Digital Realty Trust Stock’s Dividends Raised for 19 Straight Years

DLR Stock Set to Benefit From Needs of AI Industry

The growth of artificial intelligence (AI) will fuel an explosive demand for secure data centers.

That’s where Digital Realty Trust Inc (NYSE:DLR) comes into play.

The company, which operates as a real estate investment trust (REIT), has more than 300 data centers in North and South America, Europe, Africa, and Asia Pacific. (Source: “Data Center Locations,“ Digital Realty Trust Inc,” last accessed November 2, 2023.)

Its customer base comprises many top-tier companies, including more than 250 Fortune 500 companies.

The bullish tailwinds for the AI sector are obvious as more companies move toward using AI to generate critical insights. More importantly, the data related to AI has to be stored somewhere that’s secure.

Many companies currently operate a hybrid model in which their critical data is stored both in-house and at third-party locations like those offered by Digital Realty Trust Inc.

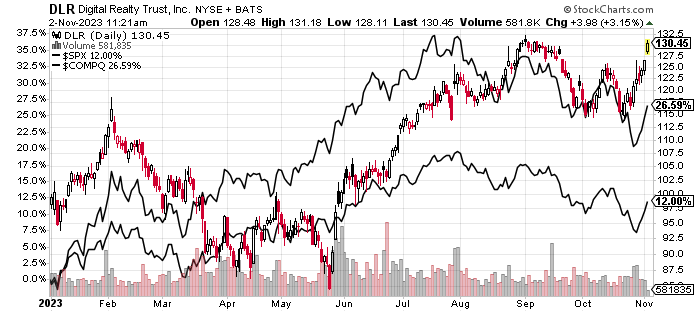

Digital Realty Trust stock has easily outperformed the S&P 500 and the Nasdaq, with a year-to-date return of 30%. It also has excellent long-term share-price potential.

Chart courtesy of StockCharts.com

Earnings Growth Supports Dividend Growth

DLR stock’s dividends have increased for 19 consecutive years.

Digital Realty Trust Inc’s current quarterly dividend of $1.22 per share represents a yield of 3.86% (as of this writing). Digital Realty Trust stock’s five-year average dividend yield is 3.54%. (Source: “Digital Realty Trust, Inc (DLR),” Yahoo! Finance, last accessed November 2, 2023.)

Given the company’s higher expected earnings over the next two years, DLR stock’s dividends will likely continue to rise.

| Metric | Statistic |

| Dividend Growth Streak | 19 Years |

| Dividend Streak | 20 Years |

| 7-Year Dividend Compound Annual Growth Rate | 5.3% |

| 5-Year Average Dividend Yield | 4.0% |

| Dividend Coverage Ratio | 1.1 |

Digital Realty Trust Inc Ramping Up Revenues

Digital Realty has grown its revenues in the last four consecutive years, from $3.1 billion in 2018 to a record-high $4.7 billion in 2022. This represents a compound annual growth rate (CAGR) of 11.0%.

The company’s revenue outlook is positive. Analysts estimate that Digital Realty Trust Inc will reenergize its revenue growth to the tune of 17.7% to $5.5 billion in 2023, followed by 5.9% to $5.9 billion in 2024. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | Revenues (Billions) | Growth |

| 2018 | $3.1 | N/A |

| 2019 | $3.2 | 5.34% |

| 2020 | $3.9 | 21.64% |

| 2021 | $4.4 | 13.43% |

| 2022 | $4.7 | 5.96% |

(Source: “Digital Realty Trust, Inc,” MarketWatch, last accessed November 2, 2023.)

On the bottom line, Digital Realty has delivered generally accepted accounting principles (GAAP) earnings-per-share (EPS) profits in the last five straight years. The company’s five-year best GAAP-diluted EPS were $5.94 in 2021.

Analysts expect Digital Realty Trust Inc to report a slight increase in adjusted earnings to $1.03 per diluted share in 2023 and $1.29 per diluted share in 2024. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $1.21 | N/A |

| 2019 | $2.35 | 94.63% |

| 2020 | $1.00 | -57.38% |

| 2021 | $5.94 | 491.87% |

| 2022 | $1.11 | -81.22% |

(Source: MarketWatch, op. cit.)

The company’s funds statement shows negative free cash flow (FCF) over the last three years. The company has, however, improved its FCF in the first and second quarters of 2023.

| Fiscal Year | FCF (Millions) | Growth |

| 2018 | $11.7 | N/A |

| 2019 | $10.8 | -7.06% |

| 2020 | -$472.1 | -4,457% |

| 2021 | -$818.5 | -73.37% |

| 2022 | -$984.7 | -20.18% |

(Source: MarketWatch, op. cit.)

On its balance sheet, Digital Realty Trust Inc was saddled with debt of $18.3 billion at the end of June, but this was partially offset by $1.1 billion in cash. (Source: Yahoo! Finance, op. cit.)

A risk is that the current high-interest-rate environment will have a negative impact on the company’s margins and expenses, but that’s not a major concern at this point.

Digital Realty Trust Inc’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a relatively strong reading of 6.0. That’s well above the midpoint of the Piotroski score’s range of 1.0 to 9.0.

The following table shows that Digital Realty has consistently covered its interest expense via its higher earnings before interest and taxes (EBIT).

| Fiscal Year | EBIT | Interest Expense (Millions) |

| 2019 | $964.3 Million | $353.1 |

| 2020 | $733.8 Million | $333.0 |

| 2021 | $2.1 Billion | $298.2 |

| 2022 | $711.0 Million | $299.1 |

(Source: Yahoo! Finance, op. cit.)

The Lowdown on Digital Realty Trust Inc

The growth of the AI industry should drive a revolution in the demand for data centers. In my view, Digital Realty Trust Inc is well positioned to benefit from that growth.

Digital Realty Trust stock provides capital appreciation potential and steady dividends to income investors.

Meanwhile, DLR stock has extremely high and broad institutional ownership, with 1,317 institutions holding the majority of the outstanding shares. This is a good sign. (Source: Yahoo! Finance, op. cit.)