Dow Inc: Insiders Swarming Over This 6% Dividend Stock

Executives Buying Shares of Dow Inc Hand Over Fist

If you want to make a lot of money in business, then you need to heed this one simple rule: “Watch what people do, not what they say.”

People say things for all sorts of reasons. Only occasionally do their words reveal their true intentions. If you want to know what they really believe, you have to observe their actions.

For that reason, I keep a close eye on which stocks insiders are buying. In the investment world, every manager says their business has wonderful prospects with lots of upside potential. But it’s only when they put up their own money and buy shares of their own company’s stock that you know they’re serious.

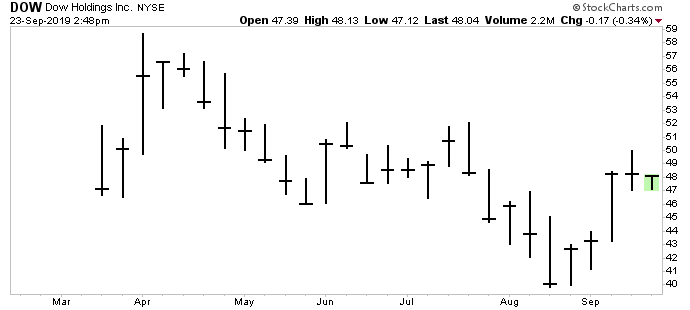

Case in point: Dow Inc (NYSE:DOW). In March, DuPont de Nemours Inc (NYSE:DD) spun off the chemicals business to simplify its operations. The new company, however, has gotten off to a slow start, with Dow stock dropping as much as 15% from its initial public offering.

Yet insiders see an opportunity. Several Dow directors have made large purchases of Dow common shares in recent months, buying over $1.6 million worth since the beginning of August. (Source: Dow Inc Insider Trading History, MarketBeat, last accessed September 24, 2019.)

Income investors should take notice.

In fairness, Dow Inc faces challenges. Short-term, the company has struggled with a tighter spread between the price of finished goods and input costs. Longer-term, analysts worry we may soon approach “peak plastic.”

Revenue growth will likely remain muted for the foreseeable future, given that the chemicals business has long since matured and the global economy is slowing. And if companies opt to use less plastic, it will bite into Dow’s sales.

Investors, however, may have already priced in those fears. Today, Dow stock trades at only nine-times forward earnings. That means, using this metric, it’s one of the cheapest stocks in the Dow Jones Industrial Average.

Moreover, new growth projects could reignite the shares of this company. Dow Inc has several new chemical plants poised to come online in the next two years, primarily along the U.S. Gulf Coast, which will provide a quick boost to earnings.

After that, management plans to shift their investment dollars to “brownfield” projects, industry lingo for reengineering existing facilities to create new products. These facilities not only deliver the same production growth as building plants from scratch, but they are also far cheaper to develop.

Cost cuts could further pad the company’s bottom line. Since 2015, management has chopped $1.9 billion from corporate overhead and from research and development.

Dow executives have aimed to find another $600.0 million in annual cost savings by the end of this year, likely through layoffs. (Source: “The New Dow,” Dow Inc, May 30, 2019.)

All these efforts could turn Dow into a money machine. Management wants to add $3.0–$4.0 billion in annual free cash flow and $2.0–$3.0 billion in annual earnings before interest, taxes, depreciation, and amortization (EBITDA). At the same time, they have aimed to boost the company’s return on invested capital to 13%, up from 10%–11% today.

Chart courtesy of StockCharts.com

In the meantime, shareholders will get well paid while they wait. Today, Dow stock pays a quarterly dividend of $0.70 per share, which comes out to an annual yield of almost six percent.

Management has supplemented this income through a generous stock buyback program. Last quarter, Dow executives spent $300.0 million on repurchases, boosting stockholders’ claim to future earnings and increasing the value of the remaining shares. If you include both dividends and stock buybacks together, Dow stock provides a jaw-dropping shareholder yield of nearly nine percent.

No wonder insiders have gotten so excited.

Bottom line: as I said earlier, it pays to watch what people do, not what they say. And in the case of Dow Inc, insider buying says more than their words ever could. This business is a cash machine and investors will likely be rewarded for their patience.