Delek Logistics Stock: 9.3%-Yielder Reports Record Q1 Results & Hikes Dividend

DKL Stock’s Distribution Rose in 41 Consecutive Quarters

Delek Logistics Partners LP (NYSE:DKL) is a great way for investors to take advantage of oil price swings and take home reliable, growing, ultra-high-yield dividends.

The Tennessee-based company owns and operates logistics and marketing assets for crude oil, intermediate products, and refined products in the U.S. (Source: “Investor Presentation: Delek Logistics Partners: November 2022,” Delek Logistics Partners LP, last accessed May 9, 2023.)

Right now, oil is trading around $71.00 per barrel, down from its March 2022 high of $130.0 per barrel. Despite the pullback, analysts believe that the record-high global demand could send oil prices to $100.00 per barrel over the coming quarters.

But nothing is certain; the energy sector could face unexpected headwinds or tailwinds that drastically affect supply/demand metrics and prices.

That’s where Delek Logistics Partners LP comes in. The partnership operates through two business segments: Pipelines and Transportation, and Wholesale Marketing and Terminalling.

The company’s Pipelines and Transportation segment includes pipelines, trucks, and ancillary assets that provide crude oil gathering; crude oil, intermediate product, and finished product transportation; and storage services.

This segment has approximately 805 miles of crude oil and oil product pipelines, a 600-mile crude oil gathering system in Arkansas, a 200-mile gathering system in the Midland basin of Texas and New Mexico, and storage facilities with 10 million barrels of shell capacity (gross storage capacity). The Pipelines and Transportation segment also owns rail offloading facilities.

The Wholesale Marketing and Terminalling segment provides wholesale marketing, transportation, storage, and terminalling services related to refined products to independent third parties. This segment has approximately 1.4 million barrels of active shell capacity.

Delek Logistics Partners LP has multiyear firm contracts for minimum volume contracts that include long-term take-or-pay commitments. According to the most recent data, three percent of those contracts have a duration of less than one year, eight percent have a duration of one to three years, 49% have a duration of three to five years, and 40% have a duration of greater than five years.

This provides the company with financial flexibility and a growing distributable cash flow. Between 2016 and 2022, Delek Logistics Partners LP’s net income increased from $62.8 to $158.1 million, while its earnings before interest, taxes, depreciation, and amortization (EBITDA) grew from $97.3 to $289.2 million.

This helps explain why Delek Logistics has been able to increase its distributable cash. For 2016, it reported a distributable cash flow of $83.0 million. For 2022, it reported $231.2 million. As a result, the company’s quarterly dividend has increased 41 consecutive times since the company’s initial public offering (IPO) in October 2012.

Delek Logistics Partners LP Closed Acquisition Deal in 2022

Delek Logistics’ cash flow got a boost from the company’s recently closed $624.7-million acquisition of 3Bear Delaware Holding – NM, LLC, which was an indirect subsidiary of 3Bear Energy, LLC. The acquisition expands Delek Logistics’ business footprint in the Delaware Basin of New Mexico. (Source: “Delek Logistics Partners, LP Announces Closing of Acquisition from 3Bear Energy,” Delek Logistics Partners LP, June 1, 2022.)

3Bear Delaware Holding operates a crude oil, natural gas, and water gathering, processing, and disposal business in the Northern Delaware Basin, which is in West Texas and Southern Mexico.

3Bear Delaware Holding’s assets are anchored by about 350,000 dedicated acres and long-term fixed-fee contracts. The company’s asset base includes about 485 miles of pipelines, 88 million cubic feet of daily natural gas processing capacity, 120,000 barrels of oil storage capacity, and 200,000 barrels per day of water disposal capacity.

Management Reported Record Q1 EBITDA

Delek Logistics’ strong momentum that started in 2013 has continued in 2023. The company recently reported first-quarter net income of $37.4 million, or $0.86 per share. That’s compared to first-quarter 2022 net income of $39.5 million, or $0.91 per share. (Source: “Delek Logistics Reports First Quarter 2023 Net Income Attributable to All Partners of $37.4 million,” Delek Logistics Partners LP, May 8, 2023.)

The partnership’s cash flow from operations in the first quarter of 2023 was $29.1 million, compared to $47.9 million in the first quarter of 2022. Its distributable cash flow went up by approximately 20% year-over-year from $51.7 to $61.8 million. The company’s adjusted distributable cash flow coverage ratio was 1.38x.

Delek Logistics Partners LP’s first-quarter 2023 EBITDA increased by 41% to $93.2 million, over $66.0 million in the first quarter of 2022.

Commenting on the results, the company’s president, Avigal Soreq, said, “Delek Logistics Partners started 2023 with another record quarter. Delek Logistics continues to deliver solid operating performance, generating strong cash flow, and progressing growth initiatives.” (Source: Ibid.)

He continued, “Year over year, we have more than doubled the volume in the Midland Gathering and advanced on new connections in the Delaware and Midland gathering systems. We see great opportunities in these basins and are well positioned to participate.”

Delek Logistics Stock’s Quarterly Dividend Hiked to $1.025/Unit

Thanks to its improved balance sheet and increased cash flow, Delek Logistics Partners LP has been able to reward buy-and-hold investors with reliable, growing, ultra-high-yield dividends.

In April, the board approved DKL stock’s 41st consecutive increase in its quarterly distribution to $1.025 per unit, for a current yield of 9.3%. This represents a 4.6% increase over the $0.98 per unit that Delek Logistics Partners LP paid out in the first quarter of 2022 and a 0.5% increase over the $1.02 per unit it distributed in the fourth quarter of 2022.

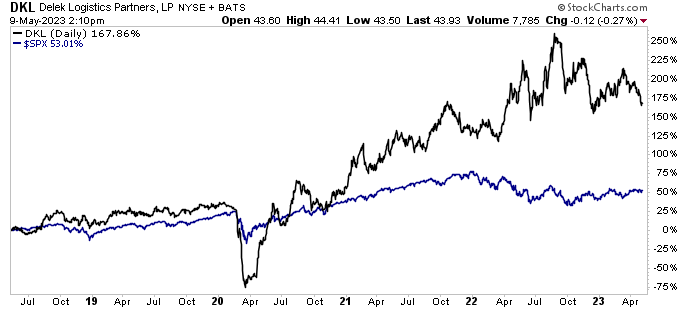

In addition to providing growing dividends, Delek Logistics stock has been rewarding buy-and-hold investors with share-price appreciation. While DKL stock is up by just 1.5% year-to-date, it’s also up by 33% over the last two years, 1,040% over its March 2020 low, and more than 100% from its pre-pandemic level (as of this writing).

Chart courtesy of StockCharts.com

Longer term, Delek Logistics Partners LP has a solid history of outperforming the broader stock market.

Over the last five years, with dividends reinvested, Delek Logistics stock has provided returns of 168%, compared to 53% from the S&P 500. Over the last 10 years, DKL stock has posted total returns of 218%, compared to 154% from the S&P 500.

The Lowdown on Delek Logistics Partners LP

Delek Logistics is a financially robust company with a long history of returning cash to its shareholders, having increased its dividends for the last 41 consecutive quarters—essentially since it went public.

Delek Logistics Partners LP targets an annual five-percent increase in its distributions. And judging by its record first-quarter financial results, it looks like 2023 will be another year of inflation-busting returns from Delek Logistics stock.