Energy Transfer Partners LP: This Quiet Company Yields 13.9%

A 13.9% Yield Right Here

You wouldn’t know it now, but I used to be quite the athlete.

Years ago, I won the title of Under-17 State Cycling champion. It sounds impressive, until you learn about one little detail… I was the only one who competed.

But as I like to say, “When you’re the only one, you’re number one.” If you’re the only person who shows up at the starting line, it’s far easier to take home the trophy. Leave the actual job of competing to the other guys.

The same thing applies to business. Beating out the competition makes for great headlines. But you’ll make far more money owning a monopoly, operating as the sole provider of a good or service.

Case in point: Energy Transfer Partners LP (NYSE:ETP). This partnership operates 7,700 miles of natural gas pipelines in Texas and 12,800 miles of interstate pipelines. And with a distribution yield approaching 13.9%, income investors should give this name a second look.

Pipelines work as quasi-monopolies, to begin with.

New routes cost billions of dollars to construct upfront. And even if you can fork over that kind of money, potential rivals often have a tough time securing the needed rights-of-way from landowners.

Worse, any new pipeline would only split the existing business along the route. In most cases, that would be an unprofitable outcome for everybody. As a result, we often only see one pipeline moving oil or natural gas between areas.

For proof, just look at some of the headlines out of the oil patch. TransCanada Corporation’s (NYSE:TRP) infamous Keystone XL pipeline has gotten stuck in the political mud, despite years of lobbying for construction. And it’s hardly the only one. Despite the desperate demand for new construction, new oil and gas projects are few and far between.

For owners of existing pipelines, this results in an outrageously profitable situation.

The monopoly-like position allows operators to raise prices each year. And thanks to their strong negotiating position, they can commit customers to long-term, multi-decade contracts.

In the case of ETP specifically, you can see the strength of this operation in their financial results. Over the past decade, the partnership has earned between $0.15 and $0.20 in profit on every dollar of capital invested into the business.

Sure, you might see businesses earn returns like these from time to time. Such high profits, however, tend to attract competition. Over a few years, that tends to bite into your returns on invested capital.

That’s why I get so excited about a business like ETP. Of the thousands of companies I’ve reviewed over the years, only a handful have maintained such high profits over such a long period. Over time, that results in much better total returns for unitholders.

It also results in more impressive distributions.

Once buried, pipelines don’t cost a lot of money to maintain. Ongoing costs come in at a fraction of income, leaving a lot of money left over for investors.

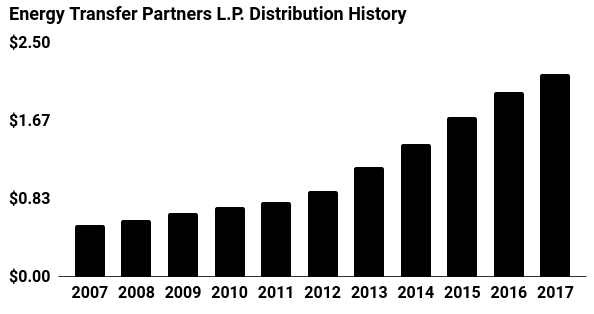

In other words, it’s the textbook example of a wonderful business. We have a near-monopoly that requires little investment to maintain. As you can see in the chart below, ETP has become quite the income stream for investors.

(Source: “Distribution History,” Energy Transfer Partners LP, last accessed April 9, 2018.)

These small hikes really add up over time. Today, ETP pays out a quarterly distribution of $0.57 per unit. That comes out to an annual yield of nearly 13.9%.

Of course, pipelines don’t represent some kind of surefire investment.

Because of their bond-like cash flows, unit prices get hit especially hard by rising interest rates. The units also tend to trade alongside the booms and busts of the energy industry.

But when you go around buying near-monopolies like ETP, you’re going to do pretty well over the long haul. Leave the hard work of competing to the other guys. Because when you’re the only one, you’re number one.