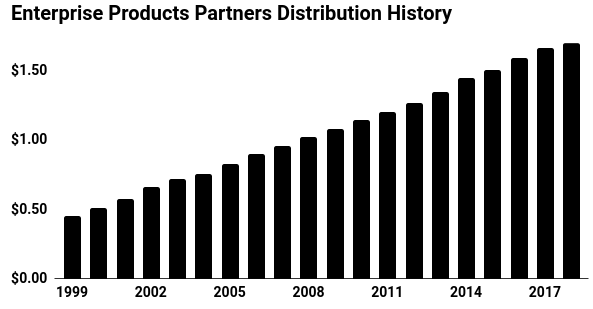

Today’s chart highlights one of my favorite strategies at work: owning “trophy assets.”

Regular readers have heard the term “trophy assets” before. These include the world’s highest-quality, one-of-a-kind assets which can’t be easily replicated.

Examples include New York skyscrapers, a world-class copper mine, and casinos on the Las Vegas Strip. As the government continues to print and borrow money, these properties represent one of the best ways to protect your wealth. And when you own the highest-quality assets of the investment world, you will do pretty well over time.

Case in point: Enterprise Products Partners L.P. (NYSE:EPD). The partnership owns more than 50,000 miles of pipelines–enough to crisscross the continental U.S. 20 times. Management has also dipped their toes in a number of other energy businesses over the years, including crude storage, natural gas processing, and import/export terminals.

Also Read:

MLP Stock List: Earn Reliable Income From These Energy Partnerships

Such assets act as “highway and truck stops” of the energy business. Enterprise charges a toll on every barrel of oil that flows through its network and passes on the profits to owners. And with a yield approaching seven percent, this business looks interesting.

You’d have a tough time replicating this business, for one.

Trucks and rail cars can’t compete once you get a pipeline in place. The only competitor to a pipeline is another pipeline (owned by a rival) running directly alongside yours.

And if this didn’t sound good enough, pipelines rarely face direct competition. Even if you manage to secure the right-of-ways from hostile landowners and governments, new routes cost billions to construct. Any new line will only split the existing business between two competitors, greatly diminishing the returns for both firms.

For this reason, pipelines resemble quasi-monopolies. In the case of Enterprise, this has allowed the partnership to earn 15%+ returns on capital for years. Some businesses can manage to generate profits like these for a year or two. Few, though, can sustain those profits over decades.

That has created quite the income stream for owners.

Since 1998, Enterprise has raised its distribution on 63 occasions. Over the past five years, management has boosted the payout at a six-percent compounded annual clip.

Those small bumps can really add up over time. Last month, executives raised the distribution 3.7% to $0.425 per unit. For prospective investors, that raises the upfront yield to almost seven percent. (Source: “Enterprise Declares Quarterly Distribution Increase,” Enterprise Product Partners Investor Relations, January 12, 2018.)

That payout will likely keep growing. Pipeline volumes grow slowly but relentlessly over time, and Enterprise should be able to raise fees at or above the rate of inflation. That should result in a mid-single digit earnings growth rate, with the distribution growing more or less in line.

Source: “Distribution Payments,” Enterprise Product Partners L.P., last accessed February 16, 2018.

And the thing is, now is the perfect time to become a partner.

Oil prices have plunged over the past few years. Traders have soured on the energy patch, preferring instead to chase fast money in tech stocks and cryptocurrencies.

Pipelines have little exposure to commodity prices. But when an industry sours on Wall Street, funds will dump wonderful businesses for a fraction of their real value. And in the case of Enterprise Product Partners, the recent 40% selloff has created a once-in-a-generation chance to scoop up this business on the cheap.

The best investors look to buy these trophy assets during a crisis. Because when you own high-quality, irreplaceable business at a discount, you’re going to do pretty well over the long haul. And in the case of Enterprise Product Partners, we have a rare opportunity to do exactly that.