Easterly Government Properties Stock: Uncle Sam’s Landlord Pays 7.7% Dividend

Why DEA Stock Is Attractive Right Now

Equity real estate investment trusts (REITs) are only as strong as their tenants. When times are good, REITs have no problem collecting rent, but when their tenants are slammed by a recession, pandemic, or competition from e-commerce giants, it’s a different story. That’s what makes Easterly Government Properties Inc (NYSE:DEA) such a no-brainer: its biggest tenant is the U.S. Government. If you can’t trust Uncle Sam to pay the rent, who can you trust?

Easterly Government Properties acquires, develops, and manages commercial properties and leases them to various U.S. government agencies. According to the most recent data, 97% of the company’s lease income is “backed by full faith and credit of the U.S. government.” (Source: “Investor Presentation: March 2023,” Easterly Government Properties Inc, last accessed May 1, 2023.)

The REIT’s 86 properties are spread out across the country. Office buildings currently make up the bulk of Easterly Government Properties’ real estate portfolio (62%). The rest of the portfolio comprises Veterans Affairs outpatient clinics (20%), labs (seven percent), courthouses/legal offices (four percent), and properties classified as “other” (eight percent).

U.S. government agencies that pay rent to Easterly Government Properties include the following:

- Customs and Border Protection

- Department of Defense (DoD)

- Department of Energy

- Department of Veterans Affairs

- Federal Bureau of Investigation (FBI)

- Food and Drug Administration (FDA)

- Internal Revenue Service (IRS)

- The Judiciary of the U.S.

- National Archives & Records Administration

- National Park Services

- U.S. Attorney’s Office

(Source: “Properties,” Easterly Government Properties Inc, last accessed May 1, 2023.)

Government agencies tend to remain in place significantly longer than private-sector businesses. A typical lease for one of Easterly Government Properties’ sites has an initial term of 10 to 20 years and a renewal term of five to 10 years. The long-term leases bring stability to the REIT’s revenues.

The market for federally leased real estate is fragmented at the moment, with no single landlord owning more than 5.4% of the properties that the U.S. government rents. The U.S. General Services Administration (GSA) is responsible for overseeing the vast majority of federal government leases, but there’s no national broker or clearinghouse for properties that the GSA leases.

This market, however, has high barriers to entry. U.S. government agencies aren’t just going to rent random office buildings. A company that wants to become a landlord to Uncle Sam needs access to a substantial amount of capital and knowledge of the GSA’s procurement process, protocols, and culture. It also needs proven experience in acquiring, developing, and managing GSA properties.

The federal government has increasingly stringent standards when choosing which properties to lease. Those standards relate to factors such as Leadership in Energy and Environmental Design (LEED) designations, Energy Star certifications, utilization rates, security measures, recycling capabilities, fuel efficiency, and emissions.

The good news is that Easterly Government Properties Inc has a proven track record of sourcing, acquiring, developing, and managing properties leased through the U.S. GSA. Easterly Government Properties’ experience in working with the GSA can help it meet the government’s standards.

Easterly Government Properties’ inside edge gives it a leg up on would-be competitors.

Acquisition of 10 Properties

In October 2021, Easterly Government Properties announced its formation of a joint venture with an unnamed partner that it described as “one of the preferred leading global investors.” (Source: “Easterly Government Properties Enters Into Joint Venture and Announces Agreement to Acquire 1,214,165 SF Department of Veterans Affairs Portfolio for $635.6 Million,” Easterly Government Properties Inc, October 13, 2021.)

The joint venture is a vehicle for the acquisition of 10 properties for $635.6 million. Those properties, which cover 1.2 million leased square feet, are 100% leased to the U.S. Department of Veterans Affairs, with a weighted average lease term of 19.6 years. The acquisitions are expected to close on a rolling basis by the end of 2023.

Easterly Government Properties Inc will retain a 53% stake in the joint venture, receive asset management fees from its partner, and be responsible for the day-to-day management of the properties.

Easterly Government Properties has also been successful at selling its properties at the right time. In November 2022, the REIT announced that it had sold 10 of its primarily government-leased assets, representing a combined total of about 668,000 leased square feet for approximately $205.3 million. (Source: “Easterly Government Properties Announces Agreement to Sell 10-Property Portfolio and Completes Sale of Nine Portfolio Properties,” Easterly Government Properties Inc, November 1, 2022.)

2022 Another Successful Year for Easterly Government Properties Inc

For the fourth quarter of 2022, Easterly Government Properties announced net income of $18.4 million, or $0.18 per share. That was a 138% increase over its fourth-quarter 2021 net income of $7.7 million, or $0.08 per share. (Source: “Easterly Government Properties Reports Fourth Quarter and Full Year 2022 Results,” Easterly Government Properties Inc, February 28, 2023.)

The company’s funds from operations (FFO)—a term REITs use for their cash flow from operations—in the fourth quarter of 2022 was $30.9 million, or $0.30 per share. For the fourth quarter of 2021, Easterly Government Properties reported FFO of $31.8 million, or $0.33 per share. Its adjusted FFO (AFFO) in the fourth quarter of 2022 was $29.9 million, or $0.29 per share, compared to $31.2 million, or $0.32 per share, in the same prior-year period.

Easterly Government Properties Inc’s cash available for distribution in the fourth quarter of 2022 was $21.7 million.

In full-year 2022, the company’s net income went up by 4.7% to $33.5 million, or $0.34 per share. Its 2022 FFO came in at $129.7 million, or $1.27 per share, versus $117.9 million, or $1.31 per share, in 2021. Its AFFO grew by 9.2% in 2022 to $128.9 million, or $1.26 per share.

The REIT’s full-year 2022 cash available for distribution went up by eight percent to $108.0 million.

Commenting on the fourth-quarter and full-year results, William C. Trimble, Easterly Government Properties Inc’s CEO, said, “We spent much of 2022 strengthening the Easterly portfolio and fortifying our balance sheet. With 97% of our annualized lease income originating from the United States Federal Government, we feel well positioned as we navigate an evolving economic backdrop in 2023.” (Source: Ibid.)

Easterly Government Properties Stock’s Quarterly Dividend Maintained at $0.265/Share

With almost all of its lease income coming from the U.S. government, it’s safe to say that Easterly Government Properties’ cash flow is secure. That’s one big reason the REIT is able to provide DEA stockholders with safe, growing, quarterly dividends.

In April, management declared a quarterly dividend of $0.265 per share, for a current yield of 7.7%. This dividend is payable on May 23 to shareholders of record as of May 11. (Source: “Easterly Government Properties Announces Quarterly Dividend,” Easterly Government Properties Inc, April 26, 2023.)

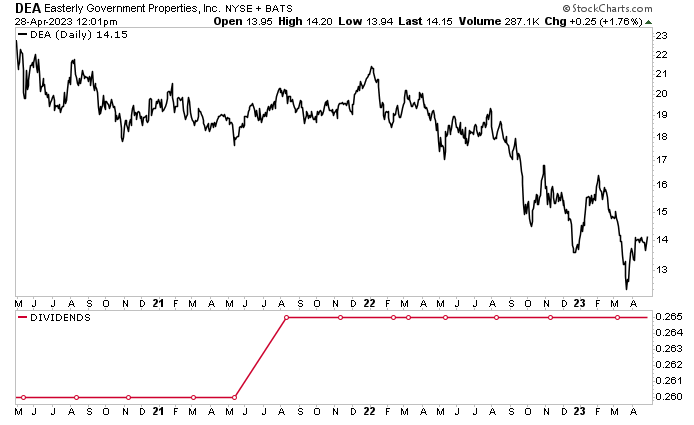

Since going public on April 6, 2015, Easterly Government Properties has raised its dividend seven times. As you can see in the red line in the chart below, Easterly Government Properties Inc held its dividend at $0.26 per share throughout the COVID-19 pandemic and raised it slightly in August 2021 to $0.265.

Because of the company’s recent strong financial results, there’s a good chance it will raise its quarterly payout again in 2023.

DEA Stock Has 20% Upside

In terms of share price, Easterly Government Properties stock has been underperforming the market lately. As of this writing, the stock is up one percent year-to-date and down 24% year-over-year.

Most of DEA stock’s decline has to do with overall investor sentiment and concerns about interest rate hikes, which increase companies’ cost of borrowing and decrease their earnings growth.

The rising interest rates haven’t hurt Easterly Government Properties Inc’s business activities or financials, though. As mentioned earlier, in 2022, the company sold off 10 properties and acquired 10 other properties. Also that year, its net income, FFO, AFFO, and cash available for distribution went up.

Chart courtesy of StockCharts.com

REITs are one type of company that should perform well during periods of inflationary pressure. One reason is that they can pass their additional costs on to their tenants through rent increases. Having a rock-solid tenant base that pays its rent on time helps.

Despite the downtrend in its share price, Easterly Government Properties stock’s outlook is bullish, with analysts providing a 12-month target of $15.67 to $17.00. This points to gains in the range of about 10% to 20%.

The Lowdown on Easterly Government Properties Inc

In addition to macroeconomic headwinds like interest rates and inflation, one of the biggest problems facing a REIT is its tenants. If the tenants can’t pay their rent, the REIT’s cash flow will deteriorate, and it won’t be able to pay dividends. Fortunately, that hasn’t been the case for Easterly Government Properties: 97% of its annualized lease income originates from the U.S. government.

This provides the company with a reliable cash flow, which allows it to make acquisitions and target opportunistic developments. The situation also translates to super risk-adjusted returns for Easterly Government Properties Inc and reliable, high-yield dividends for DEA stockholders. Dividend hogs can use Easterly Government Properties stock’s high-yield dividends to offset any volatility in its share price.