CubeSmart Stock: Self-Storage REIT Paying 5.1%-Yield Dividends

With Its Share Price Down, CUBE Stock Is a Contrarian Opportunity

Times have been tough for real estate investment trusts (REITs) lately, due to the higher cost of financing and servicing debt as the yield on 10-year Treasury bonds approaches five percent. This has had negative impacts on REITs’ financing rates, margins, and profitability.

Although the current macroeconomic overhang is a concern, I suggest adopting a long-term perspective. While you wait for the economic situation to improve, investing in a REIT is a great way to generate income. That’s because the mandate of this kind of business structure is to pay out a minimum of 90% of its taxable income in the form of dividends.

Take CubeSmart (NYSE:CUBE), an $8.4-billion industrial REIT. With more than 1,200 self-storage properties across the U.S., the company is the third-largest owner and operator of self-storage properties. (Source: “Investor Relations,” CubeSmart, last accessed October 19, 2023.)

The REIT has paid dividends for 19 consecutive years. Moreover, in January, the company extended its dividend growth steak to 13 years by raising its quarterly dividend. Its 2023 annualized dividend of $1.96 per share is up by 13.9% from its 2022 annualized dividend of $1.72 per share. (Source: “Dividend History,” CubeSmart, last accessed October 19, 2023.)

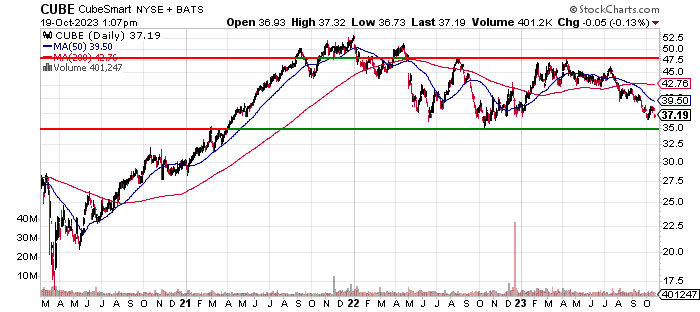

As of this writing, CubeSmart stock’s price is down by 24.5% from its 52-week high and down by 19% over the past three months. I view this as an opportunity.

CUBE stock is still way up from its March 2020 low after mounting a significant rally to its December 2021 high. Unfortunately, as interest rates began to ratchet higher, CubeSmart stock started to move lower. Since early 2022, it has been caught in a sideways channel.

I like to see CUBE stock hold support around $34.00–$35.00. This could be followed by a rally toward $48.00–$50.00. If the stock fails to hold support, it could drop toward $27.00–$32.00.

Chart courtesy of StockCharts.com

High Profitability & Free Cash Flow

CubeSmart has reported higher revenues for four straight years, up by 69% from $597.9 million in 2018 to a record-high $1.0 billion in 2022. The company’s revenue growth rate of 22.8% in 2022 was a five-year best, while its compound annual growth rate (CAGR) for the 2018–2022 period was a healthy 14.0%. (Source: “CubeSmart,” MarketWatch, last accessed October 19, 2023.)

Analysts estimate that CubeSmart will experience a revenue contraction of 6.5% to $943.6 million in full-year 2023 due to the macroeconomic uncertainties, albeit they have a high estimate of $1.06 billion. (Source: “CubeSmart (CUBE),” Yahoo! Finance, last accessed October 19, 2023.)

There’s some optimism for 2024, however, as analysts expect the company’s revenues to rebound by 3.5% to $976.7 million that year. For 2024, they have a high estimate of $1.11 billion.

| Fiscal Year | Revenues | Growth |

| 2018 | $597.9 Million | N/A |

| 2019 | $643.9 Million | 7.7% |

| 2020 | $679.2 Million | 5.5% |

| 2021 | $822.6 Million | 21.1% |

| 2022 | $1.0 Billion | 22.7% |

(Source: MarketWatch, op. cit.)

On the bottom line, CubeSmart has been consistently profitable on a generally accepted accounting principles (GAAP) diluted earnings-per-share (EPS) basis. The company had significant earnings growth in 2021 and 2022, reporting record-high GAAP-diluted EPS for 2022.

Analysts expect the company to report earnings of $1.76 per diluted share for full-year 2023, followed by $1.85 per diluted share for 2024. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $0.88 | N/A |

| 2019 | $0.88 | 0.0% |

| 2020 | $0.85 | -3.4% |

| 2021 | $1.09 | 28.2% |

| 2022 | $1.29 | 18.3% |

(Source: MarketWatch, op. cit.)

Looking at its funds statement, CubeSmart has consistently churned out positive free cash flow (FCF), which is a positive sign, considering the company’s ability to pay out dividends.

| Fiscal Year | FCF (Millions) | Growth |

| 2018 | $285.4 | N/A |

| 2019 | $301.3 | 5.6% |

| 2020 | $307.4 | 2.0% |

| 2021 | $481.2 | 56.5% |

| 2022 | $612.9 | 27.4% |

(Source: MarketWatch, op. cit.)

The high interest rate environment is somewhat taxing on CubeSmart, but it’s not a concern at this point. The company’s balance sheet held debt of $3.0 billion at the end of June. (Source: Yahoo! Finance, op. cit.)

The REIT’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a strong 8.0, which is just a notch below the high point of the Piotroski score’s range of 1.0–9.0.

Moreover, CubeSmart had a strong interest coverage ratio of about 4.1 in 2022. The following table shows that the company has been able to easily cover its interest expense via its significantly higher earnings before interest and taxes (EBIT). Therefore, I don’t expect any problems.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2019 | $243.3 | $72.5 |

| 2020 | $243.5 | $75.9 |

| 2021 | $309.3 | $78.4 |

| 2022 | $385.8 | $93.3 |

(Source: Yahoo! Finance, op. cit.)

CubeSmart Stock’s Dividend Should Be Safe

CubeSmart’s current quarterly dividend of $0.49 per share translates to a yield of 5.12% (as of this writing). CUBE stock’s five-year average dividend yield is lower, at 3.8%, due to a higher share price over that time frame.

The company’s payout ratio of 110.5% isn’t unusual for a REIT. (Source: Yahoo! Finance, op. cit.)

Given the company’s expected earnings over the next two years, CubeSmart stock’s dividends will likely continue rising.

| Metric | Value |

| Dividend Streak | 19 Years |

| Dividend Growth Streak | 13 Years |

| 7-Year Dividend CAGR | 12.9% |

| 10-Year Average Dividend Yield | 4.1% |

| Dividend Coverage Ratio | 1.5 |

The Lowdown on CubeSmart

CUBE stock has broad institutional ownership, with 586 institutions holding the majority of the outstanding shares. Moreover, company insiders purchased shares to the tune of a net 20,808 shares over the last six months. (Source: Yahoo! Finance, op. cit.)

The fact that CubeSmart consistently generates more FCF than earnings is impressive. The company’s high earnings growth is attractive, which should result in investors being rewarded.