Dynex Capital Inc: 14.5%-Yielder Trading at Highest Level in 25+ Years

Get Paid Monthly by Dynex Capital Inc

With interest rates heading lower, income hogs are on the lookout for reliable yields. One place to look is at mortgage real estate investment trusts (mREITs). With Dynex Capital Inc (NYSE:DX), you get a bullish mREIT that is crushing the broader markets and comes with a frothy 14.5% dividend yield.

There have been concerns that interest rate cuts would harm mREITs. But those fears may be a little overblown. The Federal Reserve isn’t cutting interest rates as quickly as many expected. Moreover, the U.S. housing market remains strong, and the average 30-year fixed mortgage rate remains above six percent. That’s all good news for mREITs like Dynex Capital.

Virginia-based Dynex Capital Inc is an mREIT that invests primarily in residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS), and CMBS interest-only (IO) securities. The company’s current portfolio is 93% agency RMBS. (Source: “Third Quarter 2025 Earnings Presentation,” Dynex Capital Inc, October 20, 2025.)

This high concentration of RMBS investments helps provide Dynex with balanced income generation and capital preservation. This is due in part to the fact that RMBS securities are backed by government-sponsored entities, which provides them with a level of security and stability

For the third quarter ended September 30, 2025, Dynex reported total economic return of $1.23 per common share. Book value per common share was $12.67. Third-quarter net income was $147.5 million, or $1.08 per share, up from a net loss of $16.2 million, or a loss of $0.14 per share, in the same prior-year period. (Source: “Dynex Capital, Inc. Announces Third Quarter 2025 Results,” Dynex Capital Inc, October 20, 2025.)

During the quarter, the mREIT raised equity capital of $254.0 million and purchased $2.4 billion in agency RMBS and $464.0 million in agency CMBS.

Commenting on the results, Smriti Popenoe, Dynex’s co-chief executive officer and president, said, “In the third quarter, we continued to execute on our strategy of raising and deploying capital. The results this quarter reflect our opportunistic positioning, expert risk management and the opportunity in a leveraged Agency mortgage-backed securities portfolio.”

Monthly Dividend of $0.17/Share

As an mREIT, Dynex has to legally distribute at least 90% of its taxable earnings to shareholders as dividends. Better still, unlike the vast majority of dividend stocks, the mREIT distributes its payouts monthly. And that payout has been on the rise of late.

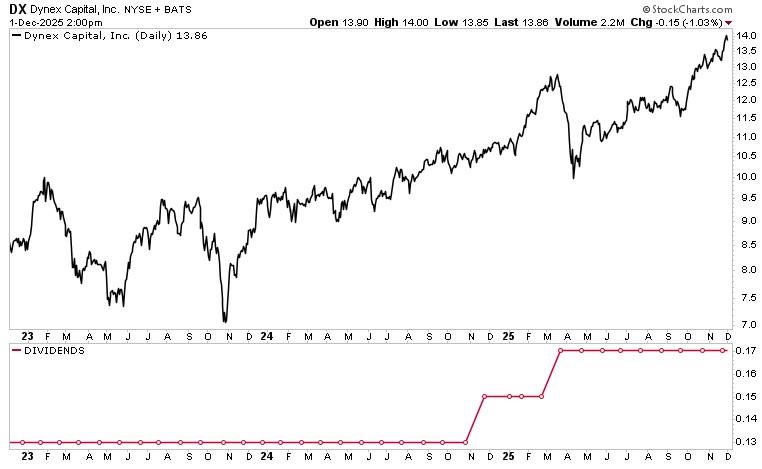

In November 2024, Dynex Capital increased its monthly distribution from $0.13 per share to $0.15 per share. For March 2025, the company’s board increased the monthly distribution again to $0.17 per share. It has held it there since then. This works out to an annual distribution of $2.04 per share, for a massive dividend yield of 14.56%. (Source: “Dynex Capital, Inc. Declares Monthly Common Stock Dividend of $0.17 Per Common Share for November 2025,” Dynex Capital Inc, November 10, 2025.)

That ultra-high dividend yield isn’t a result of a lower share price. Dynex’s trailing annual dividend yield is 13.56% and the five-year average dividend yield is 11.71%.

DX Shares Thumping the Broader Market

The S&P 500 has been having a pretty solid year, but not as great as that of DX shares. Currently trading at its highest levels in more than 25 years, DX is currently trading up:

- 14% over the last three months

- 25% over the last six months

- 28% year to date

- 29% year over year

Chart courtesy of StockCharts.com

The Lowdown on Dynex Capital Inc

Listed on the NYSE in 1989, DX is the longest tenured mREIT on Wall Street. Over the years, it has provided investors with solid capital appreciation. On the dividend and stock fronts, the company’s disciplined investment process has allowed its stock to outperform the S&P 500 Financials and iShares Mortgage Real Estate ETF.

Outperforming the markets is what shareholders and institutional investors are looking for. Currently, 273 institutions hold 45.4% of all outstanding shares. The three biggest holders are BlackRock Inc., The Vanguard Group Inc, and Geode Capital Management, LLC.