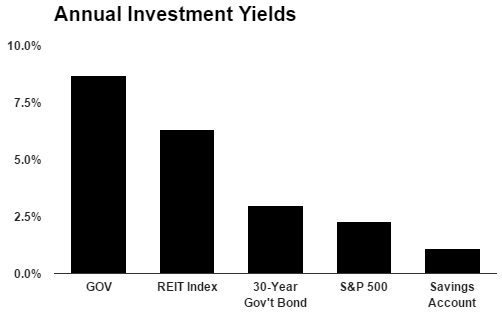

Earn an 8.7% Yield from This Real Estate Stock

How to Collect Rent Checks from “Uncle Sam”

I bet most people have never heard of this real estate stock.

The trust has a lucrative business with the U.S. government. Longtime shareholders have quietly made a fortune.

And thanks to an obscure tax loophole, this firm gushes cash flow. Right now, investors can collect an 8.7% yield. For this reason, it’s one of my favorite real estate stocks of 2017.

Let me explain.

I hate watching taxpayers’ money get flushed down the toilet. It turns my face red and my veins get so swollen, they look like they’re going to rupture and burst. But I have to admit, “Uncle Sam” is a great customer.

Take Michelle Obama’s anti-obesity campaign, for example. Her team paid a marketing firm $100,000 to come up with the slogan “Let’s Move.” An intern probably could’ve done the same work for a few hundred bucks. (Source: “Obama-linked firm received ‘unauthorized’ $100,000 contract for Michelle Obama’s anti-obesity effort,” The Daily Caller, November 6, 2013.)

Of course, $100,000 is just the tip of the iceberg. When the federal budget tops $3.5 trillion, you know somebody is getting paid. It’s little wonder that some of the best-performing stocks around do extensive business with the government.

Case in point: Government Properties Income Trust (NASDAQ:GOV). The firm leases out more than 11-million square feet spread across 72 buildings, mostly to the public sector. And like most companies working with the Feds, it’s a lucrative business for a couple of reasons.

First, they might have the best tenant in the world. Every year, the U.S. General Services Administration spends $66.00 billion to keep the government running. Their biggest cost? Real estate. Uncle Sam employs 2.8 million people, making him the nation’s largest renter. (Source: “General Services Administration,” U.S. General Services Administration, last accessed February 21, 2017.)

By square footage, the IRS is GOV’s biggest tenant. The next-largest are the FBI, the Center for Disease Control, and U.S. Customs & Immigration. Together, they make up most of GOV’s rental income. Municipalities, state governments, and other departments round out the rest. (Source: “Investor Presentation,” Government Properties Income Trust, November 2016.)

Needless to say, the government has a lot more “rent money” than the nice people answering an ad on Craigslist. And unlike corporate tenants, government agencies won’t go out of business when the next financial crisis hits. All of this results in a nearly recession-proof stream of cash flow.

Better still, departments tend to stay put. Most landlords are happy when a tenant signs a one-year lease–and actually pays. GOV’s typical lease term is between 10 and 25 years, which keeps vacancies low and profits fat. (Source: Ibid.)

Second, this real estate stock pays almost no taxes. GOV has structured its business as a real estate investment trust. Thanks to a special agreement with the government, the landlord pays no income taxes. In exchange for this benefit, however, it must pay out all of its profits to unitholders.

Better still, GOV has struck a great deal with tenants. In most of their lease agreements, taxpayers cover insurance, maintenance, and repairs. Contracts also have built in provisions to cover inflation and property tax adjustments.

All of this means that GOV gushes cash flow. The trust generates $0.64 in fund flows from operations for every dollar earned in rental income. I can only think of a few other businesses in the world this profitable.

This income has resulted in solid returns for investors.

Since 2016, units have surged 40%. The trust has been one of the best performing real estate stocks in the industry.

GOV also provides a tidy income stream. Right now, units pay a quarterly distribution of $0.43 each. That comes out to an annual yield of 8.7%.

Source: Google Finance

That payout will likely grow in the years ahead.

Executives are always hunting for new deals. Last month, for example, the firm pulled the trigger on a Grade-A office building in Monassas, Virginia. The place is already occupied by Prince William County, so GOV won’t even have to search for a new tenant. (Source: “Government Properties Income Trust Announces Third Quarter Results,” Government Properties Income Trust, February 22, 2017.)

Instant cash flow! Unitholders can already see the purchase show up on the bottom line. And given the lease won’t end for another decade, the building will pay out steady rent checks until at least 2027.

Of course, this real estate stock is no slam dunk. Higher interest rates could always crimp the stock price. And sometimes, politicians start a ruckus about trimming the fat. But given our country’s ballooning deficit, this seems to be more bark than bite.

Bottom line: if you’re looking for a safe place to earn high yields, look into doing business with Uncle Sam. Government Properties Income Trust offers great returns, recession-proof profits, and a big yield to boot. For these reasons, it’s a top real estate stock for 2017 and beyond.